Ethereum Long‑Squeeze vs. BitMine Accumulation: Dissecting the Derivatives Shock and Recovery Paths

Summary

What happened: a succinct recap of the long‑squeeze

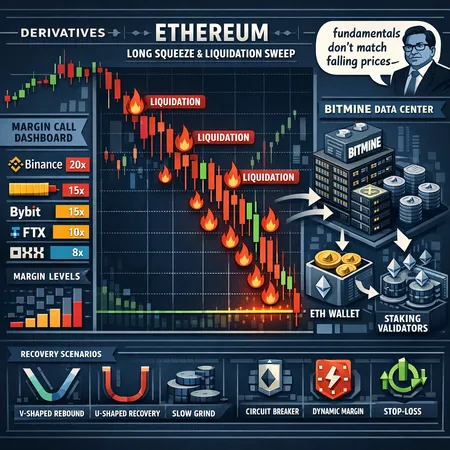

In the past week ETH experienced a broad long‑squeeze that pushed prices sharply lower as leveraged long positions were forcibly closed across major derivatives venues. News outlets described a cross‑exchange unwind that didn’t feel localized to any single platform—liquidations propagated through funding shocks, margin calls, and the mechanical deleveraging rules many venues use. For many active ETH traders this felt like a classic cascade: prices dip, funding flips, and liquidations compound the move.

The short version: elevated open interest and crowded long positioning met a liquidity vacuum, and the market paid the price.

Mechanics of the long‑squeeze: how leverage and liquidity interact

A long‑squeeze isn’t a mystical event; it’s the interaction of three concrete forces: leverage, available liquidity, and exchange margin mechanics.

Leverage concentrates risk

High leverage magnifies price moves. When many participants use 5x–50x leverage, small spot declines create outsized P&L erosion. Once mark prices breach maintenance margins, exchanges execute liquidations—selling into whatever liquidity is available. If many accounts are long, those forced sell orders add downward pressure.

Funding and open interest dynamics

Funding rates are the market’s short‑term thermometer. When funding is strongly positive (longs paying shorts), it signals crowded long bets. A sudden price drop flips funding, incentivizing short entries and further pressuring longs. Meanwhile, elevated open interest means there are many leveraged claims that can be closed mechanically; the larger the open interest relative to available liquidity, the greater the chance of a cascade.

Venue mechanics and cross‑margin contagion

Different venues handle liquidations differently: some use isolated margin (risk limited to a position), others use cross‑margin (where losses can wipe collateral across positions). Auto‑deleveraging (ADL), insurance funds, and maker‑taker structure also matter. When a big cross‑margin account is liquidated on one exchange, it can trigger stop losses and margin calls elsewhere, producing cross‑venue contagion.

The NewsBTC coverage captured this as a broad long‑squeeze across derivatives exchanges, with stress concentrated in places where leverage and open interest were highest NewsBTC report.

Margin dynamics across major derivatives venues: what desks should watch

Margin rules are the plumbing beneath every derivatives market move. Active desks should monitor:

- Funding rate divergences across exchanges and perpetual vs. quarterly contracts. A sudden divergence hints at short‑term dislocation.

- Open interest vs. order book depth. Large OI relative to top‑of‑book liquidity is a risk multiplier.

- Liquidation engine behavior: speed of market orders, ADL thresholds, and insurance fund coverage.

Exchange‑specific idiosyncrasies matter. A desk hedged on Exchange A might still be vulnerable if Exchange B liquidates counterparties in the same ecosystem. That cross‑venue correlation is what turned local pain into a broad squeeze.

On‑chain evidence: BitMine accumulation and staking activity

Reporting from market outlets highlights institutional miners and firms stepping into the weakness. Multiple pieces noted BitMine — an industrial miner/operator — adding ETH to its balance and staking as prices fell. Coverage suggests BitMine has been buying and staking ETH rather than selling to cover operational costs, which signals accumulation from an operator traditionally aligned to PoW mining economics (TheNewsCrypto coverage, see also CryptoPotato).

On‑chain evidence to validate such claims typically includes exchange outflows, staking contract deposits, and known BitMine addresses moving funds on‑chain. Traders should watch:

- Net ETH flows from exchanges to private or custodial addresses—sustained outflows often mean accumulation.

- Deposits to ETH staking contracts or services (e.g., withdrawals to Lido or direct Beacon Chain deposits) that reduce liquid supply.

- Clustering signals from known entity addresses (e.g., miner or company wallets) that show balance growth.

Taken together, these metrics convert the narrative from rumor to measurable behavior: miners adding and staking ETH reduce liquid supply and can be a bullish fundamental offset to a derivatives‑led sell‑pressure spike.

Tom Lee’s bullish thesis: fundamentals vs. price action

Market commentator Tom Lee argued that the ETH dip is “attractive” and that fundamentals don’t match the falling prices. His view mirrors the BitMine activity: institutional actors continue to accumulate while staking removes supply from liquid markets (TheNewsCrypto, CryptoPotato).

Why this thesis has traction:

- Staking demand and institutional accumulation reduce liquid ETH available to sell, supporting a higher price floor over time.

- Protocol upgrades and DeFi growth continue to drive on‑chain activity and tether ETH to real utility. For many, ETH remains an essential DeFi settlement layer—similar to how Bitcoin anchors macro crypto narratives.

- Miners and institutional participants buying into weakness suggests conviction rather than capitulation.

That said, fundamentals are a multi‑quarter story; short‑term derivatives dynamics can still dominate price action. Tom Lee’s argument is that the structural, longer‑term drivers (staking, institutional treasury buys) outpace transient funding and leverage noise.

Short‑ and medium‑term recovery scenarios

Active desks should plan for multiple plausible paths. Here are three structured scenarios with implications and tactical responses.

1) Fast relief rally (days to 2 weeks)

Trigger: washed‑out long liquidations, improved funding (back to neutral), and a wave of spot buying (retail/institutional). Price reaction: sharp bounce as short covering meets renewed demand.

Implication: Volatility collapses quickly; funding rates normalize. Traders who survived the squeeze can opportunistically rebuild directional exposure, but beware of a double top.

Tactical actions:

- Add size via staged buys or TWAP execution to avoid front‑running.

- Use options structures (e.g., call spreads) to participate with capped downside.

2) Choppy recovery with volatility (2–8 weeks)

Trigger: mixed macro news, intermittent liquidations, and slow absorption of supply. Price reaction: several volatile swings that test both lower and higher support.

Implication: Funding whipsaws; OI rebuilds unevenly. This is where desks should favor active risk management and hedged exposure.

Tactical actions:

- Ladder positions and maintain dynamic hedges (inverse futures or short dated options).

- Tighten intra‑day risk limits and increase stress‑test frequency.

3) Prolonged consolidation or make‑lower (months)

Trigger: macro shocks, further deleveraging, or a drying up of buyers. Price reaction: extended basing or lower lows before fundamentals reassert.

Implication: Staking and accumulation can be slow to offset persistent selling—if liquidity remains thin, prices can re‑test support zones.

Tactical actions:

- Reduce gross exposure; focus on liquidity provisioning and market‑making at wide spreads.

- Prioritize capital preservation—use collars or systematic re‑risking frameworks rather than directional bets.

Each scenario should be accompanied by lead indicators: funding trends, exchange flows, open interest changes, and known entity accumulation (like further BitMine moves).

Risk controls for derivatives desks: a practical playbook

Derivatives desks can survive and even profit from volatile squeezes if they operationalize risk controls before volatility arrives.

Key controls and processes:

- Position sizing and concentration limits

- Cap leverage per trader, per strategy, and per account. Enforce maximum notional exposure relative to capital.

- Dynamic margin and stress testing

- Run “what‑if” scenarios daily: 10–20% adverse move, spike funding, and liquidity evaporation. Tie results to required margin buffers.

- Cross‑venue correlation monitoring

- Real‑time dashboards that show open interest, funding rate, and top‑of‑book liquidity across major venues to detect cross‑margin contagion early.

- Hedging and liquidity management

- Use staggered expiries, options hedges, and spot/futures pairs to reduce undifferentiated directional risk.

- Maintain a liquidity reserve in stable assets to cover margin calls without forced selling.

- Automated circuit breakers and human overrides

- Auto‑reduce or cancel new aggressive orders when volatility and liquidation signals spike. Empower a small response team for fast judgement calls.

- Counterparty and execution risk controls

- Limit exposure to venues with opaque liquidation engines. Prefer venues with transparent insurance funds and documented ADL rules.

- Funding and basis monitoring

- Watch the perpetual basis and basis shifts across maturities. Rapid basis widening is a reliable early warning of dislocation.

These steps help desks limit tail losses while preserving optionality for rapid redeployment when a recovery begins.

Putting it together: a balanced read on price vs. fundamentals

The recent long‑squeeze was an outcome of crowded leverage and fragile liquidity; those are classic proximate causes. At the same time, institutional accumulation and staking—illustrated by BitMine activity and amplified by voices like Tom Lee—create a countervailing structural narrative: less liquid ETH supply and longer‑term demand.

For active traders and desks the takeaways are practical:

- Respect derivatives plumbing (funding, OI, venue rules) — it moves markets quickly.

- Use on‑chain signals (exchange flows, staking deposits, known entity clusters) to test accumulation narratives.

- Scenario plan across time horizons and hard‑wire risk controls that survive the next squeeze.

Platforms and tools that aggregate exchange flows and funding across venues can accelerate decision‑making; many traders use third‑party analytics and execution tools, and services such as Bitlet.app offer features that help retail traders manage installments and execution strategies in volatile markets.

Conclusion

Short bursts of deleveraging will continue to punctuate ETH price action as long as leverage remains a dominant participation mode. However, institutionally driven accumulation and staking reduce floating supply and can support higher prices over months if the buying continues. Active desks should marry macro and on‑chain monitoring with robust margin and liquidity playbooks—because when the next squeeze comes, preparedness will be the difference between recovery and capitulation.