How to Trade the 2026 Meme Coin Resurgence: Dogecoin, Pepe, Liquidity and Position Sizing

Summary

What happened in early 2026: a quick read

The start of 2026 brought a vivid rematch of previous "meme season" dynamics: Dogecoin (DOGE) and Pepe (PEPE) led headline rallies, with price jumps and volume surges that pulled in both nostalgic retail and faster speculative capital. Market coverage noted double-digit moves for these tokens and a broader rise in meme-index metrics — CoinDesk highlighted an 11% spike in DOGE and a 25% jump in PEPE alongside a higher GMCI meme index reading, signaling cross-market interest in high-beta assets.

Those moves were not pure noise. They coincided with measurable changes in liquidity and positioning—higher spot volumes, decreasing exchange balances for some tokens, and elevated derivatives open interest and funding rates. News outlets and market commentary debated whether this was a durable rotation back into high-risk crypto or a classic short-lived liquidity chase; pieces from TokenPost and CoinPedia captured both the rebound and questions around sustainability, while AMBCrypto dove deeper into whether rising liquidity signaled a real breakout or a bull trap.

Drivers behind the comeback: macro, flows and narratives

Several forces conspired to reignite meme assets at the start of 2026. Layering them together helps explain why DOGE and PEPE moved at the same time.

1) Quiet macro and rising risk appetite

Inflation volatility eased in late 2025 and early 2026, and central bank commentary grew less hawkish in many regions. When broader macro stress retreats, speculative capital tends to chase higher volatility assets. Crypto markets, which amplify shifts in global risk appetite, often react first in the most levered and sentiment-driven corners — namely memecoins.

2) Retail flows and social momentum

Memecoins are social-first assets. Renewed chatter on social platforms, trader communities rotating narratives from one token to another, and a fresh wave of retail onboarding created a self-reinforcing cycle. Retail flows into spot and simple leveraged products can accelerate price moves rapidly; CoinPedia and TokenPost both report that DOGE's jump attracted renewed retail bids that compounded momentum.

3) ETF/structured and institutional spillover (indirect)

While major spot ETFs tend to center on large-cap Bitcoin and Ether, gains there or sidelined inflows into structured products can leak into riskier arenas. When institutional risk budgets expand, allocators often rotate some capital into micro-cap or high-beta pockets via derivatives and OTC desks, increasing order flow into coins like PEPE.

4) Liquidity concentration and market microstructure

Meme rallies are fuelled not just by buyers but by a temporary thinning of available sell-side liquidity. When exchange order books tighten and concentrated bids push prices through thin layers of resting liquidity, spikes occur. AMBCrypto's analysis highlighted rising liquidity metrics for DOGE and posed the question of whether this was a true breakout or a fragile squeeze.

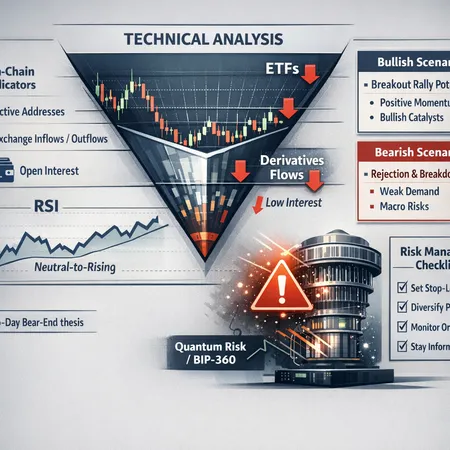

On-chain and exchange indicators to watch

If you're planning to trade memecoins, watching the right indicators gives you both entry context and early exit signals. Here are the most useful ones and what they imply.

Volume spikes and the rate-of-change

Sustained volume increases across spot and derivatives markets are the first sign that a move is backed by real demand. Short, isolated volume spikes can be manipulative or noise; persistent elevation for several sessions is more meaningful. CoinDesk's coverage of the January moves emphasized the breadth of volume across exchanges for DOGE and PEPE.

What to monitor:

- 7- and 21-day volume moving averages vs. 90-day baseline

- Exchange-traded spot vs. derivatives volume split

Exchange supply and whales

A falling exchange balance (more coins moving to cold wallets or DeFi addresses) often accompanies price rises — it signals reduced immediate sell pressure. Conversely, coins concentrating in a few wallets can raise counterparty risk if those holders sell into rallies.

What to monitor:

- Net flows to centralized exchanges

- Top-10 holder share and changes week-over-week

Leverage: open interest and funding rates

Derivatives metrics matter for meme seasons because leverage amplifies both rallies and crashes. Rising open interest and persistent positive funding rates indicate buyers are paying shorts to stay hedged — a sign of crowding.

What to monitor:

- Perpetual funding rates across major exchanges

- Open interest as a percent of market cap

- Liquidation clusters (price levels with high open interest concentrated)

If funding rates spike and stay elevated, the trade becomes riskier: a sudden liquidity withdrawal or large sell order can trigger cascading liquidations and exacerbate drawdowns.

Sentiment indexes and memecoin indices

Index measures like CoinDesk's GMCI meme index provide a snapshot of how broad-based meme interest is. An uptick there alongside on-chain signals strengthens the case for a sustained rotation into memecoins; a divergence (index rising but volumes slipping) is a red flag.

Lessons from prior meme seasons

Meme seasons are historically fast and brutal. Two consistent patterns emerge from previous cycles:

Rapid accumulation phases are followed by violent mean reversion. Profit-taking, regulatory noise, or simple fatigue can wipe 30–70% of gains in days.

Crowding effects make liquidation cascades more likely. When many participants use similar leverage or stop-loss placements, the same price move can force simultaneous exits.

These patterns mean that even if the macro backdrop supports higher risk appetite, memecoins are tactical plays — not strategic holdings. Treat them as short-duration, consciously allocated exposures.

Tactical rules for sizing and managing meme coin exposure

Below are practical, conservative rules aimed at retail traders and risk-focused speculators who want to participate without overexposure.

Position sizing: absolute and per-trade caps

- Maximum portfolio exposure to memecoins: 1–5% for most retail traders. If you have higher risk tolerance and explicit non-essential capital, consider 5–10% but only as a speculative sleeve segregated from core holdings.

- Maximum exposure to a single memecoin (e.g., DOGE or PEPE): 0.5–2% of portfolio.

These caps keep drawdowns manageable and prevent a single speculative position from degrading overall financial health.

Use leverage sparingly and with hard limits

- Avoid using cross-margin or portfolio-level leverage for memecoins. Use isolated margin only if required.

- Limit leverage to no more than 2x on perpetuals; for most retail traders, 0–1.5x is safer.

- If your platform shows concentrated open interest at specific price points, reduce leverage further — these are likely liquidation magnets.

Time-box trades and target-based exits

- Treat meme coin trades as time-bound: set a horizon (e.g., 3–14 days) and re-evaluate rather than holding indefinitely.

- Use a tiered exit: take partial profits at pre-set targets (e.g., 30–50% of position at +20–30% price move) and trail stops on the remainder.

Risk controls: orders and hedges

- Use limit entries where possible; market orders into thin books increase slippage.

- Place stop losses or alerts — decide whether an x% loss will trigger a full exit (common choices: 10–30% for highly speculative positions).

- Consider small protective hedges if your platform supports them (e.g., buying a small opposing put or shorting a correlated instrument), but hedges have costs and can reduce upside.

Liquidity-aware sizing

- Adjust trade size to prevailing order-book liquidity. If bid-ask depth at your target entry is shallow, reduce size and stagger entries.

- Monitor exchange supply flows; if a token's exchange balances begin to rise quickly, consider trimming exposure — this can precede sell pressure.

Behavioral rules

- Avoid FOMO-driven scaling. If social chatter is your main input, wait for confirmatory on-chain or volume signals.

- Keep a trade journal: record rationale, entry, size, and exits. This builds discipline and helps calibrate future sizing.

Practical example: sizing a DOGE/PEPE swing

Imagine a $50,000 tradable account and a balanced risk plan:

- Allocate 2% ($1,000) to memecoins total.

- Split allocation: $600 to DOGE and $400 to PEPE (within single-coin cap).

- Use isolated margin with 1.25x leverage max (if any), so notional exposure stays below $1,250 per position.

- Set a 20% stop-loss and partial profit-taking at +25% (sell 40%), trail rest with a 15% trailing stop.

If either token experiences a funding spike or open interest concentration at unwanted levels, reduce size immediately and tighten stops.

Monitoring cadence and exit triggers

A disciplined monitoring routine helps you exit before cascading liquidations. Check these daily while you hold:

- 24–72h volume change and whether it is broad across exchanges

- Net exchange flows and top wallet movement

- Funding rates and derivatives open interest

- Social sentiment vs. on-chain reality (high mentions with low volume = dangerous)

Exit or reduce if you see: rapidly rising funding rates, large inflows to exchanges, or a momentum divergence where price rises despite falling volume.

Final thought: participate, but protect

The early-2026 memecoin resurgence is a useful reminder that crypto's highest-beta pockets can produce quick profits — and equally quick losses. The difference between a speculative win and a ruinous trade is often position sizing and discipline.

If you're using platforms like Bitlet.app to manage trades or installment buys, keep speculative bets clearly separated from core holdings and always respect the caps and leverage limits outlined above. Memecoins like DOGE and PEPE are fun, fast and dangerous; treat them as tactical, time-boxed opportunities and design rules that survive when markets turn.