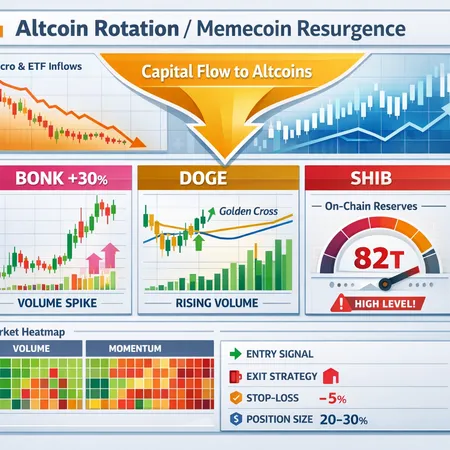

Start‑of‑Year Altcoin Rotation and Memecoin Resurgence: BONK, DOGE, SHIB — Tactical Playbook

Summary

Overview: why BTC dominance is tapering and altcoins are outpacing

The start of 2026 features a familiar yet risky market rhythm: money flows out of steady, liquid BTC and into higher‑beta altcoins and memecoins. That shift shows in falling BTC dominance metrics and an early‑year rotation into the top speculative names. CryptoTicker documented this rotation, noting liquidity and attention moving into the top five altcoins as traders hunt faster returns here.

This is not a clean “altseason” signal for every trader — it’s a higher‑volatility regime where short bursts of outsized gains coexist with steep drawdowns. If you trade these moves, you must accept that both large upside and sharp downside are possible within hours or days.

What's driving the rotation: macro, ETF flows, and retail appetite

Three factors explain why capital is leaving BTC’s relative safety and chasing memecoins and altcoins now:

- Macro and liquidity narratives: As macro markets price in rate and growth expectations, risk appetite can re‑awaken quickly. When traditional risk assets become more favorable, marginal dollars chase higher‑beta crypto names.

- ETF and institutional plumbing: Spot ETF inflows and rebalancing create temporary correlation shifts. Part of new or rotating capital can move from BTC into altcoins seeking higher short‑term returns once BTC has absorbed headline flows.

- Retail momentum and social signals: Memecoin communities, social volume, and token listing events accelerate short squeezes and FOMO liquidity spikes.

For many traders, Bitcoin remains the market bellwether, but ETF mechanics and concentrated retail flows can break that relationship in the short term. Some of those flows simultaneously touch NFT and DeFi venues, amplifying cross‑market speculation.

The memecoin wave: BONK, DOGE, SHIB — what moved and why

Here we look at each token's immediate drivers and what to look for if you're planning a tactical trade.

BONK — rapid spikes and liquidity‑driven moves

BONK produced a headline intraday gain (~30%) that typifies memecoin volatility. CryptoPotato reported the jump and tied it to renewed memecoin strength and a crowded speculative bid here.

Why it happens: BONK and similar tokens have small order books relative to market attention. A concentrated buy wave — from a few wallets, an exchange listing, or a social catalyst — can push price rapidly higher. Volume confirmation matters: a price pop without sustained, on‑chain or exchange volume often fizzles.

Tactical read: treat large single‑day moves as reactionary opportunities, not signals to buy at peak. Look for a pullback to a prior consolidation zone or a volume‑backed retest before increasing size.

DOGE — golden cross and technical confirmation

Dogecoin flashed a short‑term golden‑cross setup that traders interpret as bullish: a faster moving average crossing above a slower moving average, usually the 50‑day over the 200‑day. Coindesk covered DOGE’s near‑term technicals and associated volume behavior, noting the bullish implications for momentum traders here.

What to watch: golden crosses are lagging indicators — they confirm trending strength but do not predict quick reversals. Validate with volume expansion, positive open interest if derivatives are liquid, and that price holds the breakout level on a retest.

Tactical read: for DOGE, a typical approach is to wait for a retest of the breakout with declining selling volume and place stops under the retest low. Use smaller position sizes if volatility (measured by ATR) is elevated.

SHIB — on‑chain warning at the 82T reserve threshold

Shiba Inu bears point to an on‑chain indicator: exchange reserves around the 82 trillion SHIB mark have historically signaled increased sell pressure when breached. U.Today highlighted the 82T threshold as a potential bearish trigger tied to past distribution events here.

Why it matters: exchange reserves measure supply potential for immediate selling. A sudden accumulation of SHIB on exchanges — or crossing a historically meaningful level — increases the likelihood of near‑term dumps as large holders seek liquidity.

Tactical read: if reserves hover at or rise above that threshold, tighten stops, reduce size, and prefer short‑timeframe mean reversion strategies rather than trend following.

How to size, enter, and exit memecoin trades: practical rules

Below are pragmatic, repeatable rules designed for active traders and speculators exposed to memecoin volatility. These are not investment recommendations but a risk‑aware playbook.

- Risk per trade: cap absolute capital at 0.25–1.0% per memecoin trade for aggressive speculators; conservative traders should use 0.1–0.3%. Memecoins are higher‑vol so risks must be small.

- Maximum portfolio exposure: keep total memecoin exposure (all memecoins combined) under 3–7% of capital. Altcoins beyond memecoin bets can sit in a separate 10–20% bucket depending on your risk tolerance.

- Stop placement: use ATR (14) to set volatility‑aware stops. Example: enter DOGE on a breakout and place a stop at 1.5× ATR below entry. For extremely thin names like BONK, use a tighter percentage stop (e.g., 12–20%) but reduce position size accordingly.

- Position sizing formula (simple): Position size = (Account risk per trade) / (Entry price − Stop price). Convert to token units and cap by max position %.

- Scaling: scale in-size across 2–3 tranches on confirmation (initial entry 50% of intended size on breakout or retest, add 25% on a clean retest, final 25% on momentum confirmation).

- Profit targets and exits: take partial profits at 25–35% gains and again at 70–100% if volatility supports it. Use a trailing stop (e.g., 2× ATR below peak) to capture runs while protecting gains.

- Leverage: generally avoid leverage on memecoins. If you use margin, keep it very low (≤2×) and size down aggressively.

Example tactical checklists (BONK, DOGE, SHIB)

BONK checklist:

- Confirm surge with exchange volume or on‑chain transfers showing buyer concentration.

- Wait for a 20–50% intraday pullback or retest to a prior consolidation range.

- Entry: limit order near the retest zone; stop at 12–18% below entry for very tight trades or use ATR method if order book depth permits.

- Size: use the lower end of risk per trade (0.25–0.5%).

- Exit: partial at +30%, trail remainder with a 1.5–2× ATR trailing stop.

DOGE checklist:

- Confirm golden‑cross is accompanied by higher than average volume and positive derivatives OI if available.

- Entry: buy on retest of breakout support or a close above short term resistance with volume confirmation.

- Stop: 1.0–1.5× ATR below the retest low or fixed 8–15% depending on ATR.

- Size: 0.5–1% of account risk; higher liquidity allows slightly larger sizing.

- Exit: scale out at +30% and +80%, or use a 2× ATR trailing stop.

SHIB checklist:

- Check exchange reserves and on‑chain transfer patterns; if reserves climb near or above 82T, be cautious.

- Prefer short‑duration plays (swing scalp, mean reversion) when reserves are high.

- Entry: only on clear technical support and low exchange inflow; otherwise stand aside.

- Stop: tighten stops (smaller % or 1× ATR) when exchange reserves rise.

- Size: conservative (0.1–0.4% risk) given distribution risk.

Risk controls beyond stops

- Forced cap: implement a hard cap for memecoin exposure in your portfolio (e.g., 5% max). If the market rips, you can still participate but without jeopardizing the account.

- News filters: avoid initiating new positions immediately after major exchange listings, celebrity mentions, or token airdrops unless you size tiny and plan a scalp.

- Correlation kill‑switch: if BTC drops >6–8% intraday and liquidity tightens, reduce or exit memecoin exposure — most memecoin crashes correlate with market-wide liquidity shocks.

- Execution slippage: use limit orders in thin books; factor slippage into stop and target planning.

Final notes — balancing opportunity and discipline

Early‑2026 rotation into altcoins and memecoins offers fast, headline‑grabbing returns, but it also raises the probability of quick losses. The edge for active traders is discipline: trade only with a tested sizing method, confirm moves with volume or on‑chain signals, apply volatility‑aware stops, and cap total exposure.

Memecoin episodes like the BONK spike and DOGE’s golden‑cross are tradeable, but treating each as a high‑variance event rather than a durable trend reduces the chance of catastrophic drawdowns. Watch SHIB’s exchange reserve levels closely — thresholds like the 82T mark have historically preceded distribution and should force you to tighten risk.

If you use trading tools or installment platforms to manage exposure, keep position sizing rules encoded into your routine. On platforms in the Bitlet.app ecosystem some users combine recurring buys for larger allocation strategies and tighter stop/limit orders for tactical trades, but the core principle remains: small, disciplined bets in memecoins, and scale only with confirmed momentum.

Sources

- CryptoTicker — Early‑2026 altcoin rotation and BTC dominance coverage: https://cryptoticker.io/en/bitcoin-dominance-falls-rotation-top-5-altcoins/

- CryptoPotato — BONK’s intraday surge and memecoin strength: https://cryptopotato.com/bonk-skyrockets-by-30-daily-bitcoin-taps-3-week-high-above-91k-weekend-watch/

- CoinDesk — DOGE technical note and short‑term golden‑cross: https://www.coindesk.com/markets/2026/01/04/dogecoin-pops-4-amid-memecoin-rally-as-a-short-term-golden-cross-flashes

- U.Today — SHIB exchange reserve warning near 82T threshold: https://u.today/is-shiba-inus-shib-82000000000000-bearish-threshold-coming-back?utm_source=snapi