Monero

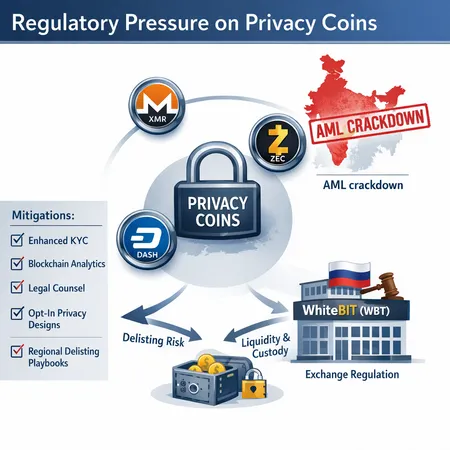

Regulators are tightening the squeeze on privacy coins like XMR, ZEC and DASH while regional politics expose exchanges to new risks. This analysis maps legal basis, market impact, and actionable mitigation steps for developers, exchanges and traders.

Worldcoin’s forced deletion of Kenyan biometric records and Monero’s recent market strength have exposed a split in how privacy is built and regulated in crypto. The clash between centralized biometric ID projects and decentralized privacy coins reshapes risks for investors, developers, and regulators.

Privacy coins such as XMR, DASH, DUSK and ZEC outpaced the market during the recent crypto slump. This note unpacks on‑chain and macro demand drivers, the Dusk spike and its risks, Zcash governance friction, and tactical implications for portfolio managers.

A renewed investor appetite for on-chain privacy has shifted narratives from absolute anonymity to practical ‘selective disclosure’. This article explains audit/view keys, compliance rails, and what the trend means for DeFi, institutions, and builders.

Privacy tokens (DASH, XMR, ZEC) led the 2026 rally as investors revisited anonymity-focused protocols. Regulatory outcomes — notably the SEC closing its probe into the Zcash Foundation — are reshaping fundraising, listings, and institutional appetite.

Monero’s recent multi-session spikes have reignited interest in privacy coins, but bullish flows collide with growing regulatory pressure — including Dubai’s new privacy-token ban. This article unpacks the drivers behind XMR’s moves, where privacy coins sit in the altcycle, and practical risk controls for traders.

Monero (XMR) recently surpassed Zcash (ZEC) as the leading privacy coin amid developer departures and governance turmoil at Zcash. The emergence of the CashZ wallet and shifting developer activity have implications for exchanges, regulators, and privacy adoption.

A fresh rally in Monero (XMR) and Zcash (ZEC) has reignited debate over relisting privacy tokens as exchanges weigh market demand against regulatory exposure. This article breaks down the market drivers, the political arguments about privacy coins’ impact on crypto narratives, and pragmatic guidance for compliance teams and traders.

DeFi

All DeFi postsBitcoin

All Bitcoin postsLiquidity

All Liquidity posts- How US–Israel Strikes, an Oil Shock, and Strait of Hormuz Risk Are Roiling Bitcoin — What Traders Should Watch

- How U.S. Spot Bitcoin ETF Inflows Are Changing BTC Price Discovery and Liquidity

- Bitcoin's Tug-of-War: ETF Inflows Lift BTC to ~$68–70K — But Liquidity and a Multi‑Billion Options Expiry Threaten Volatility