Portfolio Construction

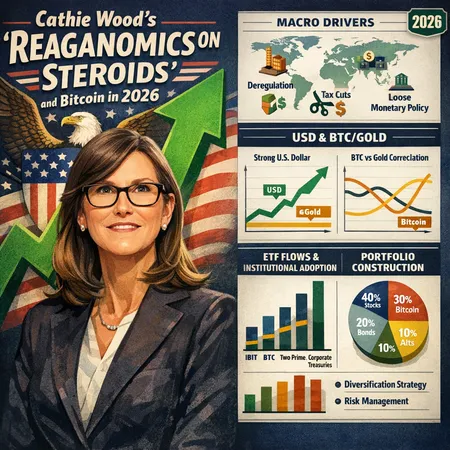

Cathie Wood's thesis of a deregulatory, tax-cut, risk-on US macro regime could rewrite Bitcoin's portfolio role in 2026. This article breaks down the macro argument, on-chain and ETF signals, and practical allocation and risk-management approaches for investors treating BTC as a diversifier.

Arthur Hayes argues that weak 2025 for crypto was a dollar-credit story, not a rejection of crypto narratives. This article unpacks his thesis, the channels that turn U.S. dollar liquidity into crypto returns, and actionable portfolio frameworks for allocators.

Bitwise CIO Matt Hougan argues Bitcoin is more likely to produce steady, lower-volatility gains over the next decade than explosive, headline-grabbing rallies. This piece unpacks his assumptions, contrasts the super-cycle narrative, and lays out portfolio and trading guidance for allocators and wealth managers.

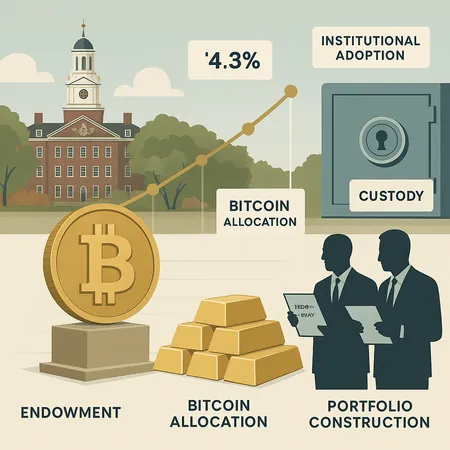

Harvard’s Q3 2025 increase in Bitcoin exposure — now reported at $443M — is a watershed for endowments, testing governance, custody, and the precedent for other institutions. This feature unpacks the allocation’s scale versus gold, fiduciary risks, operational hurdles, likely copycat behavior, and market impact on BTC liquidity and volatility.

Tokenized gold’s $3 billion milestone signals a maturing market for digital commodities. This primer breaks down product types (PAXG, XAUT), institutional drivers, custody and legal risks, and practical due diligence for integrating tokenized metals into portfolios.

DeFi

All DeFi postsBitcoin

All Bitcoin postsLiquidity

All Liquidity posts- How US–Israel Strikes, an Oil Shock, and Strait of Hormuz Risk Are Roiling Bitcoin — What Traders Should Watch

- How U.S. Spot Bitcoin ETF Inflows Are Changing BTC Price Discovery and Liquidity

- Bitcoin's Tug-of-War: ETF Inflows Lift BTC to ~$68–70K — But Liquidity and a Multi‑Billion Options Expiry Threaten Volatility