Shiba Inu

Shiba Inu’s SOU recovery framework has launched to convert bridge-exploit claims into transferable on-chain assets. This article explains the recovery-NFT mechanism, evaluates outcomes for users and the ecosystem, and places the approach in the wider context of bridge security and remediation best practices.

Shiba Inu sits between two narratives: a technical crash to 2023 lows and a bullish roadmap tied to Shibarium upgrades. This piece compares both views, examines market drivers, and gives practical risk-sizing frameworks for retail traders and community managers.

21Shares' Nasdaq‑listed, Dogecoin Foundation‑backed spot Dogecoin ETF changes institutional access and custody for DOGE, but a true memecoin rally will depend on liquidity, narratives, and on‑chain dynamics. This article evaluates ETF mechanics, historical precedents, Shiba Inu technical targets, and practical portfolio rules for speculative exposure.

An investigative look at the Shibarium remediation plan, concentrated SHIB reserves on exchanges and what those facts mean for retail holders. Practical steps to manage exposure to memecoin risk and how recovery operations may actually play out.

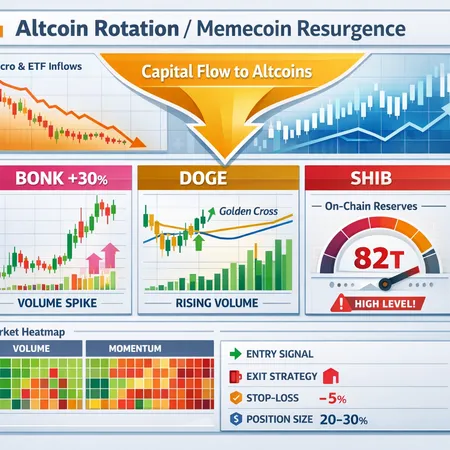

A practical analysis of why BTC dominance is slipping into high‑beta altcoins and memecoins, which names are leading the move (BONK, DOGE, SHIB), and concrete rules for entry, exit, and position sizing for active traders.

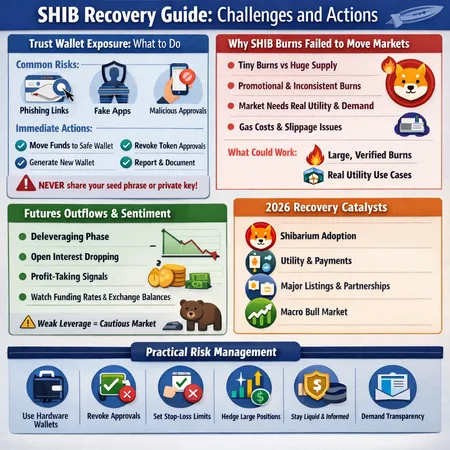

SHIB faces a mix of security and market-structure headwinds that complicate any 2026 recovery narrative. This feature breaks down the Trust Wallet exposure, recent burn data, large futures outflows, roadmap claims, and practical risk controls for holders.

Exchange outflows of 50 billion SHIB draw attention, but how meaningful are they for circulating supply, liquidity and price dynamics? This article models supply-shock scenarios, weighs whether the move signals long-term locking or whale accumulation, and outlines catalysts and risks for a 2026 SHIB comeback.

A panoramic take on short-term catalysts and risks across SHIB, SOL and SUI — from an eye-popping Shiba Inu burn spike and community governance friction to Solana’s broken support and SUI’s long-term accumulator case. Practical trade setups and governance checks for retail traders and community managers navigating a stretched altcoin season.

After 65–80% drawdowns across DOGE, SHIB and PEPE, memecoins sit at a crossroads. This article dissects tokenomics, technical breaks, macro drivers and a step‑by‑step framework to judge revival potential vs permanent loss.

Shibarium plans a 2026 privacy upgrade with Zama promising fully homomorphic encryption (FHE) for private transactions and confidential smart contracts. This article examines the technical promise, deployment tradeoffs after the 2025 exploit, developer hurdles, AML tensions, and how this compares to DA-focused upgrades like Fusaka.