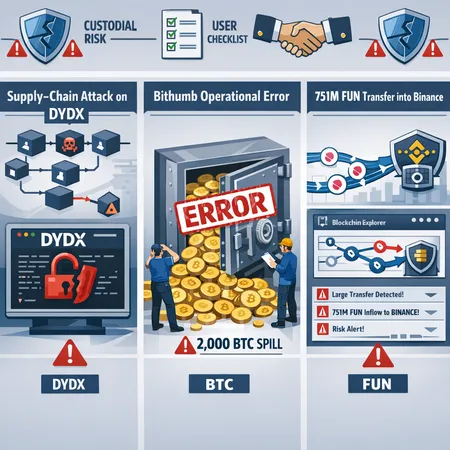

Custody and Protocol Risk: Lessons from dYdX Package Attacks, Bithumb’s 2,000 BTC Error, and the 751M FUN Move

Summary

Why these three incidents matter

Security incidents in crypto come in many forms: a malicious package in an open-source dependency is a supply‑chain attack; a human or system error at an exchange can create an exchange error that instantly affects market confidence; and a huge deposit to an exchange can create measurable price pressure and uncertainty. Recent headlines — the malicious packages used to target dYdX users, Bithumb’s emergency probe after it accidentally distributed roughly 2,000 BTC, and the on‑chain alert of 751 million FUN moving to Binance — are not isolated curiosities. Together they show how custody and protocol risk span developer tooling, exchange operations, and on‑chain monitoring signals used by traders and compliance teams.

Each incident teaches a different lesson: the dYdX case exposes how development ecosystems and package managers are attack surfaces; Bithumb’s mistake shows the consequences of operational complexity and why regulators step in during systemic anomalies; the large FUN transfer shows how on‑chain transparency becomes an input for market behavior and compliance monitoring.

Anatomy of the dYdX malicious‑package attacks and mitigations

How package‑supply‑chain attacks work

Supply‑chain attacks target dependencies rather than protocols directly. An attacker either compromises a widely used package (npm, pip, etc.), publishes a malicious drop‑in replacement with similar naming, or injects backdoors into code paths that many projects import. For DeFi users and tooling, that means a wallet‑related script, a deployment helper, or a utility library can be the vector that ultimately leads to a compromised seed, signed approvals, or drainable allowances.

In the dYdX incident, attackers used malicious packages that reached developer environments and, through crafted scripts or misleading prompts, led to emptying of user wallets. The reporting details how a supply‑chain actor leveraged trust in open‑source ecosystems to get code running in user contexts and then executed wallet‑draining flows (dYdX malicious packages report).

Why this is different from a smart‑contract exploit: the protocol may be sound but the tools around it — CLIs, SDKs, browser extensions or scripts — are the weak point. Attackers don't need to find a re‑entrancy bug if they can simply get a developer or user to run a malicious package that signs transactions or reveals private keys.

Practical mitigations for DeFi users and integrators

- Use curated registries and verified packages; prefer audited SDKs from official protocol repos. Maintain an allow‑list for critical tooling.

- Lock down developer environments: containerize CI builds, pin dependency versions with lockfiles, and enable reproducible builds.

- Adopt multi‑sig and gas‑limit policies: never sign high‑value transactions with a single key; use spending limits and timelocks for contracts that control funds.

- Monitor NPM/PyPI package names and set alerts for typosquatting attempts; integrate supply‑chain scanners into CI.

- Educate end users: prompt users to verify origin of CLI downloads and browser extension sources; discourage copy‑paste flows that bypass verification.

These steps reduce the probability of compromise and increase detection speed if something slips through. For integrators building on DYDX or other protocols, combine code hygiene with on‑chain monitoring and permissioned access controls. You can learn more about best practices for DeFi tooling by following protocol developer channels and audited SDKs like the ones listed in official repositories.

Exchange operational risk: what Bithumb’s 2,000 BTC error shows

Bithumb’s emergency probe after mistakenly handing out roughly 2,000 BTC during a promotion is a cautionary tale about operational complexity. When an exchange process, script or human workflow malfunctions, the results can be massive and immediate. Coverage of the incident highlights how a promotional or wallet batching error rapidly triggered regulatory attention in South Korea (Bithumb emergency probe coverage).

Operational risks at exchanges include: flawed batch processing of withdrawals or airdrops, misapplied accounting entries, weak separation of duties for hot wallet signing, and over‑trust in automated scripts without strong test harnesses. The real danger is not only the immediate loss or misallocation of assets, but the erosion of trust that leads to withdrawals, liquidity stress, and regulatory alarm.

Typical emergency responses and why regulators act

Regulators tend to respond quickly when an exchange mistake could affect many retail users or the broader market. Emergency probes often look at: customer protection policies, internal controls, incident timelines, and whether the exchange followed mandatory reporting rules. In some jurisdictions, exchanges are required to freeze suspicious funds, notify affected customers, or provide post‑mortem transparency.

From a compliance officer’s perspective, effective exchange responses should include timely customer notifications, transaction tracing (often with help from forensic firms), and cooperation with law enforcement if funds move to mixers or external wallets. Regulators and exchanges increasingly expect formal incident response playbooks and tabletop exercises to minimize reaction time.

Large on‑chain deposits to exchanges: why 751M FUN matters

On‑chain transparency provides a real‑time signal that traders and compliance teams watch closely. A large deposit — like the 751 million FUN move to Binance — is often interpreted as potential selling pressure. There are technical and behavioral reasons for this: institutional or whale holders that want liquidity will send tokens to centralized venues to convert into other assets or fiat, and large inbound flows can exceed on‑exchange liquidity, forcing market impact.

However, context is everything. Not every large deposit equals an immediate dump. Important factors:

- Address clustering and historical behavior: does the depositor have a pattern of previous sells after depositing?

- Exchange deposit semantics: some deposits fund OTC desks, staking pools or are custodying for other services.

- Market depth and orderbook resilience: a large deposit relative to orderbook depth typically exerts downward pressure.

In the FUN move, on‑chain alerts flagged a meaningful transfer to Binance, and analysts noted why such transfers matter for token holders and traders monitoring short‑term liquidity (FUN transfer to Binance report). For trading desks and compliance teams, automated on‑chain monitoring and heuristics that detect abnormal inflows are essential to forecast market impact and to trace potential wash trading or market‑manipulative behaviors.

Checklist: how users and traders can limit custody risk

Pre‑trade and setup

- Prefer non‑custodial wallets with strong UX for approvals and nonce management.

- Use hardware wallets for private key storage where possible; enable passphrase/BIP‑39 protection.

- Keep separate wallets for small daily trading and for long‑term storage (cold vs hot segregation).

Transaction hygiene

- Inspect and limit contract approvals; regularly revoke allowances you no longer use.

- Set explicit gas limits and use contract interaction previews in trusted tools.

- For large transfers, split into smaller tranches and monitor mempool and exchange liquidity before sending.

Tooling & devops

- Pin and audit dependencies, run automated supply‑chain scanners in CI, and sign builds reproducibly.

- Use multi‑sig for treasury operations and require time locks on high‑risk actions.

- Implement on‑chain monitoring and alerting for inbound deposits to custodial addresses you care about.

Operational and human controls

- Maintain an incident response runbook; run tabletop exercises with legal and compliance teams.

- For custodial relationships, review exchange proof‑of‑reserves, withdrawal limits, and insurance terms.

- Check exchange operational history and regulator relationships before placing large deposits — history matters.

Following this checklist reduces exposure to both supply‑chain attack vectors and exchange‑level mistakes. Many of these controls are common sense but often under‑implemented in small teams or new projects.

Policy implications: regulator–exchange cooperation and practical next steps

These incidents underline a few policy takeaways for regulators and exchanges:

- Standardize incident reporting: require timely, standardized disclosures for material security incidents and exchange errors, enabling coordinated market protections.

- Enforce operational standards: minimum requirements for hot wallet controls, multi‑sig thresholds, and separation of duties could be part of licensing.

- Encourage supply‑chain safety practices: regulators can push for baseline developer security standards (dependency scanning, SBOMs for critical infrastructure) for firms that custody or manage user funds.

- Improve on‑chain monitoring partnerships: exchanges and supervisors should share anonymized heuristics for detecting large inbound flows and suspicious mixing patterns to speed response.

Regulators that move from ex post enforcement to collaborative supervision can reduce systemic risk. Exchanges that run frequent audits, publish proof‑of‑reserves, and maintain open incident playbooks increase market confidence. For compliance officers, the practical path is clear: demand better visibility from custodians and insist on demonstrable operational controls.

Conclusion — connective tissue between protocol security and custody

Security incidents like the dYdX malicious packages, Bithumb’s BTC distribution mistake, and the 751M FUN transfer to Binance are not edge cases; they’re reminders that custody and protocol risk are multifaceted. One attack targets developer tooling, another springs from human or automation error at a centralized operator, and another is a pure on‑chain signal that can move markets.

For security‑conscious DeFi users, traders, and compliance officers the prescription is threefold: harden tooling and development practices against supply‑chain attack vectors; insist on strong operational controls and proven incident‑response capabilities from custodians and exchanges; and adopt robust on‑chain monitoring to detect abnormal flows. These practices, combined with better regulator–exchange cooperation, make the ecosystem more resilient.

For practitioners who want to build or evaluate tooling and custody relationships, platforms like Bitlet.app and other service providers increasingly surface operational controls and monitoring features that complement non‑custodial best practices.

Sources

- Cryptopolitan — dYdX malicious packages empty user wallets: https://www.cryptopolitan.com/dydx-malicious-packages-empty-user-wallets/

- Cryptopolitan — Korean emergency probe after Bithumb bitcoin error: https://www.cryptopolitan.com/korean-emergency-probe-bithumb-bitcoin-error/

- Coincu — 751M FUN moves to Binance: https://coincu.com/news/funtoken-faces-pressure-as-751m-fun-moves-to-binance/?utm_source=snapi

For many traders, Bitcoin remains the primary market bellwether, while developer teams building DeFi primitives still need to watch trends on DeFi tooling and security. For specific protocol notes, teams integrating with DYDX should review SDK provenance and supply‑chain practices when conducting audits.