Investor Brief — Bit Digital’s Pivot From BTC Mining to ETH Staking & AI Infrastructure

Summary

Executive summary

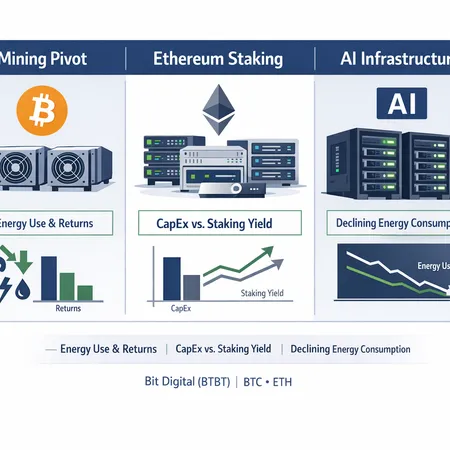

Bit Digital's recent announcement that it will shift emphasis away from traditional Bitcoin mining toward Ethereum staking and AI infrastructure marks a pivotal strategic reorientation for a public mining operator. According to coverage of the company’s move, Bit Digital is reallocating capital and operational focus toward staking exposure and AI compute rather than expanding Proof‑of‑Work (PoW) BTC rigs Blockonomi. For investors, that change alters the company’s risk/return profile: lower sensitivity to BTC hashprice swings, new protocol‑level risks tied to ETH staking economics, and exposure to the commercial dynamics of AI data centers.

This brief breaks down the strategic rationale, contrasts PoW mining economics with staking, explores the mining‑industry and capital allocation implications, and evaluates how the shift may change energy usage and investor returns. It also highlights what to monitor next for public‑market investors and industry observers.

Why the pivot: strategic rationale

Three pragmatic drivers appear to underlie Bit Digital’s decision: (1) capital efficiency and predictable yields, (2) desire for differentiated infrastructure revenue, and (3) risk management against concentrated BTC exposure.

Capital efficiency and yield predictability: PoW mining requires continual CAPEX refresh (ASIC replacements every cycle), volatile operating margins tied to BTC price and hashprice, plus significant site and power management. By contrast, staking ETH demands less rolling hardware spend per unit of protocol exposure and can produce steady staking yields (plus potential MEV capture if operating validator infrastructure). That tradeoff is attractive for a company seeking more predictable cash flows.

Diversification into AI infrastructure: AI compute is a growth market willing to pay for specialized GPU capacity and managed services. Hosting and operating AI workloads can command higher utilization rates and contractual revenue profiles compared with selling a commodity (BTC) that is highly correlated with market sentiment. Combining ETH staking economics with AI services creates a paired strategy: one protocol income stream and one commercial infrastructure business.

De‑risking BTC concentration: Historically, mining stocks have traded with high beta to Bitcoin. Moving some capital into ETH staking and AI infrastructure can reduce pure BTC correlation and give investors differentiated exposure to ETH protocol yields and AI demand.

Blockonomi’s coverage of Bit Digital frames this as a deliberate shift in asset mix and operational focus, not just a short‑term trade. That distinction matters when valuing future cash flows against legacy mining comparables.

How staking economics differ from PoW mining economics

Understanding the differences is essential for valuation and risk assessment.

Revenue source and predictability

PoW mining revenue = block rewards + transaction fees (BTC) minus electricity, maintenance, and depreciation. Revenue is highly correlated with BTC price and network hashprice; margins swing quickly as competitors and ASIC efficiency change.

ETH staking revenue = staking yields (annualized % paid to validators) + validator fees + potential MEV/transaction ordering revenue. These yields are influenced by protocol parameters (e.g., total ETH staked), network demand, and fee market dynamics. After the Ethereum Merge and post‑Shanghai changes, staking withdrawals are possible, making staking economics more fungible than immediately post‑Merge.

Staking yields can be more predictable in nominal terms but are still affected by protocol supply dynamics and ETH market price. Unlike mining, staking does not require continual large‑scale ASIC replacement, reducing one dimension of capex volatility.

Cost structure and capital intensity

PoW requires large upfront investment in ASICs, dedicated hosting sites, and ongoing electricity costs. Unit economics depend on watt/TH and equipment efficiency.

Running ETH validators requires far less specialized hardware (commodity servers with GPU/CPU depending on whether the operator runs additional execution clients or MEV infrastructure). Capital is tied up in ETH holdings if the strategy is to own ETH and stake it, or in securing third‑party staking obligations if offering staking as a service.

AI infrastructure, however, is capital‑intensive in its own way: GPUs and networking are expensive, and facilities need power and cooling on par with mining farms. But AI work can attract enterprise contracts and higher utilization than idle ASICs awaiting a favorable hashprice.

Risk vectors: slashing, censorship, and market correlation

Stakers face protocol‑specific risks like slashing for validator misbehavior or prolonged downtime, and the need to run secure validator stacks. They also face different regulatory and custody risks tied to holding native ETH (custodial staking attracts more scrutiny). Miners face equipment obsolescence, site risks (e.g., regional bans), and hashprice competition.

Implications for the mining industry and capital allocation

Bit Digital’s pivot signals a few broader trends for public miners and infrastructure allocators:

Reallocation of capital away from pure ASIC accumulation toward diversified infrastructure. Companies may split CAPEX between GPU/data center investments and ETH holdings/validator operations.

M&A and partnership activity could increase: mining companies with balance sheets may buy into AI hosting providers or validator operators instead of buying more miners.

Geographic and regulatory considerations regain prominence. State actions can reshape where and how miners operate — for example, Kazakhstan's decision to turn seized BTC into a national treasury illustrates how geopolitical and regulatory moves change the supply/demand backdrop and operational risks for miners on the ground CoinPaper.

For capital allocators, the pivot redefines comparable sets: Bit Digital will need valuation peers that mix staking platforms and AI data center operators, not just other BTC miners. That complicates relative multiples but can justify multiple expansion if investors price in recurring infrastructure revenue and lower cash‑flow volatility.

Energy use: from diffuse PoW consumption to concentrated AI demand

A common narrative is that staking is “green” because it eliminates PoW electricity. That’s directionally correct but too simple.

Net electricity for validators is orders of magnitude lower than for hash‑dominated mining per unit of protocol exposure. ETH staking itself does not require energy‑hungry hashing.

However, AI infrastructure is power‑intensive. High‑density GPU clusters and cooling systems concentrate consumption into data centers rather than distributed mining farms. Total energy use shifts profile: less global grid strain from widely distributed ASIC farms, but potentially more concentrated loads in data center hubs where AI compute is provisioned.

The operational footprint also changes: mining farms often prioritize cheapest power (sometimes sourced from stranded or curtailed generation), while AI data centers require reliable, high‑quality power, which can strain local grids differently and require larger investments in power distribution and cooling.

The net environmental impact depends on where Bit Digital locates AI centers, the energy mix of those grids, and whether they pursue renewable procurement. Investors should not assume “lower energy = better returns” without modeling the cost of site power, availability, and potential carbon pricing/regulatory constraints.

What this means for investor returns and valuation

Shifting from BTC mining to ETH staking + AI infrastructure changes how to model expected returns:

Revenue volatility: expect lower day‑to‑day volatility from protocol yield streams compared with the highly BTC‑correlated miner revenue, but still meaningful exposure to ETH price and staking APR dynamics.

Capital efficiency: less churn of specialized ASIC capex can improve long‑term free cash flow if staking yields plus AI margin cover the cost of capital. AI contracts can be long‑dated and high‑margin, but require sales, software, and operations skill sets that differ from pure mining.

Multiple drivers: valuation will need to segregate components — ETH stake value (which sits on the balance sheet and can appreciate with ETH), validator service margins, and AI infrastructure margins. Each component carries different multiples; the market will determine how much of the old mining premium migrates to the new businesses.

New risk premiums: slashing risk, MEV capture ability, and AI utilization risk should be incorporated into discount rates. Operational execution risk is higher during a strategic pivot.

Practical modeling tip: run scenario analyses — (A) BTC price rebounds and miner margins improve; (B) ETH appreciates with steady staking yields and AI revenues grow; (C) AI demand softens and ETH price falls. Compare enterprise value per unit of deployed capital under each.

Key metrics and watchlist for investors

Investors should shift from hashpower‑centric KPIs to a blended dashboard:

- ETH staked (owned vs. delegated) and validator uptime/slashing history

- Staking APR and MEV capture (gross and net of infrastructure costs)

- AI capacity: GPUs deployed, utilization rate, average billed rate per GPU-hour, and contractual vs spot revenue mix

- Power cost per MW (location basis) and PUE for data centers

- Capital allocation cadence: % of free cash flow or equity directed to ETH purchases vs. AI capex vs. legacy miner maintenance

- Balance sheet exposure to crypto inventory vs. operating assets — how liquid is protocol exposure?

Also watch management’s execution: hiring AI ops staff, partnerships with cloud/colocation providers, and whether they retain or sell ASIC inventory.

Conclusion: a sensible pivot with executional risk

Bit Digital’s move from Bitcoin mining toward Ethereum staking and AI infrastructure is understandable given the capital and margin differences between the businesses. The shift can reduce pure BTC beta and create new recurring revenue streams, but it replaces one set of operational challenges with another: slashing and protocol risk on the staking side, and sales/operations complexity on the AI side. Energy consumption will likely become more concentrated and facility‑centric rather than widely distributed.

For public‑market investors, the change calls for updated comparables, new KPIs, and scenario modeling that includes ETH staking yields, AI utilization, and evolving regulatory/geopolitical risks. Keep an eye on execution milestones and on how management balances staking liquidity with the capital needs of AI infrastructure.

For those tracking sector narratives, this pivot is another example of how crypto firms are broadening beyond single-protocol bets; platforms like Bitlet.app and others are reshaping services around multi‑protocol infrastructure rather than pure commodity mining.

Sources

- Bit Digital pivots to Ethereum and AI coverage: Blockonomi

- Kazakhstan turns seized Bitcoin into national treasury — geopolitical example affecting mining supply: CoinPaper