Why Ethereum Looks Poised for a 2026 Rally: Dollar Weakness, Whale Accumulation and BitMine’s MAVAN

Summary

Executive snapshot

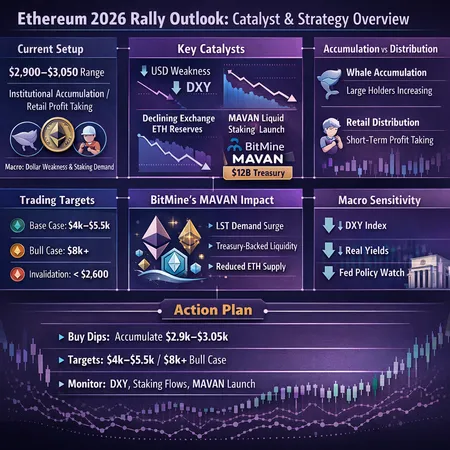

Ethereum’s narrative for 2026 is converging along three axes: on-chain accumulation, a constructive macro backdrop if the dollar weakens, and structural supply shifts via staking — now with BitMine’s MAVAN proposal in the conversation. Price action has been grinding between roughly $2,900 and $3,050, a consolidation band that traders watch for a directional breakout. For portfolio managers and DeFi traders, the interplay of whale behavior, dollar dynamics, and new staking vehicles will determine whether ETH’s next move is a steady grind higher or a volatility-led squeeze.

On-chain accumulation: whales buying, retail lightening up

Throughout 2025 we saw a clear divergence: large wallets were accumulating ETH while small retail addresses trimmed exposure. Analysis and reporting show significant whale accumulation that often precedes meaningful multi-month rallies in ETH. CryptoPotato summarized this dynamic, noting that institutional-sized players increased holdings while retail distributed positions. That distribution pattern matters: when concentrated hands own a larger share of supply, volatility can compress — until a catalyst forces re-leveraging or profit-taking.

This asymmetry is bullish when combined with a small float available for active trading. But it also increases tail-risk: if a liquidity shock forces large holders to sell, squeezes can amplify downside. Traders should monitor on-chain metrics — exchange inflows, large transfer counts, and balance changes in top wallets — to see whether the accumulation continues into early 2026.

Technical picture: consolidation around $2,900–$3,050

ETH’s price has spent time consolidating near the $2,900–$3,050 band. Observers flagged this setup as constructive but unresolved: Blockonomi noted ETH consolidating around $2,972 and highlighted the market’s sensitivity to macro cues, while TheNewsCrypto recorded short-term dips below $2,950 with resistance pegged near $3,050. That technical range now functions as an on-chain battleground — break and hold above $3,050 would validate bullish momentum; a decisive breakdown below $2,700–$2,800 would shift the narrative back toward consolidation or deeper correction.

In practice, the consolidation favors trend-following managers who prefer confirmation above resistance, and opportunistic traders targeting mean-reversion plays within the range. Liquidity around these price levels will be critical: watch derivatives open interest, funding rates and concentrated orderbook depth on major venues.

Macro multiplier: how a weaker U.S. dollar could amplify ETH gains

Macro is a force-multiplier for crypto returns. If the dollar weakens, asset allocators often shift toward risk assets and hard assets; for crypto specifically, a weaker USD can lift dollar-priced returns and attract cross-border capital. Cryptoticker made a cogent case that a sustained weakening of the U.S. dollar could be a major tailwind for ETH in 2026, especially because Ethereum's use cases and institutional interest are growing.

The transmission mechanism is straightforward: dollar weakness raises the nominal USD price of ETH; it also relaxes real yields on dollar-denominated assets, nudging portfolio allocation toward higher-beta exposures. For ETH, that effect compounds with on-chain buying and staking demand. However, timing matters — macro shifts can be abrupt and reverse just as fast. Portfolio managers should pair dollar indicators (DXY, real yields, FX reserves flows) with ETH on-chain signals rather than assuming a linear correlation.

Staking flows and the BitMine MAVAN shock

Staking already removes ETH from liquid supply. Large staking inflows tighten available tradable ETH and historically correlate with a higher price floor if demand remains stable. BitMine recently entered the conversation with MAVAN, reportedly backed by a large ETH treasury. TheNewsCrypto reported that BitMine plans to launch MAVAN with a multi-billion-dollar ETH backing, and BeInCrypto linked large staking moves by the firm to potential breakout catalysts.

Why MAVAN matters: if BitMine deploys a $12B-equivalent ETH treasury toward staking derivatives or liquid-staking tokens, the market dynamics change in two ways. First, institutional staking demand increases, reducing spot liquidity. Second, the supply of liquid staking derivatives (LSDs) could expand — but they may stay within tightly-held treasury pools initially, limiting circulation. An institutional-scale LSD that consolidates yield and liquidity could attract capital from traditional yield-seeking pools, altering DeFi capital flows and collateral dynamics across lending, derivatives, and AMMs.

That said, the devil is in the implementation: product design, tokenomics, and regulatory posture will dictate whether MAVAN adds constructive staking demand or introduces new systemic complexity. Traders should watch announcements, staking rate differentials, and flows into liquid staking protocols for clues about how MAVAN will be integrated into the broader liquidity fabric.

Trading targets and scenarios for 2026

Base-case bullish scenario (probable if dollar weakens and accumulation continues):

- Break above $3,050 confirmed with increasing volume and rising derivatives open interest. Short-term targets: $3,500–$4,200 by mid-2026; extended target: $5,000+ if macro and staking catalysts align and liquidity remains thin.

Bull-run / aggressive scenario (strong dollar weakness + institutional staking demand + MAVAN adoption):

- Rapid repricing toward $6,000+ driven by concentrated buying and yield-seeking flows into LSDs and ETH staking products. This is higher-probability if capital rotations from FX and bond markets accelerate.

Risk / downside scenario (dollar strengthens, regulatory shocks, or MAVAN execution failure):

- Rejection at $3,050 followed by a test of $2,300–$2,600. A larger macro shock or regulatory clampdown on staking derivatives could force a larger re-pricing.

Quant managers should layer exposure: conviction-sized long positions above confirmed breakouts; opportunistic range trades within $2,700–$3,050; and strict risk limits given the concentration of supply and liquidation risk.

Key indicators to watch

- On-chain whale flows and top wallet balance changes (are institutions still accumulating?).

- Staking inflows and LSD issuance rates (including any MAVAN tokenomics disclosures).

- Dollar strength metrics: DXY, real yields and FX reserve shifts.

- Exchange net flows (are exchanges seeing inflows or withdrawals of ETH?).

- Derivatives metrics: open interest, funding rates and liquidations around major levels.

Also keep a close eye on narrative shifts. For example, if BitMine or MAVAN-related headlines accelerate institutional staking demand, retail FOMO and derivatives positioning can quickly create feedback loops.

Risks and execution pitfalls

- Concentration risk: heavier ownership by whales and treasuries increases downside volatility if exits are forced.

- Regulatory scrutiny: liquid staking vehicles and large custodial treasuries attract regulatory attention, which can derail product rollouts or depress demand.

- Macro reversal: if the dollar strengthens unexpectedly or rates surprise higher, risk assets can retrace sharply even if on-chain fundamentals remain intact.

- Product risk: MAVAN’s structure, governance and liquidity provisioning will determine whether it is additive or disruptive.

Putting it together: what active managers should do now

- Monitor confirmation above $3,050 before reallocating large, directional bets; use scaled entries and tight risk controls.

- Follow staking yields and LSD supply changes closely — rising staking demand with constrained LSD circulation increases the probability of higher spot prices.

- Hedge macro exposure where appropriate — a long ETH position paired with a partial hedge on FX-sensitive exposures can protect against a dollar surprise.

- Stay nimble around MAVAN updates; institutional-scale staking products can shift composition of supply quickly, and early positioning can be rewarded or punished depending on execution.

For those building DeFi strategies, consider collateral and liquidity provider implications: rising LSD issuance tied to MAVAN could change APYs and borrowing constraints across DeFi venues, while broader market moves will remain tied to Bitcoin narratives as well (for many traders, Bitcoin remains the primary macro bellwether).

Conclusion

Ethereum’s technical consolidation, concentrated whale accumulation and rising staking demand create a plausible runway for a 2026 rally — particularly if a weaker U.S. dollar materializes. BitMine’s MAVAN proposal, on paper backed by a substantial ETH treasury, could be a structural catalyst for staking demand and liquid-staking dynamics, but details matter. Active managers and DeFi traders should combine on-chain flow monitoring, macro indicators and careful position sizing to navigate a market that could re-rate sharply if multiple catalysts align. Bitlet.app users and other market participants will want to keep an eye on MAVAN disclosures and the behavior of large wallets as the calendar turns toward 2026.

Sources

- Ethereum price consolidates at $2,972; eyes FOMC minutes for the next direction — Blockonomi

- Ethereum price dips below $2,950 after brief rebound; eyes on $3,050 resistance zone — TheNewsCrypto

- Can a weaker US dollar fuel a 2026 ETH rally? — Cryptoticker

- Whales are buying, retail is selling — what's next for Ethereum? — CryptoPotato

- BitMine to launch MAVAN backed by $12B Ethereum treasury — TheNewsCrypto

- Ethereum staked by BitMine could catalyse price breakout — BeInCrypto