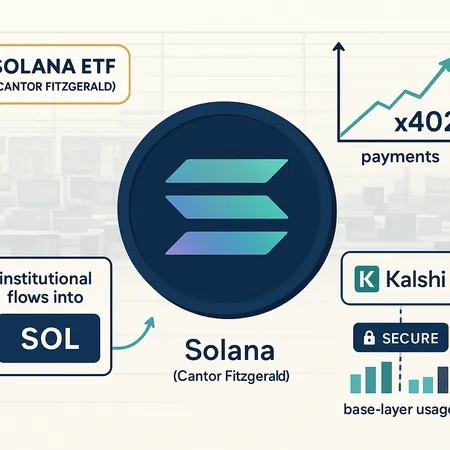

Is Solana Becoming a Regulated L1? Cantor Fitzgerald, x402 & Kalshi Explained

Summary

Executive summary

Three discrete events over recent months — Cantor Fitzgerald’s public Solana ETF stake, a spike in real‑usage payments via x402 on Solana, and Kalshi choosing Solana for tokenized prediction contracts — have moved Solana from speculative narratives toward conversations about regulated product flows. For institutional crypto strategists and exchange product teams evaluating L1s for regulated product flows, these are not just PR wins: they are early tests of distribution, throughput economics, and compliance feasibility for SOL as a regulated L1.

This feature walks through each development, places them in the context of regulated product design (ETFs, tokenized contracts, high‑volume rails), and assesses whether the observed activity signals a durable shift in institutional flows and base‑layer usage.

What happened — the three signals

Cantor Fitzgerald’s Solana ETF disclosure

Cantor Fitzgerald disclosed a stake tied to a Solana ETF effort, a visible sign that a traditional institutional intermediary sees enough customer demand and product viability to allocate resources and balance sheet to Solana‑linked instruments. Coverage of that move highlighted both direct interest and the broader institutional ecosystem now watching SOL as a candidate for regulated product wrappers and futures listing activity. See reporting on Cantor Fitzgerald’s disclosure for context and implications for underwriting and distribution strategies (Cantor Fitzgerald reveals Solana ETF stake).

x402 payments: on‑chain usage that looks like real payments

Separately, the payments network x402 reported an all‑time high in daily volume on Solana. This is meaningful because payments are a higher‑frequency, low‑latency use case: durable institutional flows will only route through an L1 if throughput, latencies, and fee predictability meet operational SLAs. Cointelegraph covered the spike, which points to real‑world message and value settlement happening on‑chain rather than purely speculative token trading (x402 payments expands on Solana).

Kalshi launching tokenized prediction contracts on Solana

Kalshi’s decision to issue tokenized prediction contracts on Solana is notable for another reason: regulated derivatives and prediction markets require robust custody, clear settlement mechanics, and regulatory alignment. Kalshi moving to Solana to attract crypto users signals that product teams see Solana’s speed and cost profile as attractive for tokenized, regulated derivatives flows (Kalshi launches tokenized contracts on Solana).

Why these signals matter together

Taken individually, each event is interesting; together they form a pattern: distribution interest (Cantor Fitzgerald), real‑use payments throughput (x402), and regulated product issuance (Kalshi). For institutional adoption there are three axes to clear:

- Product distribution and underwriting (who sells the exposure?) — signaled by Cantor Fitzgerald and the broader institutional discussion around ETF mechanics and futures hedging (context on ETF/futures ecosystem).

- Base‑layer throughput and fee stability (can the chain settle high‑frequency flows without disruptive congestion?) — signaled by x402’s volume spike.

- Regulatory and product engineering (can regulated derivatives be implemented with custody, settlement, and compliance?) — signaled by Kalshi’s substrate choice.

For product teams and institutional strategists, the presence of all three makes Solana an active candidate for pilot flows. That doesn’t mean a full migration, but it does change the due diligence checklist from “can it be done?” to “how do we operationalize this at scale?”

Technical and operational realities: can Solana handle regulated flows?

Solana’s value proposition for institutional use is simple: high throughput, sub‑second finality, and low fees — attributes attractive for payment rails and tokenized derivatives. But institutions care as much about reliability, observability, and predictable failure modes as they do about latency.

Throughput: Architecturally, Solana supports very high transactions per second and the x402 data point shows the L1 can carry real payment volume. But sustained institutional flows produce correlated load spikes (batch settlements, rebalance runs) that stress RPC and validator networks differently than retail traffic.

Resilience: Historically, Solana has experienced outages and performance incidents. For regulated flows, those incidents translate into operational risk that must be mitigated with redundancy (multi‑RPC providers, fallback settlement rails), insurance, and contractual SLA language.

Custody and compliance: Institutional products need custody with clear KYC/AML, auditability, and legal segregation. Custodians are increasingly supporting SOL, but custody maturity lags that of Bitcoin or Ethereum in terms of product breadth (native staking custody, regulated custody wrappers). Cantor Fitzgerald’s public signal suggests intermediaries are exploring those custody bridges.

Observability & settlement finality: Regulated contracts need forensic-grade transaction logs and deterministic finality to settle margin calls and price disputes. Solana’s finality model is fast, but teams must ensure their tooling captures the chain’s fork/finality semantics and that oracles used by derivatives platforms are robust.

Compliance, market structure and the economics of regulated flows

Regulated flows typically require KYC’d onboarding, capital controls, and settlement assurances. Solana’s architecture is neutral on these topics — compliance is implemented in the application layer and through custodians and marketplaces.

Kalshi’s tokenized contracts indicate vendors believe they can build compliant rails on Solana or combine off‑chain custody and on‑chain settlement. The question for compliance officers: can you produce transaction histories and identity attestations that satisfy regulators without undermining decentralization? That’s a product design trade‑off, and it’s why some firms prefer hybrid flows (off‑chain matching, on‑chain settlement) during early institutional adoption.

What product and exchange teams should evaluate now

If your mandate is to design or route regulated flows, consider these practical evaluation steps:

- End‑to‑end resiliency tests: run simulated settlement runs that mimic batch margining, reorgs, and RPC outages. Include parallel fallbacks to other rails.

- Custody & issuer integrations: validate custody providers that can provide audit trails, insured storage, and KYC compliance while supporting SOL and tokenized product issuance.

- Liquidity and basis risk: analyze whether CME futures, ETFs, or OTC desks can hedge big SOL exposures; look at implied financing costs and basis behavior cited in industry commentary (ETF & futures context).

- Monitoring & dispute processes: ensure you have tooling for deterministic transaction time stamps, oracle redundancy, and dispute resolution workflows for contract settlements.

Teams building products should also watch market infrastructure: custody providers expanding SOL support, exchanges listing regulated Solana products, and validator/node operator professionalization.

Risks and unanswered questions

These are the key caveats that could stall durable adoption:

- Network incidents: repeated outages or degraded performance will force institutional flows to adopt complex safeguards or avoid the chain.

- Regulatory clarity: if regulators treat tokenized contracts differently depending on settlement mechanics, product firms will prefer chains with clearer legal precedence.

- Liquidity fragmentation: tokenized product success depends on deep, predictable liquidity and robust hedging instruments — absent that, spreads and slippage will erode product economics.

Conclusion — durable shift or trial phase?

The convergence of Cantor Fitzgerald’s ETF stake, x402’s payments volume spike, and Kalshi’s tokenized contracts on Solana marks a meaningful inflection: real teams are testing Solana for regulated, high‑throughput use cases. These moves elevate Solana from a speculative L1 to a candidate for institutional pilots.

Durability, however, is conditional. For SOL to become a mainstream regulated L1, it needs fewer operational incidents, more mature custody/distribution infrastructure, clarified regulatory guardrails, and proven hedging pathways for large‑scale market makers and custodians. Product and exchange teams should treat the current environment as an accelerated opportunity window to pilot, instrument, and harden integrations — not as a turnkey migration moment.

Institutions that run disciplined resiliency and compliance pilots now will be best positioned to capture regulated flows if Solana continues to professionalize. Observing market signals through the lens of distribution, throughput, and regulatory engineering gives a pragmatic roadmap for that work.

For those building or evaluating regulated products, keeping watch on these developments — and how market infrastructure firms respond — will separate feasible integrations from speculative hype. Bitlet.app and other platform teams monitoring installment, earn, and P2P exchange use cases will likely track these pilots closely as well.

Sources

- Cantor Fitzgerald reveals Solana ETF stake and institutional interest: https://www.cryptopolitan.com/cantor-fitzgerald-reveals-solana-etf/

- x402 payments expansion and all‑time high daily volume on Solana: https://cointelegraph.com/news/x402-ecosystem-expands-solana?utm_source=rss_feed&utm_medium=rss&utm_campaign=rss_partner_inbound

- Kalshi launches tokenized prediction contracts on Solana: https://invezz.com/news/2025/12/02/kalshi-launches-tokenized-prediction-contracts-on-solana-to-attract-crypto-users/?utm_source=snapi

- Context on Cantor Fitzgerald, Solana ETF momentum and CME Solana futures: https://bitcoinist.com/best-altcoins-to-buy-as-cantor-fitzgerald-announces-solana-etf/

For more on Solana as a project and broader layer‑1 considerations, see coverage on Solana and how tokenized products are reshaping DeFi.