Privacy Coins Under Pressure: India’s AML Push, Exchange Geopolitics, and Practical Mitigations

Summary

Executive summary

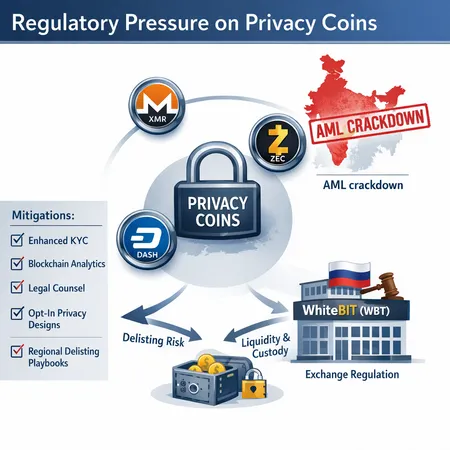

The recent regulatory moves against privacy coins and the targeting of exchanges in politically charged contexts create a two‑front compliance challenge. India’s Financial Intelligence Unit has signaled heightened scrutiny of Monero, Zcash and Dash, and national enforcement can prompt delistings, banking de‑risking and stricter monitoring. At the same time, regional geopolitical dynamics — for example, actions against WhiteBIT tied to allegations about funding related to Ukraine — illustrate how exchange operators become collateral in state disputes. This article explains the legal basis, expected market impacts and practical mitigations for developers, exchange operators and compliance officers, and it flags what retail traders should expect for liquidity and custody.

India’s AML crackdown: legal basis and enforcement mechanics

India’s increased focus on privacy coins is framed as an anti‑money‑laundering (AML) imperative: authorities argue ringed, shielded or obfuscated transaction types frustrate traceability and therefore facilitate illicit finance. Recent reporting indicates India’s FIU moved to treat coins with strong privacy primitives (Monero/XMR, Zcash/ZEC and Dash/DASH) as high‑risk — an operational cue that banks, PSPs and exchanges must apply enhanced due diligence or cut exposure. For compliance officers, the legal footing rests on India’s Prevention of Money‑Laundering Act (PMLA) and associated directives issued to reporting entities; operational rules tend to follow risk notices from intelligence units.

This approach is not unique: regulators worldwide use AML statutes and guidance to impose practical restrictions without always outlawing ownership. What changes in practice is the cost of custody and on‑ramping: correspondent banks and payment providers may impose higher fees or refuse service to entities that handle privacy coins, increasing pressure on exchanges to either delist or implement aggressive monitoring.

Expected market impact and delisting risk for XMR, ZEC and DASH

Markets respond rapidly to delisting risk. When a major national regulator signals intolerance, three effects appear quickly: a liquidity compression on local and regional venues; volume migration to decentralized venues or offshore exchanges; and price volatility tied to uncertain custody options. For XMR, ZEC and DASH, delisting scenarios vary by venue size and jurisdiction: global, compliant exchanges with banking relationships face real incentives to delist to avoid counterparty and correspondent banking risk, while smaller or offshore platforms may keep listings but face payment rails and fiat on‑ramp constraints.

Delisting risk is amplified where exchanges integrate with traditional finance. Expect to see a triage: some venues will implement withdrawal‑only policies, others will suspend fiat pairs first, and a minority will fully delist. Compliance teams should triangulate on banking partners’ stated positions and legal notices: the existence of a FIU advisory is often enough to catalyze action even without a court order.

Geopolitical exchange pressure: WhiteBIT (WBT) as a case study

Geopolitical disputes can convert exchanges into instruments of state pressure. Coverage of Russian authorities’ actions against WhiteBIT over alleged involvement with Ukraine‑related funding highlights how politically charged allegations raise regulatory exposure beyond normal AML concerns. An exchange implicated in funding or sanctions evasion triggers criminal probes, asset freezes and public reputational damage — and those consequences cascade to counterparties and service providers.

WhiteBIT’s situation illustrates asymmetric risk: even unproven allegations can force payment processors and banks to sever ties to avoid secondary sanctions or regulatory scrutiny. Exchanges operating in contested or sanction‑sensitive theaters should assume that a political incident could be as disruptive as formal regulatory action, and prepare for cross‑border legal complexity and urgent communications requirements. (See reporting that outlines the Russian case against WhiteBIT for context.)

How geopolitical and AML pressures compound exchange regulatory exposure

When AML advisories and geopolitical accusations arrive together, exchange exposure is multiplicative. An exchange serving users across borders may suddenly face overlapping obligations: a domestic AML notice to delist privacy coins, simultaneous inquiries by a state security agency, and multijurisdictional civil suits. These overlapping threads increase the probability of abrupt operational changes — frozen withdrawals, emergency KYC escalations, and forced data disclosures under mutual legal assistance treaties.

Practically, this environment places a premium on two capabilities: rapid legal assessment tied to a reliable sanctions and AML intelligence feed, and resilient liquidity management to insulate customers from sudden delistings or fiat corridor closures. Exchanges that lack diversified fiat rails or strong legal counsel are likely to be first movers toward de‑risking.

Mitigation paths for privacy‑coin developers

Privacy‑coin projects can reduce regulatory friction while preserving core privacy goals by adopting a layered strategy:

- Adjustable privacy modes: Consider opt‑in privacy features or transparent upgrade paths where privacy can be attenuated for compliance contexts without destroying the underlying tech. This preserves user choice while offering exchanges and custodians a workable model.

- Selective hardening and auditability: Implement and publish third‑party audits, reproducible build processes, and, where feasible, privacy primitives that permit accountable disclosures for lawful requests (e.g., view keys with user consent as ZEC supports in shielded/transparent modes).

- Interoperability with analytics tools: Work with chain‑analysis vendors to develop heuristics that respect user privacy but give exchanges signals about high‑risk behavior. This is a compromise, but one that reduces delisting probability by offering pragmatic traceability options.

- Legal and policy engagement: Invest resources in legal teams and engage with regulators proactively; developer voices that can explain design tradeoffs reduce knee‑jerk regulatory reactions.

These measures won’t eliminate risk, but they change the risk equation for counterparties and make delisting less attractive than building procedural controls.

Compliance playbook for exchanges (operators and officers)

Exchange operators should move from reactive to anticipatory compliance with a structured playbook:

- Risk mapping and ruleset tiering: Categorize listings by privacy characteristics and set differentiated onboarding, transaction monitoring and limits for XMR, ZEC, DASH and similar assets.

- Bank and PSP coordination: Maintain direct lines with banking partners about exposure tolerances and pre‑agree escalation steps before a FIU advisory forces abrupt action.

- Enhanced transaction monitoring: Deploy or partner with analytics providers that can flag high‑risk patterns on privacy networks and combine on‑chain signals with behavioral KYC to form probabilistic assessments.

- Withdrawal‑only protocols and staged delisting: If legal pressure rises, prefer staged approaches (withdrawal only → suspend fiat pairs → delist) to avoid trapping retail users and creating custody crises.

- Legal readiness and cross‑border counsel: Prepare mutual legal assistance treaty (MLAT) playbooks and crisis PR templates. Geopolitical incidents like the WhiteBIT example show you must be ready for rapid legal complexity.

- Customer communication and contingency funds: Publish transparent customer‑facing policies for privacy coin treatment and maintain fiat/liquidity buffers to accommodate sudden user flow changes.

These steps help balance regulatory compliance with market continuity; they also reduce reputational fallout.

What retail traders and custodians should expect (liquidity, custody and best practices)

Retail traders should anticipate episodic liquidity shocks and temporary custody limitations. Practical expectations:

- Liquidity squeezes: Local exchange volumes for XMR, ZEC and DASH may fall sharply after advisories; spreads widen and slippage increases on market orders. Traders should expect fragmented liquidity and consider using limit orders or smaller trade sizes.

- Custodial shifts: Some custodians and custodial OTC desks will stop offering inbound fiat services or custody for privacy coins. Self‑custody may look attractive, but note the operational risks. Custodians that remain will likely require enhanced KYC and activity monitoring.

- Access to decentralized venues: Trading may migrate to decentralized exchanges and peer‑to‑peer markets, but these venues carry counterparty, privacy, and AML compliance risks of their own.

For retail users: diversify custody (hardware wallets, multisig, reputable custodians), avoid large market orders during high‑volatility delisting windows, and keep records that demonstrate transaction intent to help in any future compliance queries. Platforms like Bitlet.app that focus on custody and installment services will need to factor these dynamics into product design and partner selection.

Practical next steps and contingency planning checklist

For compliance officers, exchange operators and developers, a short checklist:

- Conduct a jurisdictional risk matrix for privacy coins and related service providers.

- Negotiate contingency agreements with banks and PSPs that include notice periods and escalation protocols.

- Implement staged delisting procedures to protect customers from custody shocks.

- Formalize partnerships with analytics vendors and establish proof‑of‑concepts for monitoring shielded transactions.

- Document legal rationale and communication templates ahead of any public enforcement actions.

Being proactive reduces the probability of panic‑driven decisions and preserves longer‑term market functioning.

Closing perspective

Privacy coins occupy a difficult spot between legitimate privacy needs and AML concerns. Regulatory advisories — like those emerging from India regarding XMR, ZEC and DASH — and geopolitical actions against exchanges such as WhiteBIT (WBT) show that compliance risk is both legal and political. Pragmatic, layered responses from developers and exchanges, driven by careful risk mapping and clear customer protections, can mitigate many immediate harms while preserving user choice where feasible. For desks and compliance teams, the priority is to turn uncertainty into manageable, documented procedures rather than ad hoc reaction.

For broader context on how states are moving on privacy coins and exchange targeting see reporting on India’s FIU actions and the WhiteBIT coverage cited below. For related market narratives, many traders still watch Bitcoin as a macro bellwether, and liquidity migration often routes through DeFi venues when centralized entry points constrict.

Sources

- Report on India’s FIU action against Monero, Zcash and Dash: https://bitcoinist.com/monero-zcash-and-dash-prohibited-in-india/

- Coverage of WhiteBIT facing regulatory pressure in Russia: https://www.cryptopolitan.com/whitebit-undesirable-in-russia-ukraine-help/