BNB Chain's Brand-Security Breach: What the CoinMarketCap Incident Reveals About Ecosystem Risk

Summary

Executive summary

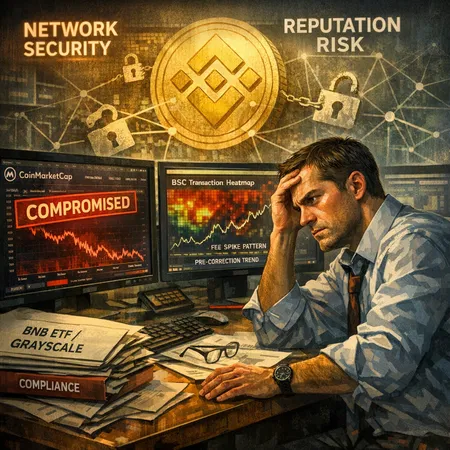

A recent suspected compromise of BNB Chain’s CoinMarketCap profile—where an attacker posted a fake AI-generated image and altered branding details—didn’t infiltrate the ledger, but it did accomplish something almost as costly: it undermined trust. At the same time, Binance Smart Chain (BSC) is seeing a surge in fees and on-chain activity that some analysts say resembles pre-correction patterns, and institutional actors like Grayscale are moving on BNB ETF filings. Taken together, brand-security incidents, rising network activity, and an ETF race create a compound risk profile that token issuers, exchange operators, and compliance teams must understand and mitigate.

What happened: the CoinMarketCap profile incident and why it matters

In late reporting, observers flagged a suspected compromise of BNB Chain’s CoinMarketCap profile, where the attacker uploaded an AI image and modified visible profile details. While the core protocol and BNB funds were not reported stolen in public coverage, the event is notable because it targeted a high-traffic information gateway rather than the chain itself. Coverage of the episode is available in reporting that details the profile compromise and the attacker-posted AI image.

Why this matters beyond a prank or defacement:

- Public-facing pages like CoinMarketCap are primary trust anchors for retail and institutional users; manipulation can produce fake narratives (e.g., false upgrade announcements) that prompt rash actions.

- Reputation risk often converts quickly into economic risk: market makers, custodians, and exchanges may pause flows while investigating, harming liquidity.

- Attacks on external touchpoints are lower-cost and high-impact—social engineering and profile compromises are an attractive vector for threat actors.

The CoinMarketCap incident is a reminder that brand-security is part of the broader network security posture. A chain’s security model must extend to the third-party ecosystems that act as its public face.

On-chain dynamics: BSC fees are surging—and that can mean more than revenue

Parallel to the brand incident, Binance Smart Chain has exhibited heightened network activity and fee/revenue increases. Analysis from industry outlets shows BSC’s revenue spike mirrors patterns historically observed before significant market corrections. Higher fees and concentrated activity can reflect genuine growth—more users, higher-value transactions—but they can also signal speculative concentration and leveraged behavior that precedes volatility.

A few practical consequences of rising fees and "pre-correction patterns":

- Short-term revenue for validators and the network rises, but volatile fee regimes can make user experience worse, pushing smaller users away to alternatives and concentrating value in large holders and validators.

- Elevated activity attracts adversaries: flash-loan attacks, rug pulls, or social-engineering campaigns around high-profile tokens become more lucrative during these windows.

- Monitoring on-chain signals alone is insufficient. The combination of on-chain surges with off-chain reputation incidents (like the CoinMarketCap compromise) compounds systemic risk.

Industry analysis that charts these fee and revenue surges helps contextualize the risk for operators and compliance teams who must factor network health into their operational planning.

Institutional implications: the BNB ETF race and the sensitivity to PR/security issues

Grayscale’s filing to pursue a BNB ETF underscores growing institutional appetite for BNB exposure. When regulated products are in play, reputational incidents that previously might have been considered "brand problems" become compliance issues. Regulators and custodians evaluate not just the asset’s code or market structure, but also the integrity of the ecosystem around it.

Key pressure points:

- Custody and counterparty risk: custodians evaluate whether third-party vectors (social pages, pricing oracles, indexing services) are secure enough to support institutional flows.

- Regulatory optics: a sequence of public misconfigurations, hacks, or compromises can slow approvals and invite more onerous conditions (enhanced audits, third-party attestations, insurance).

- Investor perception: institutional investors demand operational resilience; a high-profile PR incident can chill demand even if the underlying asset economics remain attractive.

Grayscale’s filing brings this into focus—if a product sponsor argues for supervised market access to BNB, regulators will scrutinize the ecosystem’s governance, security controls, and the overall maturity of operational practices. The recent profile incident could become part of that dossier unless operators harden controls and document remediation.

Short-term market and regulatory implications

For traders, exchanges, and compliance teams, the combined signal of a brand-security incident plus pre-correction-like fee patterns implies an elevated risk environment for the near term.

Market implications:

- Volatility spikes are more likely while sentiment oscillates between enthusiasm for ETF prospects and worry about operational fragility.

- Liquidity providers may widen spreads; exchanges can impose temporary delists or flow controls if they suspect a manipulation vector.

Regulatory implications:

- Supervisors may request more granular incident reports or demand post-incident remediation before greenlighting products linked to the chain.

- Compliance teams should anticipate questions about third-party monitoring, historical incident response, and communications protocols.

In practice, exchanges and custodians will need to reconcile on-chain metrics (fee spikes, transaction patterns) with off-chain signals (social attack surfaces, public incidents) when assessing counterparty and asset risk.

Governance and security best practices for chain maintainers and custodians

To reduce compound risk, teams should treat brand-security as a first-class element of network defense. Below are recommended controls and governance steps that are practical and actionable.

1. Threat-surface inventory and third-party mapping

Audit every public-facing dependency: data aggregators, price feeds, official social channels, and listing profiles like CoinMarketCap. Maintain an up-to-date catalogue of who controls these endpoints and their access practices.

2. Hardened access and recovery for third-party profiles

Require multi-party controls (MFA, hardware keys, role-based admin separation) for accounts on key services. Establish documented, tested recovery procedures and contracts with platform providers for emergency takedowns.

3. Incident response playbooks that include PR and legal tracks

Beyond technical response, have pre-approved messaging templates, legal escalation paths, and a designated communications owner. Speed and clarity in public messaging limit rumor spread and reduce market overreaction.

4. On-chain monitoring tied to off-chain alerts

Combine fee/revenue dashboards (to catch pre-correction signals) with watchlists for social and web anomalies. If on-chain metrics spike, trigger robust verification of off-chain channels before publishing any major announcements.

5. Custodial due diligence and insurer-ready documentation

Custodians and custodial wallets should require proof of continuous controls across the chain’s ecosystem. Maintain incident history, audit reports, and an insurance-ready package that demonstrates operational maturity.

6. Continuous red-team and supply-chain assessments

Simulate social-engineering and third-party compromise scenarios. Test the chain’s ecosystem resilience—how quickly can a false announcement be corrected, and what knock-on effects occur?

7. Governance transparency and stakeholder engagement

Publicly publish governance roadmaps and security budgets. Engaging exchanges, institutional market makers, and services like Bitlet.app on contingency plans helps demonstrate readiness to regulators and counterparties.

Practical checklist for token issuers, exchanges, and compliance teams

- Verify and document control of all official profiles and data sources.

- Integrate social/profile monitoring into KRI (Key Risk Indicator) dashboards.

- Tie fee/revenue spike alerts to an operational response (pause announcements, check oracle integrity).

- Ensure custodians can demonstrate separation of duties and incident insurance coverage.

- Run tabletop exercises that include PR and regulatory response scenarios.

Conclusion: reputation is part of the attack surface

The CoinMarketCap profile compromise targeting BNB Chain is a useful case study: attackers can inflict meaningful damage without touching private keys or smart contracts. When that kind of incident coincides with increased on-chain activity and an active institutional race (BNB ETF filings), the ecosystem’s aggregate risk rises.

Token issuers, exchange operators, and compliance teams must broaden their threat models to include brand and third-party integrity. Combine this with on-chain observability—spotting early pre-correction patterns in fees and activity—and you move from reactive to anticipatory risk management. For custodians and product sponsors pursuing institutional rails, documenting these practices will increasingly be part of the price of entry.

For broader market context, remember that macro cues like Bitcoin movements still influence altcoin flows—so watch both on-chain signals and broader market dynamics. For many traders, Bitcoin remains the primary bellwether, while protocol-level narratives continue to play out across DeFi and centralized venues.

Sources

- Report on the suspected compromise of BNB Chain’s CoinMarketCap profile and attacker-posted AI image: Cryptopolitan coverage

- Analysis showing Binance Smart Chain fee/revenue surge resembling pre-correction patterns: Blockonomi analysis

- Coverage of institutional interest in BNB via Grayscale’s new SEC filing: Cointribune coverage