When Institutions Trim BTC and Miners Buy: Reconciling ETF Rotation with Stickier On‑Chain Supply

Summary

Executive summary

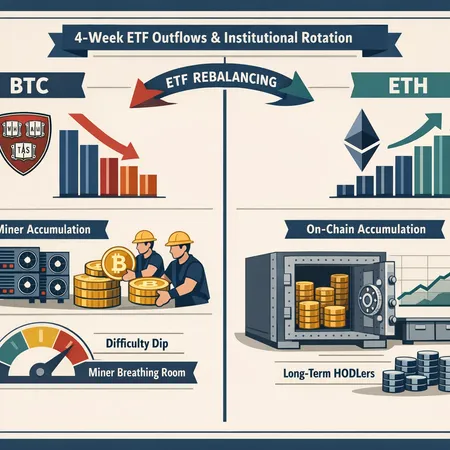

Two narratives are colliding across crypto markets this quarter. On one side, allocators and large endowments are trimming ETF exposure to BTC and reallocating into ETH—Harvard Management’s Q4 rebalance is a clear example. On the other, miners and long‑term holders are accumulating, and a recent mining difficulty dip has given miners temporary breathing room. The result is a subtler, structural shift: headline institutional holdings may be drifting lower, but the effective supply available to the market is becoming stickier.

This article reconciles those narratives for asset managers deciding whether to overweight or underweight BTC vs ETH in a diversified crypto sleeve. It draws on recent institutional flow data, on‑chain miner activity, and difficulty dynamics to outline market scenarios and a practical allocation framework.

Harvard’s rebalance: signal, not noise

Harvard Management’s Q4 moves—reducing its ETF exposure to Bitcoin while opening an Ethereum ETF position—were public enough to be treated as a signal rather than a one‑off. The rebalancing was documented in a reporting note that showed trimming of BTC ETF exposure and addition of ETH exposure, a microcosm of a broader institutional rotation. The Block’s coverage of the Harvard rebalance highlights how sophisticated allocators are actively reweighting their crypto sleeves.

Why this matters: institutional rebalances are intentional portfolio decisions driven by risk budgeting, correlation assumptions, macro views and liquidity needs. When allocators reduce BTC exposure in favor of ETH, it generally reflects one or more of these assumptions: perceived lower tail risk in ETH (post‑merge fundamentals and staking economics), an active view on DeFi/utility growth, or a desire to diversify crypto beta away from a single market bellwether.

That doesn’t mean BTC is out of favor forever. It means some allocators are fine‑tuning risk tolerance and seeking exposure to different risk premia across BTC and ETH.

ETF and fund flows: tactical caution in the near term

Flow data provides the tactical pulse. Recent reporting showed approximately $173 million in crypto fund outflows over a four‑week window, coinciding with short‑term weakness in BTC and ETH prices. Cointelegraph’s summary of those flow numbers underscores that institutional demand via funds has softened in the recent period, creating near‑term headwinds for price momentum. (See the coverage on four‑week outflows and funds under pressure.)

Flows are noisy. A multi‑week outflow streak matters because it reduces immediate buying pressure from ETFs and mutual funds that have been, historically, reliable marginal buyers during risk‑on periods. But outflows alone don’t tell the whole story: they coexist with increasing on‑chain accumulation among entities that are not reflected in ETF holdings.

Mining difficulty dip and miner economics: a short window for accumulation

Miners got a break recently when Bitcoin’s mining difficulty experienced its largest dip in roughly six months. That difficulty reset eased some near‑term pressure on profitability, temporarily improving miner cash flow dynamics and giving them an opportunity to rebalance operational and balance sheet positions. Cryptopolitan’s reporting on the difficulty dip provides the technical context: lower difficulty reduces the time and cost needed to mine a block, translating into marginally higher BTC inflows to miners.

That breathing room matters in practice. Miners under severe revenue stress often liquidate BTC to cover OPEX and capex; a sustained improvement in mining economics reduces forced selling. As some miners move from forced sellers to optional sellers—or even stop selling entirely for a period—the exchange‑facing supply tightens.

Hodlers and miner accumulation on‑chain

Complementing the miner story, on‑chain data shows that long‑term holders continue to signal accumulation even while prices slump. Cryptopotato highlights on‑chain metrics that reveal accumulation behavior among both hodlers and miners during the recent downdraft. This accumulation reduces the circulating float (the supply that’s opt‑in to trade in any given moment) and increases the proportion of coins that are effectively illiquid.

Put differently: ETFs and funds are one class of marginal demand; miners and hodlers determine marginal supply. If institutional allocations fall while a significant share of mined coins is retained or moved off exchanges, the market may become more supply‑inelastic.

Reconciling the divergence: what changes for supply/demand dynamics?

These trends push the market toward a different supply/demand topology:

- Reduced headline institutional ETF holdings lower a steady, passive source of demand. Funds that buy on inflows and rebalance algorithmically will, by definition, be less active buyers if allocations drop.

- Simultaneously, sticky on‑chain holdings (from miners and hodlers) reduce available float. When fewer coins are available to be sold into dips, price moves can become sharper on a given shock to demand.

Net effect: greater price sensitivity to spot demand. With a thinner available float, even modest spot buying from retail or renewed institutional interest can move prices more than before. Conversely, if risk sentiment turns decisively negative, fewer institutional stop‑loss purchases may amplify selloffs.

For asset managers, that means thinking about skew and liquidity more than headline allocations. It’s not just whether institutions own more or fewer BTC or ETH; it’s whether the marginal buyer/seller that sets price during shocks is available.

Scenarios for BTC vs ETH allocations (practical guidance)

Below are three plausible scenarios and suggested allocation tilts for portfolio managers with a diversified crypto sleeve.

Scenario A — Institutional allocations continue to fall; supply grows stickier

- Environment: ETF rotations away from BTC persist; miners/hodlers keep stacking. Exchange inventories decline, spot depth thins.

- Implication: BTC becomes scarcer in the float sense. Volatility may rise, and upside moves can be sharper on positive demand shocks.

- Tactical allocation: Maintain or modestly increase a long‑term core BTC allocation for scarcity exposure, but reduce tactical bet sizes and widen stop bands. Consider 60/40 BTC/ETH core split for strategic exposure (example only), with smaller tactical exposure to avoid liquidation risk on volatility spikes.

Scenario B — Institutional rotation stabilizes into ETH (Harvard‑style) while flows to crypto funds normalize

- Environment: Allocators keep moving some weight to ETH for utility and yield (staking) reasons. Fund flows normalize after a pause.

- Implication: ETH catches a re‑rating relative to BTC in the near term, supported by allocation flows and DeFi activity. BTC remains the base money but loses some relative momentum.

- Tactical allocation: Trim BTC overweight and reallocate a portion to ETH (e.g., move 10–25% of crypto sleeve from BTC to ETH depending on risk budget). Use position sizing limits and consider duration (staking lockups vs liquid exposure).

Scenario C — Institutional allocations rebound into BTC; on‑chain stickiness persists

- Environment: Macro or regulatory clarity brings institutions back to BTC ETFs, creating a buyer wave while miners still hold.

- Implication: A potent demand shock on a tight float could trigger outsized BTC appreciation. ETH may lag if rotation reverses.

- Tactical allocation: Overweight BTC tactically but hedge concentration risk through options or by keeping some ETH exposure as a hedge against protocol‑level growth.

A practical allocation framework and checklist

For allocators deciding how to size BTC vs ETH exposure, use a repeatable framework:

- Monitor weekly ETF and fund flows (trend > 4 weeks is meaningful). If outflows persist at a scale that reduces demand velocity, act to reduce tactical exposure.

- Watch exchange balances and realized supply metrics: falling exchange inventories + rising long‑term holder supply = stickier float and higher price sensitivity.

- Track miner dynamics: hash rate, difficulty changes and miner reserve accumulation. Difficulty dips can reduce forced selling; rising miner reserves increase stickiness.

- Assess macro and regulatory signals that drive institutional risk tolerance: changes in capital markets, yield curves and risk parity flows matter.

- Size positions with volatility in mind: if supply is stickier, consider smaller tranche sizes and wider rebalancing bands to avoid being caught in liquidity squeezes.

- Use hedges: options and futures can manage tail risk if you keep core exposure for long‑term scarcity or protocol adoption.

A rule‑of‑thumb allocation update for many allocators could be: keep a core strategic BTC stake for scarcity and inflation hedging, but shift 10–30% of active risk budget into ETH if institutional rotation and DeFi fundamentals (staking yields, TVL growth) continue to look favorable.

Signals to watch next 90 days

- Continued weekly ETF flows (incoming vs outgoing) — four‑week trends matter. See recent four‑week outflow coverage for context.

- Exchange on‑chain metrics: exchange reserves, stablecoin flows into exchanges, and order‑book depth on major venues.

- Miner indicators: difficulty adjustments, reported miner selling, and miner reserve accumulation.

- Protocol‑level developments for ETH: staking rates, rollouts that affect MEV or L2 demand, and DeFi activity.

Platforms and services that synthesize these metrics can speed decision‑making; integrate on‑chain data with flow reports and fundamental signals. For allocators using a mix of OTC, ETF and direct spot, consider how execution choice affects realized exposure — and how tools from the ecosystem, including Bitlet.app, fit into distribution and liquidity strategies.

Conclusion

Harvard’s ETF rebalancing, the recent four‑week outflow picture, the mining difficulty dip and on‑chain accumulation by hodlers and miners are not contradictory so much as complementary. Together they signal a market where headline institutional allocations may be lower even as the effective float tightens. For asset managers, the implication is to prioritize liquidity and skew management: keep a strategic BTC allocation for long‑term scarcity, maintain tactical flexibility to rotate into ETH should institutional preference persist, and use hedges and position sizing to navigate higher short‑term volatility.

What matters is not a binary call on BTC vs ETH, but an allocation playbook that adapts to the evolving marginal buyer and seller. Watch flows, miners, exchange balances and protocol fundamentals — and let those signals drive rebalancing cadence, not headlines alone.

Sources

- Harvard Management trimmed BTC exposure and added ETH: Harvard Management ETF rebalancing report

- Four‑week crypto fund outflows and ETF flow context: Cointelegraph — $173M crypto fund outflows

- Mining difficulty dip details: Cryptopolitan — Biggest difficulty dip in six months

- On‑chain accumulation by miners and hodlers: CryptoPotato — Miners and hodlers signal support

For deeper reading on market structure and allocation tools, see on‑chain analytics and flow trackers; and for execution or P2P options relevant to allocators, consider ecosystem services such as Bitlet.app.

For many allocators, Bitcoin remains a strategic anchor, even as short‑term rotations and protocol growth change the tactical picture. For exposure to on‑chain utility and institutional rotation trends, watch DeFi metrics alongside these supply signals.