How ETF Flows and RLUSD’s $1.2B Surge Are Rewiring Ethereum’s Liquidity and Price

Summary

Executive overview

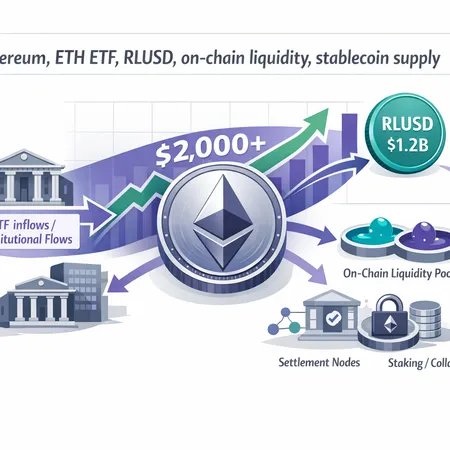

In early 2026 Ethereum (ETH) reclaimed the $2,000 level as spot‑ETF inflows resumed, a technical and structural rally tied to renewed institutional demand. At the same time, Ripple’s RLUSD stablecoin has expanded rapidly on Ethereum — crossing about $1.2 billion of supply on‑chain — adding a sizeable, immediately usable pool of USD‑pegged liquidity. These two shifts are not independent. Institutional flows create predictable, programmatic bids for ETH, while large stablecoin issuance changes how that liquidity is routed, settled, and reused inside the DeFi stack.

This article unpacks how ETF inflows and the RLUSD supply surge interact to influence on‑chain liquidity, settlement behavior, collateral use, and medium‑term price scenarios for ETH. I cite recent reporting on ETH’s price reclaim and ETF flows, and on RLUSD’s on‑chain expansion, and then outline implications product managers and institutional researchers can act on.

What resumed ETF flows mean for ETH price mechanics

Two recent pieces documented the same theme: spot‑ETF money is back and it matters. Coverage of ETH reclaiming $2,000 links the move directly to renewed ETF inflows and returning institutional interest (CoinPedia, Crypto.News). Institutional flows are different from retail flows: they are larger, more predictable, and often executed via authorized custodians who convert fiat into custody‑grade ETH holdings.

Mechanically, ETF inflows create demand in one of two ways:

- Custodial purchase: ETF managers instruct custodians to acquire ETH on spot markets to back ETF shares. That means direct demand for liquidity on exchanges and OTC desks.

- Secondary effects: ETFs reduce sell pressure from exchange wallets (assets move to long‑term custodial accounts) and increase derivative hedging flows that temporarily change basis and funding rates.

A simple conversion model helps frame the scale: a sustained $100M daily inflow into ETH ETFs equals roughly 50k ETH of gross acquisition at $2,000 per ETH. Even lower, recurring daily flows materially reduce available floating liquidity and can push price higher, particularly when combined with shrinking exchange reserves and elevated staking demand.

RLUSD and the new shape of stablecoin supply on Ethereum

Ripple’s RLUSD expansion onto Ethereum (reported near $1.2B) is meaningful for two reasons: scale and location. A billion‑plus of USD‑pegged ERC‑20 liquidity sitting on Ethereum becomes an active settlement layer for trading desks, market makers, and DeFi protocols. CoinPaper’s reporting on the $1.2B supply highlights how quickly RLUSD has become part of that plumbing.

Where stablecoins live matters. Additional RLUSD on Ethereum:

- Lowers frictions for on‑chain settlement between fiat rails and ETH trades (no extra cross‑chain bridges required).

- Increases base liquidity in DEX pools and lending markets, improving market depth for ETH pairs.

- Offers new collateral for on‑chain lending, repo, and yield strategies, expanding the universe of near‑cash instruments available to institutions.

But issuance is not neutral. Large, fast minting concentrates counterparty risk (issuers, redemption mechanics) and can change stablecoin dynamics vs. incumbents (USDC, USDT). If RLUSD is quickly deployed into liquidity provision, arbitrage and market‑making will reallocate existing stablecoin capital and could transiently change spreads across venues.

How the pieces interact: conversion paths from stablecoins to ETH demand

Institutional flow + stablecoin supply forms several practical paths that amplify ETH demand:

- Fiat → RLUSD → Custodial ETH purchases: Institutions or market‑making desks onboard fiat, mint RLUSD, and directly buy ETH on DEXes or OTC, accelerating ETH acquisition while keeping settlement entirely on‑chain.

- RLUSD as intraday settlement for ETF creators: Authorized participants (APs) or custodians could accept RLUSD from market makers as part of creation/redemption cycles, then convert to ETH for the ETF inventory — shortening settlement cycles and lowering funding friction.

- Collateralized borrowing: RLUSD placed as collateral into lending protocols funds leveraged ETH buys (or funds arbitrage) without immediate fiat conversion. That magnifies buying power for participants already long the asset.

These routes matter because they change which market makers supply ETH liquidity and how quickly large buy orders execute without moving price as much. An expanded on‑chain stablecoin base reduces reliance on off‑chain fiat rails and speeds execution.

On‑chain utility changes: settlement, collateral, and liquidity provisioning

Three short‑term utility shifts are most relevant to product teams:

Settlement velocity: With RLUSD, settlement between counterparties on Ethereum becomes effectively instant relative to off‑chain wire cycles. Faster settlement reduces counterparty credit friction and enables tighter spreads.

Collateral depth: New stablecoin supply enlarges available collateral for lending and synthetics. That lowers the cost of borrowing stablecoins to fund ETH purchases and supports deeper, more resilient lending pools.

Liquidity replenishment for DEXes and AMMs: Fresh RLUSD can be deployed into ETH/RLUSD pools, boosting depth and reducing slippage for large trades — an important consideration for ETF creators or OTC desks that route large fills via AMMs.

These functional improvements increase ETH’s on‑chain utility and, crucially, the fraction of ETH that can be removed from the exchange float (custody, staking, or locked liquidity) without breaking market functioning.

Risks and counterpoints: why more stablecoins can also mean more fragility

Scale and speed are double‑edged. Key risks to monitor:

Redemption waves: If RLUSD faces credibility issues or concentrated redemptions, holders might sell ETH into spot to rebalance or cover redemptions, producing correlated selling pressure at inopportune times.

Interoperability and concentration: Heavy use of a single issuer or rails concentrates settlement risk. If custodians or APs are reliant on one stablecoin’s rails, operational outages could tighten liquidity.

Regulatory friction: Stablecoin issuers and ETF managers operate under evolving regulatory regimes. Adverse rulings or compliance shifts could remove on‑chain liquidity faster than the market expects.

Product teams should instrument counterparty exposure (who mints RLUSD, who holds it, and where it is deployed) and run redemptions stress tests — something market infrastructure players like Bitlet.app already watch when building custody and settlement features.

Medium‑term price scenarios for ETH (practical framing)

Avoiding precise price forecasting is prudent; instead, use scenario frameworks with conditional drivers.

Base case (45% probability): Gradual appreciation to $2,500–$3,200 over 3–9 months

- Sustained, moderate ETF inflows and continued RLUSD deployment into AMMs and lending.

- Exchange reserves decline modestly; staking and custodial holdings rise.

- Result: tighter market depth but orderly price appreciation as liquidity normalizes.

Bull case (30% probability): Re‑rating above $3,500 driven by persistent ETF demand + integration of RLUSD into institutional pipelines

- Daily institutional inflows remain elevated (modelable as tens to low hundreds of millions USD/day) and RLUSD becomes a primary settlement coin for APs.

- On‑chain liquidity expands while exchange float shrinks (custody + staking), producing compressed volatility and higher realized prices.

Bear case (25% probability): Sharp pullback to <$1,500 amid redemption stresses or regulatory shocks

- Rapid, large-scale RLUSD redemptions or regulatory action targeting stablecoin rails force swift deleveraging.

- ETF flows dry up or reverse; market makers liquidate ETH positions, producing outsized volatility and lower prices.

These priors are operational: product managers should run sensitivity tests that map daily inflow magnitudes and stablecoin deployment rates to expected changes in exchange reserves and synthetic liquidity.

Actionable takeaways for institutional researchers and DeFi product teams

Instrument flow-to-ETH models: Convert hypothetical ETF inflows into ETH demand at price points relevant to your product (e.g., $1k, $2k, $3k scenarios). Use conservative fill assumptions (OTC slippage, AMM impact).

Track stablecoin deployment, not just supply: Where RLUSD sits and how it’s used (AMMs, lending, custody rails) matters more than nominal market cap. Build dashboards that show RLUSD concentrations by contract and protocol.

Stress test redemptions and settlement outages: Simulate short‑notice runs on RLUSD and their knock‑on effects on ETH liquidity — include margin calls and liquidation waterfalls.

Consider settlement rails for ETF creation/redemption: If APs accept on‑chain stablecoins for creation baskets, custody and accounting practices need to adapt. That’s a potential operational advantage for teams that can accept RLUSD efficiently.

Conclusion

ETF inflows and the RLUSD supply surge are complementary forces reshaping Ethereum’s market structure. Institutional demand via ETFs creates predictable bid pressure; large stablecoin supplies like RLUSD turn that bid into faster, on‑chain settlement and deeper liquidity. The net result is a market that can be more resilient and more efficient — until it isn’t. Monitoring issuance, deployment patterns, custodial behaviors, and regulatory signals will be essential for teams building the next generation of institutional DeFi products.

For more practical monitoring, teams should combine on‑chain telemetry with off‑chain flow reports; platforms such as Bitlet.app are already integrating similar signals to help product managers and traders operationalize these dynamics.

Sources

- Ethereum price reclaims $2,000 as ETF inflows return — CoinPedia

- Ethereum regains $2,000 with ETH ETF inflows returning — Crypto.News

- Ripple’s RLUSD stablecoin floods Ethereum past $1.2B supply — CoinPaper

For cross‑market context, many institutional desks still watch Bitcoin as a macro bellwether while routing liquidity through DeFi rails for execution and settlement.