XRP Supply Shock: Separating Viral Hype from On‑Chain Reality and What Traders Should Do

Summary

Executive summary

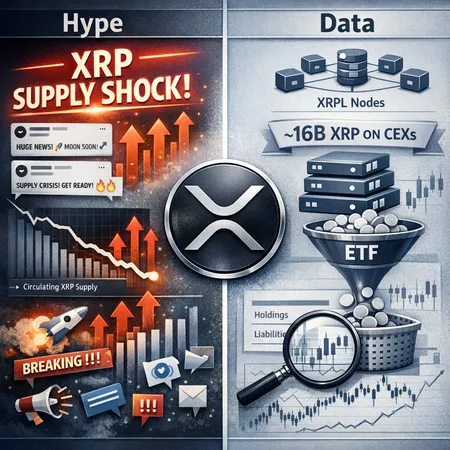

The “XRP supply shock” story — a claim that spot ETF demand is pulling a meaningful, permanent portion of circulating XRP out of the liquid market — exploded across social feeds after a series of charts showing falling exchange balances and huge ETF inflows. The headline is simple and compelling: less supply on exchanges equals higher price. Reality is rarely that tidy. On‑chain snapshots and custodian mechanics suggest a more nuanced picture: large ETF inflows exist, but meaningful XRP still sits on centralized exchanges and custodians behave in ways that can either lock supply or keep it accessible. This article separates hype from evidence and lays out tradeable scenarios.

What the ‘XRP supply shock’ claim actually says

At its core the thesis is straightforward: spot XRP ETFs are absorbing large chunks of circulating XRP, taking those tokens off exchanges and into long‑term custody. Viral charts — often in the style of Glassnode visuals — show declining exchange balances and rising ETF flows, and the interpretation is that tradable on‑exchange liquidity is evaporating. Proponents argue this creates a supply squeeze that could amplify price appreciation, especially given concentrated demand and reduced order‑book depth.

The claim taps into an easy narrative: ETFs bring steady, institutional demand (and retail flows), while exchange reserves shrink. But that narrative assumes two things that deserve scrutiny: (1) that coins moved for ETFs are being permanently removed from liquid supply, and (2) that exchange balances reflect the total accessible supply for market participants.

The supporting charts — what they show and their limitations

Charts showing falling exchange balances are visually persuasive. A declining exchange balance often correlates with reduced immediate liquidity on order books and can precede price moves. Likewise, ETF inflow charts showing millions of dollars (or billions of XRP equivalent) going into funds make intuitive sense as a bullish demand signal.

But there are several caveats: first, exchange balance charts typically aggregate wallets known or labeled as exchange hot/cold wallets — they don’t perfectly capture custodial addresses used by ETF custodians, broker dealers, or authorized participants. Second, a transfer from an exchange to a custodian doesn’t necessarily remove the asset from the market if the custodian or authorized market makers can and do use that inventory for redemptions and arbitrage. Third, some charts omit escrowed or institutional holdings that have never been on a public exchange but still influence supply dynamics.

Coinpedia summarized expert skepticism about an immediate, binding supply squeeze and emphasized the importance of understanding what those charts do and don't prove. The visual story is compelling, but the underlying assumptions require validation against custody and exchange cluster data.

On‑chain pushback: ~16 billion XRP on centralized exchanges

The most important counterpoint to the scarcity thesis is on‑chain evidence showing large XRP balances still held on centralized exchanges. Analysis reported by crypto.news highlights that roughly 16 billion XRP remains on CEXs, a material buffer that undercuts claims of an imminent liquidity vacuum. That number matters: if tens of percent of circulating supply are still exchange‑accessible, the degree of scarcity required to meaningfully compress markets is much larger than the viral charts imply.

Why the discrepancy? Viral visuals often focus on relative declines (e.g., exchange balances down X%) rather than absolute amounts. A 30% decline from a very large base can still leave a lot of tokens in exchange custody. Also, some custodial wallets used by ETF custodians may be classified within exchange clusters or labeled differently by analytics providers, which complicates direct source/recipient attributions.

Coinpedia and other analysts have pushed back on simplistic interpretations, pointing out that headline metrics need to be reconciled with exchange provisioning, authorized participant mechanics, and official custody disclosures.

Spot XRP ETF inflows: mechanics and why inflows don't automatically equal permanent drain

Recent reports show outsized ETF inflows into spot XRP products, with U.Today documenting large daily inflows that dwarf many other assets. On the surface, inflows look like a fast route to scarcity: create ETF shares, buy the underlying XRP, move it to custody, rinse and repeat. But ETF mechanics are more nuanced.

Key points:

- Authorized Participants (APs) create and redeem ETF shares. APs source the underlying XRP for creations and can redeem shares for XRP, which returns supply to the market. So while creations remove tokens from the spot market, redemptions add them back. Net effect depends on whether creations persist without matching redemptions.

- Custodians may keep ETF inventory in cold storage or with third‑party custodians; some of those custodial wallets are counted in exchange cluster metrics and some are not. If custodians choose long‑term cold storage with strict withdrawal limits, that reduces liquid supply. If custodians retain flexible custody policies and APs actively engage in arbitrage, liquidity remains accessible.

- ETF arbitrage means market makers will step in to keep ETF NAV close to spot price; this requires a ready supply of XRP either on exchanges or via custodian channels.

In short: strong inflows establish demand and can pressure supply, but whether that pressure produces a lasting supply shock depends on custody behavior, AP redemptions, and how quickly market makers can source XRP to meet arbitrage needs.

Net effect on on‑chain liquidity and exchange balances

Putting the pieces together: large ETF inflows increase demand for XRP, but the location of purchased XRP and the custodial policies matter far more than headline inflow totals. If ETF purchases are held in accounts that are effectively isolated from the trading ecosystem (no redemptions, no lending, no market maker access), on‑exchange liquidity will feel the squeeze. Conversely, if custodians, APs, and market makers maintain an operational link between ETF inventory and exchange order books, the market may simply reprice with little structural loss of liquidity.

The crypto.news finding of ~16 billion XRP on CEXs is important because it demonstrates a sizable on‑exchange buffer. It also explains why some experts quoted by Coinpedia caution that a true allocation squeeze is not yet proven — absolute exchange balances remain non‑trivial even after recent outflows.

Scenarios and price implications

Below are simplified scenarios traders and token analysts can use to frame the tradebook. Each scenario is directional but not exhaustive — actual outcomes will combine elements of each.

Scenario A — Genuine supply drain into illiquid ETF custody (Bullish)

- Mechanics: Persistent net creations with custodians holding XRP in cold, non‑redeemable or hard‑to‑redeem structures; limited AP redemptions and constrained market maker access. Exchange balances fall materially from current levels.

- Likely price impact: Liquidity dries up, bid‑ask spreads widen, depth thins; price becomes more sensitive to order flow. This can produce rapid rallies and elevated volatility. Long‑only and accumulation strategies benefit; tactical momentum trades can work but risk sharp pullbacks.

Scenario B — Exchange balances remain large and ETF inventory is fungible (Neutral to Mildly Bullish)

- Mechanics: Custodians and APs allow operational flexibility; market makers arbitrage ETF/spot spreads using exchange inventory; redemptions can return XRP quickly to the market.

- Likely price impact: ETF inflows support price via steady demand, but there is no structural scarcity. Markets reprice with more stability; premiums are kept in check by arbitrage. Traders should watch futures basis and funding rates for trade cues.

Scenario C — Concentration risk and episodic tightness (Volatility Trade)

- Mechanics: Custodians hold large sums that are technically accessible but used infrequently by APs, leading to episodic liquidity squeezes when flows spike. Meanwhile, a high percentage of supply may be illiquid due to staking, long‑term holders, or escrow releases.

- Likely price impact: Periods of acute liquidity stress alternate with calmer phases. Tactical strategies that trade volatility (strangles, calendar spreads) and monitoring liquidity on order books can profit.

Practical trade ideas: monitor ETF premium/discount to NAV for short‑term arbitrage; use options/futures to hedge if you’re long; consider accumulation on clear dips if you believe in Scenario A; if you favor Scenario B, focus on relative value trades between spot and futures.

RWA demand narrative and the XRP Ledger angle

Part of the bullish backstory for XRP in some circles ties to the 2025 RWA boom: proponents argue the XRP Ledger (XRPL) could host or facilitate real‑world asset tokenization, increasing native demand and utility. Coinpaper has outlined how the XRPL is being positioned in the RWA story.

This narrative is complementary rather than substitutive. RWA adoption could create steady demand over time, but it’s a separate channel from ETF mechanics. For RWA to materially affect price, the XRPL needs enterprise adoption, regulatory clarity, and operational rails that prove superior at scale. Traders should treat RWA as a longer‑horizon structural bullish case, not an immediate lever on circulating supply.

What to watch — a practical data checklist for traders and analysts

- Exchange balances (absolute and net flows) across major CEXs — watch both relative declines and absolute remaining supply. Reconcile with on‑chain CEX cluster attributions.

- Spot ETF daily creations/redemptions and cumulative flows (watch U.Today coverage of inflows for a high‑level read). Large, persistent creations without matching redemptions increase the chance of a structural drain.

- Custodial disclosures and wallet labels — know whether ETF custody wallets are counted inside or outside exchange clusters.

- Futures open interest and funding rates — a divergence between spot strength and weak derivatives flows can presage corrections.

- Order book depth on major venues — thinning depth increases the price sensitivity to flow.

- Escrow release schedules or large institutional wallets that could offload supply.

Tools: on‑chain analytics providers, CEX API balance snapshots, ETF filings and custody reports, and trade execution platforms such as Bitlet.app for implementing tactical trades.

Verdict: Is the ‘XRP supply shock’ thesis credible?

Short answer: partly. There is credible evidence of strong ETF demand and significant inflows that could contribute to tighter on‑exchange liquidity. But the claim of an imminent, binding supply shock is overstated given current evidence — notably the on‑chain findings showing roughly ~16B XRP on centralized exchanges and the reality that ETF mechanics allow for redemptions and arbitrage that can return XRP to markets.

The outcome is conditional. If custodians shift to effectively lock up ETF holdings and redemptions remain muted while demand continues, scarcity dynamics could become self‑fulfilling. If, instead, custodians, APs, and market makers preserve fungibility between ETF inventory and exchange liquidity, the market will absorb inflows without a structural squeeze.

How to position now (practical guidance)

- If you are a long‑term investor who believes in XRPL fundamentals and RWA adoption, accumulate on weakness but size positions to weather volatility.

- If you are a trader, monitor the checklist above and trade ETF premium/discount, futures basis, and funding. Use tight risk management: liquidity events can be fast and deep.

- For hedged players, consider using options to express a bullish view while protecting against episodic drawdowns.

Conclusion

The ‘XRP supply shock’ narrative has merit as a framework to think about ETF demand and liquidity, but it currently overstates the case if presented as an inevitable, one‑way squeeze. Large ETF inflows matter, but so do custodial behavior, authorized participant activity, and the non‑trivial XRP balances still held on exchanges. Traders and analysts who base positions on a nuanced, data‑driven watchlist — rather than a single viral chart — will navigate the next phase of XRP price action more effectively.

For ongoing monitoring, combine on‑chain metrics with ETF flow trackers and derivatives data; the interplay of those signals will tell you if scarcity is materializing or if the market is simply rotating liquidity. And remember: narratives (like RWA on the XRP Ledger) can add durable upside over time, but they rarely substitute for near‑term market microstructure.

Sources

- Is an XRP supply shock really coming? Experts take — Coinpedia

- XRP ETF supply shock fears face pushback as on-chain data shows 16B on CEXs — Crypto.News

- XRPs ETF hits $64,000,000 in inflows, dwarfing Bitcoin, Ethereum and Solana — U.Today

- RWA boom and the XRP Ledger positioning — Coinpaper

Note: For perspective on how broader crypto markets react to allocation shifts, many traders still watch Bitcoin price action as a cross‑market sentiment proxy, while flows into tokenized financials and marketplace effects overlap with DeFi liquidity patterns.