Early‑Cycle Altcoin Rotation and Upgrade Catalysts: Where to Look Next

Summary

Why capital rotates into select L1s and new narratives

As markets transition out of a Bitcoin-led phase, capital often looks for higher-beta opportunities — that’s the essence of altcoin rotation. In early cycles, traders reallocate from megacap coins into promising layer‑1s (L1s), new narrative plays, and protocol upgrades where asymmetric upside exists. Several forces drive this shift: diminishing marginal returns on large caps, improved risk appetite, and concentrated catalysts (upgrades, forks, tokenomic tweaks) that create event-driven windows for outsized moves.

Recent analysis shows this process in action: funds and retail flows are beginning to target SOL and SUI alongside newer entrants, a classic early‑cycle pattern where liquidity chases protocol-level catalysts and fresh narratives according to market coverage of capital rotation. The move is selective — not every altcoin benefits — and tends to favor protocols with clear, near-term on-chain or economic changes that materially alter supply/demand or user utility.

For many traders, Bitcoin still sets broad market direction, but active managers are increasingly looking to L1s where upgrades and tokenomic pivots can act like compressed economic catalysts: think higher effective yield to holders, staking or fee sinks, improved throughput, or major hard forks that change utility or supply mechanics.

BNB: The hard-fork case and a $1,000 technical setup

BNB has matured from exchange token to an L1 with its own upgrade cadence. The upcoming Fermi hard fork is being priced into markets as an event with potential to increase on‑chain utility and protocol features — and that narrative is already visible in technicals.

Technically, analysts have flagged a bullish reversal pattern on BNB that, combined with favorable liquidity conditions around a successful fork, supports a $1,000 target in the near to mid term. The price case rests on a few pillars: a breakout of multi-month resistance, sustained volume on rallies, and a successful hard-fork execution that reduces uncertainty and adds functionality for validators and developers. Detailed technical outlooks outline how a clean breakout and retest structure could unlock the $1,000 handle if macro conditions remain supportive and the Fermi upgrade meets expectations as discussed in recent coverage of BNB's price targets.

Risk factors are straightforward: fork delays, on‑chain bugs, or a broader risk-off leg in crypto can quickly unwind speculative positioning. For portfolio managers, weighting BNB around an upgrade should be event-driven and size-limited, with stop levels set beneath key supports and position add rules tied to realized on‑chain outcomes (e.g., successful testnet execution, validator readiness, or actual throughput gains post‑fork).

SOL and SUI: trade dynamics, narratives, and price expectations

SOL and SUI illustrate how L1 narratives can bifurcate: one leans on developer activity and DeFi/NFT throughput (Solana), the other on fresh execution stories and optimistic supply-demand narratives (Sui). Both have seen rotation flows, but the trade mechanics differ.

Solana (SOL) often reacts to raw on‑chain demand and performance metrics: TPS improvements, app launches, and ecosystem funding all matter. That makes SOL a hybrid of narrative and fundamental trading — traders can play upgrades, hackathons, and NFT waves, but must watch for congestion or recurring outage fears which can abruptly crush confidence.

Sui (SUI) has been notable for its strong speculative bids; technical commentary has argued for continued upside even when indicators look overbought, citing persistent demand and narrative momentum one price forecast argued for higher targets despite overbought conditions. Short-term price action can be violent — meaning both larger drawdowns and faster rebounds — and recent market notes highlighted SUI among the biggest gainers on selective days, underscoring how concentrated flows can lift certain L1s substantially in early cycles market watch observed SUI’s sudden strength.

Trade approach: treat SOL as a narrative-meets-utility play where on‑chain metrics and developer cadence matter; treat SUI as a higher-beta, event-sensitive instrument where momentum and news (partnerships, listings, governance changes) dominate. Use shorter leash sizes on SUI and layered entries on SOL tied to measurable improvements in ecosystem health.

Tokenomics in focus: LIT and the fee-to-token pivot

Tokenomic changes can move markets fast. A recent example is Lighter’s (LIT) announcement that it will channel DEX fees into LIT tokens — effectively creating a fee sink and increasing token utility for holders — and the market reacted quickly with a double-digit spike in the token reporting on Lighter’s fee-to-token policy and price reaction.

Why this matters: fee-sink mechanics reduce circulating sell pressure and can create predictable buyback or staking demand. For active allocators, these policy changes are high-conviction catalysts because they immediately alter token supply dynamics and the expected cashflow-like utility to holders. But not all tokenomic changes are created equal: governance clarity, implementation timelines, and transparency about the mechanism determine whether markets will sustain a rerating or quickly revert on execution risk.

When evaluating tokenomic pivots, ask: Is the mechanism on-chain and auditable? Does it create durable demand or a short-term pump? Who benefits (holders, validators, treasury)? LIT’s jump shows the market will reward tangible, immediate fee-to-token commitments, but traders should confirm implementation and watch for games where promised sinks don’t materialize.

Practical playbook: allocating to upgrades vs. momentum

For portfolio managers and active altcoin traders, the goal is to capture upgrade and narrative-driven upside without being overexposed to headline risk. Here’s a practical framework:

Position sizing and buckets: 60% core, 30% upgrade/narrative, 10% micro‑speculative. The core bucket holds lower‑beta, conviction long-term L1s; the upgrade/narrative bucket targets tokens with near-term forks, hard forks, or tokenomic changes; micro‑spec is for small caps with asymmetric upside but high failure risk.

Event sizing: cap allocation to any single upgrade trade at 2–5% of risk capital pre-event. Add only on confirmed positive execution (successful testnet, mainnet upgrade without critical bugs).

Entry and layering: scale in with limit ladders — initial 40% at conviction, 30% on catalyst confirmation, 30% on post-event strength. For momentum plays (SUI-style), use tighter stops and shorter timeframes — don’t commit core capital to pure momentum.

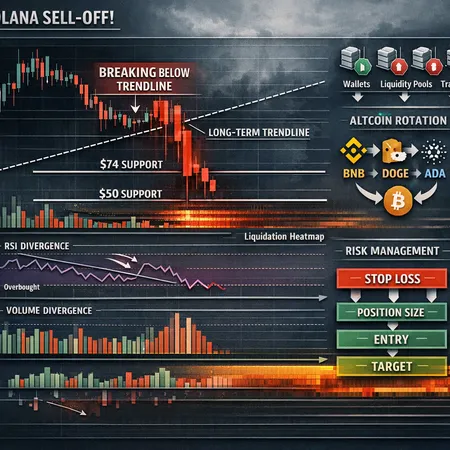

Risk rules: predefine stop-loss levels (e.g., 12–20% for upgrade trades, 6–12% for momentum scalps) and a maximum drawdown per token. Use volatility sizing — smaller position when realized vol is high.

Liquidity and exit planning: ensure exits are possible on 2–5% of circulating daily volume. For small-cap narrative tokens, plan partial exits into strength and avoid full liquidation during initial volatility spikes.

Confirmation checklist: for network upgrades, confirm timelines, testnet results, and validator readiness. For tokenomic shifts, require on‑chain implementation details and multi‑party audits. For narrative plays, track flow metrics (DEX volumes, whale wallet accumulation) and social sentiment spikes.

Tools and execution: use limit orders and TWAP for larger fills, monitor on‑chain dashboards, and keep an eye on correlated risk (BTC, macro). For portfolio managers using products or services, platforms like Bitlet.app can help with order execution and structured allocation tools, though the core discipline remains event focus and sizing control.

Risk considerations and final thoughts

Upgrade-driven and narrative-driven trades offer attractive asymmetric returns in early cycles, but they’re also exposed to execution risk and fleeting sentiment. Diversify across catalyst types (hard forks, tokenomics, developer incentives) and avoid concentration in single narrative bubbles. Maintain clear rules for adding to winners and cutting losers, and prioritize on‑chain verification for any claims that underpin a trade.

In short: the early-cycle rotation into L1s and narrative tokens is real and selective. BNB’s Fermi hard-fork story, SOL and SUI’s tradeable narratives, and tokenomic pivots like LIT’s fee-to-token plan illustrate the types of events that can produce outsized moves. A disciplined, event-aware allocation strategy — with tight execution checks and volatility-aware sizing — is the practical route for portfolio managers and active traders seeking to reweight into upgrade-driven and narrative-driven opportunities.

Sources

- https://crypto.news/rotating-capital-eyes-altcoins-from-solana-to-sui-in-early-cycle-shift/

- https://crypto.news/bnb-price-targets-1000-as-bullish-reversal-pattern-takes-shape-ahead-of-fermi-hard-fork/

- https://blockchain.news/news/20260106-price-prediction-sui-targeting-210-227-despite-overbought-conditions

- https://coinpedia.org/news/why-lighter-lit-token-price-jumped-13-today/

- https://cryptopotato.com/bitcoins-rally-stopped-at-95k-ripples-xrp-surges-by-double-digits-market-watch/