AI

Ethereum's push to embed zero‑knowledge proofs at the base layer aims to shrink validator workloads, improve scalability and create new trust primitives; the L1‑zkEVM workshop and EIP‑8025 preview show concrete design choices, while SEAL addresses the security tradeoffs. This article breaks down the technical case, validator economics, workshop takeaways and implications for decentralization and AI on Ethereum.

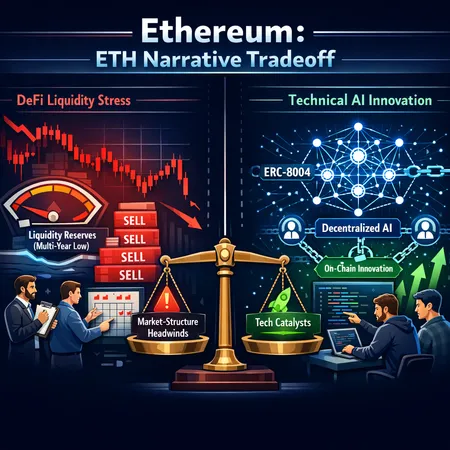

Ethereum faces a tug-of-war between DeFi liquidity stress and technical innovation from on‑chain AI standards like ERC‑8004. This deep-dive assesses reserve trends, price dynamics, and how decentralized AI could reshape Ethereum’s developer and economic moat.

Miners are expanding beyond block validation by entering AI infrastructure and capturing waste heat for industrial uses. These moves reshape CAPEX/OPEX dynamics, improve ESG profiles, and reduce long‑term BTC sell pressure.

CryptoGPT, announced by Husky Inu AI ahead of HINU’s March 2026 launch, promises AI-native on‑chain signals, sentiment synthesis, and forecasting for traders and researchers. This article evaluates what it claims to offer, where generative AI complements traditional analytics, the key model risks, and practical validation steps for quant teams.

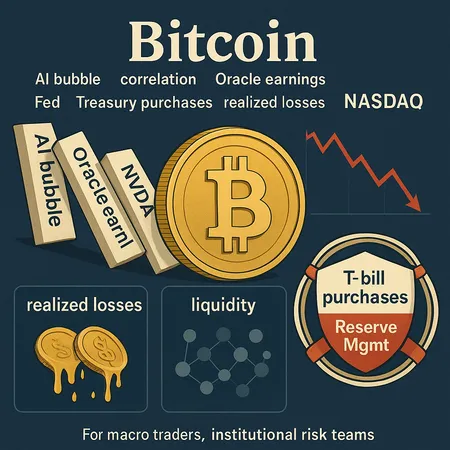

Bitcoin’s sensitivity to AI‑sector swings has increased; a selloff in AI capex narratives — sparked by events like Oracle’s earnings miss — can cascade into BTC through correlated flows and liquidity channels. This primer unpacks the empirical evidence, on‑chain stress, Fed/Treasury interventions, and practical risk controls for macro traders and institutional risk teams.

Pi Network’s recent upgrade promises a 50% faster KYC experience ahead of a large token unlock — a change with meaningful operational, security, and market implications for pioneers and exchanges. This article breaks down the technical upgrades, tradeoffs, and concrete next steps for community managers and exchange ops teams.

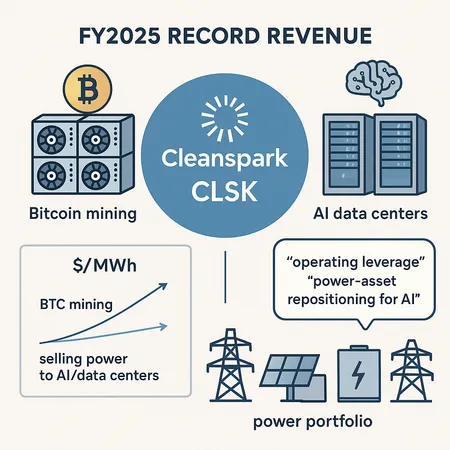

Cleanspark's FY2025 pivot shows miners can monetize power assets beyond hashing. The shift toward AI/data‑center workloads reshapes revenue mix, balance‑sheet dynamics, and BTC supply incentives for miners.

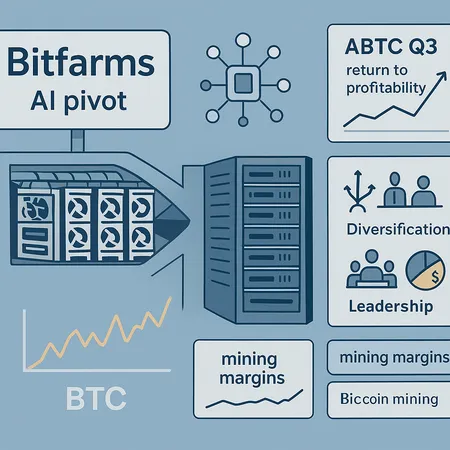

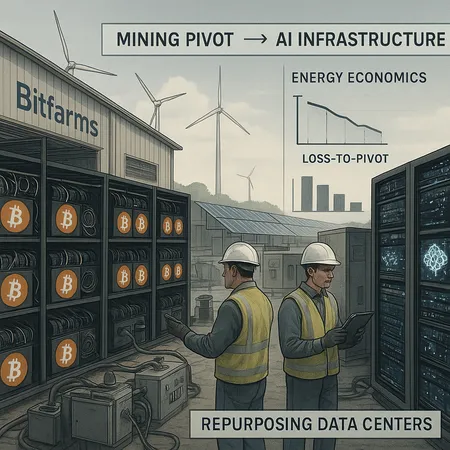

Faced with wild BTC swings, miners are reshaping strategy—pivoting workloads, pruning costs, and reallocating capital to protect margins. Case studies from Bitfarms, ABTC and governance moves at BitMine show the playbook evolving.

Major miners are reshaping strategy as BTC weakness and market stress squeeze margins. Repurposing datacenters for AI, diversifying into ETH/DeFi revenue and governance changes are changing the economics of bitcoin mining and the outlook for hashrate and sell pressure.

As sustained price pressure reshapes miner economics, Bitfarms’ announced wind-down of Bitcoin mining to explore AI infrastructure is a bellwether for capital allocation and energy strategy shifts across the industry. This feature breaks down the timeline, technical trade-offs, and a decision framework for repurposing mining assets into data-center compute.

DeFi

All DeFi postsBitcoin

All Bitcoin postsLiquidity

All Liquidity posts- How US–Israel Strikes, an Oil Shock, and Strait of Hormuz Risk Are Roiling Bitcoin — What Traders Should Watch

- How U.S. Spot Bitcoin ETF Inflows Are Changing BTC Price Discovery and Liquidity

- Bitcoin's Tug-of-War: ETF Inflows Lift BTC to ~$68–70K — But Liquidity and a Multi‑Billion Options Expiry Threaten Volatility