Meme-Coin Health Check 2026: Why Dogecoin Hit a New Low and How to Manage Risk

Summary

Snapshot: Memecoin markets at the start of 2026

The memecoin complex entered 2026 thinner and more brittle than many expected. Dogecoin (DOGE) — long the poster child for this corner of crypto — set a new low early in the year, a move that forced traders to ask whether the token’s “reserve‑asset” narrative ever had legs, or whether the drop was purely technical and liquidity‑driven. Meanwhile, on‑chain data shows broader altcoin trading volume is materially lower than late 2024, a condition that magnifies volatility and makes tactical trading riskier.

For many traders, Bitcoin remains the primary market bellwether, but the memecoin playbook is different: narratives, concentrated holders, and social momentum matter as much as macro and technicals. Platforms like Bitlet.app make it easy to access these markets, but ease of access is not a substitute for discipline.

Why DOGE hit a new low: narrative fatigue versus technical realities

Two narratives competed to explain DOGE’s decline: the reserve‑asset framing (that DOGE is a consumer‑facing store of value or a widely held hedge) and plain market microstructure problems (thin order books, concentrated supply, and stop cascades).

Narrative case: Proponents argued DOGE’s community, merchant acceptance anecdotes, and long history positioned it as a cultural reserve asset. That story buoyed prices in prior cycles.

Technical case: In early 2026 the technical picture looked worse — low weekly volume, order‑book thinness, and clustered sell orders amplified any negative news. Analyst writeups point to these mechanics as critical: trading came in despite the story. Beincrypto’s analysis of DOGE’s early‑2026 low highlights how mature narratives don’t immunize a token from technical sell pressure and liquidity shocks (see their detailed breakdown).

The reality is a mix: narrative weakness lowers the price floor buyers are willing to defend, and when volume is thin that floor becomes fragile. Add concentrated holders with predictable vesting or sell‑schedules, and a routine correction can cascade into a new low.

Altcoin volume contraction and market liquidity

On‑chain and exchange data confirm a broader trend: many altcoins — including historically liquid names like DOGE and SOL — are trading at roughly half the weekly volumes observed at the end of 2024. Lower trading volume reduces depth and increases slippage for sizeable orders.

This matters for two reasons. First, reduced volume increases execution risk: a market buy intended to capture a pop can instead chase price higher and leave you with a poor fill. Second, it amplifies downside: when buyers step back, even modest sell pressure creates outsized moves. The analysis at Bitcoinist comparing weekly volumes between end‑2024 and late‑2025 shows this contraction clearly and explains why memecoin price action feels more violent and less predictable now.

Lower liquidity is not evenly distributed: some tokens still trade relatively deep, while many speculative projects now exhibit fragile order books where single large orders move price dramatically.

Investor sentiment: SHIB, DOGE and the broader memecoin cohort

Sentiment is fragmented. Social metrics for memecoins like SHIB often spike on hype and community events, but those spikes are shorter and less predictive than before. Institutional flows that buoyed certain tokens in past cycles are largely absent for pure memecoin plays.

SHIB (SHIB) still enjoys an enthusiastic retail base, but enthusiasm alone doesn’t equal durable demand. With weaker secondary market activity and concentrated holdings, social interest can evaporate faster than it arrived — turning rallies into traps.

Compounding this is an increasing chorus of caution from market commentators. Opinion pieces published at the turn of 2026 highlight structural vulnerabilities — from tokenomics that favor early insiders to thin market depth — and warn that a subset of altcoins could see severe drawdowns if macro or sentiment conditions worsen. Those critiques are worth reading as part of any risk assessment.

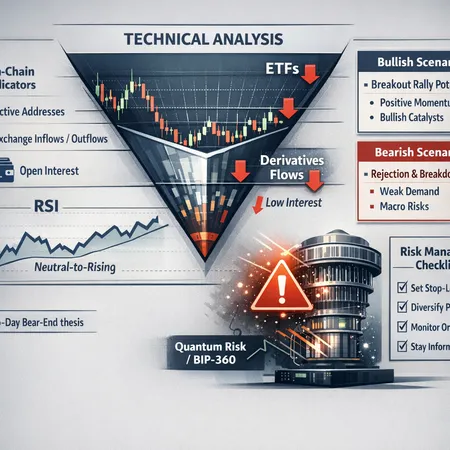

A practical checklist for risk‑managed exposure to meme assets

Below is a pragmatic, step‑by‑step framework retail traders and speculators can use before allocating to memecoins like DOGE or SHIB. Treat this as a screening and execution protocol rather than financial advice.

- Liquidity first: 24h Volume and Order‑Book Depth

- Require a minimum 24‑hour trading volume threshold relative to the position you intend to take (e.g., don’t place an order larger than 1–3% of 24h volume). Lower volumes mean higher slippage.

- Inspect order‑book depth on multiple exchanges. If aggressive buys/sells move price >2–3% for a normal retail‑sized order, treat the token as high‑impact.

- Concentration & Tokenomics

- Check holder concentration and vesting schedules. High concentration in a few wallets raises dumping risk. Look for high unlocked supply coming online that could create predictable sell pressure.

- Correlation and macro exposure

- Measure short‑term correlation to Bitcoin and wider altcoins. In stressed markets, memecoins often correlate higher to BTC drawdowns — meaning your hedge needs to account for broader crypto selloffs.

- Use conservative position sizing and stagger entries

- Cap exposure to a small percentage of your total portfolio (many traders use 1–3% for high‑risk memecoins). Scale into positions over multiple entries rather than a single lump buy.

- Execution rules: prefer limit orders and avoid leverage

- Use limit orders to control price and reduce slippage. Avoid margin or leverage on low‑liquidity tokens — liquidation risk is real and fast.

- Exit rules and stop management

- Define a loss threshold before entering (percentage or structural trigger, e.g., breach of a key support with volume). Consider mental stops if volatility makes hard stops dangerous.

- On‑chain signal checks

- Watch transfer volumes, large wallet movements, and exchange inflows/outflows. Sudden spikes in exchange inflows often precede price drops.

- Time horizon and profit‑taking

- Decide if you are trading a narrative swing or speculating on short‑term volatility. If you’re trading narratives, partial profit‑taking at predefined milestones reduces return‑to‑zero risk.

- Tools and counterparties

- Use reputable exchanges and check for reporting of order‑book transparency. If using P2P or DEX venues, account for additional slippage and MEV risk.

- Mental preparedness and paperwork

- Accept higher tax and fee friction in frequent trading. Keep records and treat memecoin trades as high‑variance, not long‑term core positions.

Applying the checklist (quick examples)

- DOGE: If your planned buy equals 2% of DOGE’s 24h volume and order books show shallow bids, scale down. If large wallets are offloading to exchanges, delay buying or cut size.

- SHIB: If on‑chain shows a developer or large holder unlocking tokens within days, factor that schedule into position sizing and consider hedging with a small BTC short or reduced exposure.

Putting it in perspective: risk vs opportunity

Memecoins still offer outsized upside on the right catalyst and with disciplined entry. But the market environment in early 2026 — lower altcoin liquidity, narrative fatigue, and heightened concentration risk — means the odds are less favorable for reckless speculators. Analysts have argued some altcoins face structural downside if sentiment deteriorates further; that’s a sober reminder that upside stories can reverse quickly.

Being prepared means accepting smaller position sizes, stricter execution rules, and clearer exit plans. For traders who treat memecoins as a tactical, limited allocation in a diversified crypto portfolio, opportunity remains. For those chasing fast gains with leverage or oversized bets, the environment is riskier than it was in the frothier moments of 2024.

Conclusion

Dogecoin’s early‑2026 low was not a simple failure of fandom — it was the product of narrative exhaustion colliding with thin market structure. Broader analytics show altcoin trading volume contracted significantly versus the end of 2024, and commentators warn that several speculative tokens could face steep drawdowns if conditions worsen. That combination makes disciplined risk management essential.

If you trade memecoins, use the checklist above: verify liquidity, cap position size relative to volume, favor limit orders, avoid leverage, monitor on‑chain flows and concentration, and always define an exit. These are basic but effective habits that reduce tail risk when markets are brittle.

Sources