Shifting Institutional Flows: What ETF Outflows and Falling Futures Volume Mean for Bitcoin

Summary

Executive snapshot

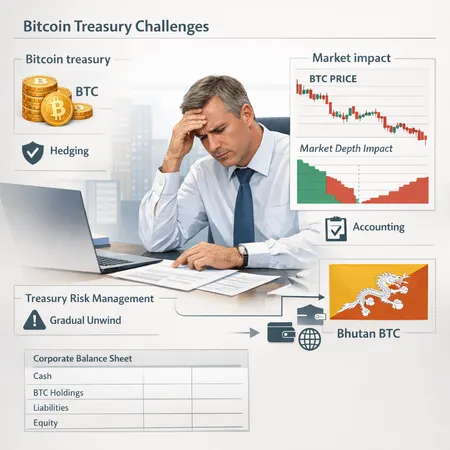

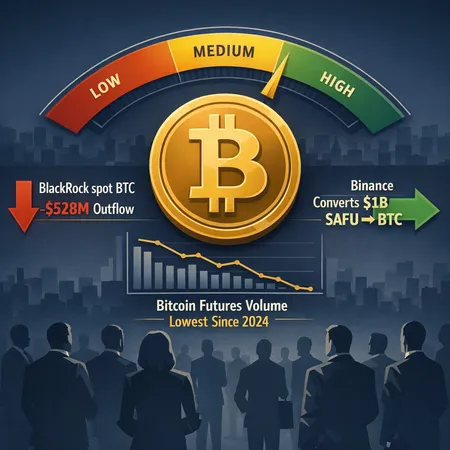

Last week’s headlines captured two competing images: a reported ~$528 million net outflow from BlackRock’s spot Bitcoin ETF — a clear headline grabber — and fresh data showing monthly Bitcoin futures trading volume at its lowest level since 2024. At the same time, corporate treasuries and exchange risk-funds are making bold allocations (Binance reportedly converted $1 billion from its SAFU fund into BTC). Together these moves expose a nuance often missed by simple “inflow vs outflow” narratives: liquidity and allocation signals are diverging. Institutional flows matter, but so does the plumbing that lets those flows trade without dislocating prices.

For many allocators and macro strategists, the practical question is not whether institutional players are fickle — they are — but which metric gives an earlier, more reliable warning of a sustained regime shift in BTC price. Below I lay out how to read ETF flows against derivatives liquidity, propose trigger thresholds and scenarios for BTC, and offer a concise watchlist you can use to translate data into allocation moves.

What the recent data actually shows

BlackRock’s spot ETF reportedly recorded roughly $528M in net outflows, a reminder that multi-billion-dollar discretionary positions can ebb quickly when rebalancing or risk sentiment flips reported here.

Monthly Bitcoin futures trading volume declined to the lowest level seen since 2024, a sign that market-making and speculative activity have softened, reducing transactional capacity for large flow absorption data discussed here.

Analysis across several commentaries argues a portion of “smart money” is pulling back amid geopolitical uncertainty and macro crosscurrents; capital is rotating away from risk assets and crypto is not immune analysis here.

Counterpoint: major corporate moves intended to signal confidence. Binance’s reported conversion of $1B SAFU into BTC is a deliberate liquidity and signaling play — it reduces available fiat and increases perceived corporate conviction report here.

Together, these datapoints create a mixed signal: allocation flows weaken while some balance-sheet actors lean in.

How to read ETF flows versus futures liquidity (framework)

Institutional allocators should treat ETF flows and futures liquidity as complementary signals. Think of them as different sensors on the same engine:

Spot ETF flows measure allocation intent that results in custody demand. Large, persistent net inflows into spot ETFs usually indicate new capital taking long-term exposure; flips to sustained outflows suggest rebalancing, deleveraging, or forced selling from margin-related constraints elsewhere. Spot flows move the underlying supply/demand for BTC directly.

Futures volume and open interest measure market-making depth, leverage appetite, and trading activity. Falling futures volumes imply thinner liquidity, wider execution costs and higher slippage for large market orders. They also increase the chance that a given flow will generate outsized price moves.

Timing and signal properties: ETF flows can be fast and headline-driven (large redemptions or creations over days), making them good near-term directional indicators. Futures liquidity deterioration is a structural risk amplifier — it doesn’t always tell you direction but signals that price impact from flows will be larger and volatility more acute.

Correlation, not causation: Both metrics can be driven by common macro factors (risk-off episodes, rates shocks, FX stress), so watch cross-asset moves — equities, rates, and FX — alongside crypto specifics.

When each is an early-warning indicator

Use ETF outflows as a first-warning when you see sustained weekly net redemptions above a material threshold (example thresholds below). These flows often precede or coincide with spot price weakness because assets must be sold or rebalanced.

Use falling futures volume as an early-warning for execution risk and volatility spikes. If volume drops to multi-month lows while open interest collapses, that signals market makers are retreating and that subsequent flows will have outsized price impact.

The highest-risk signature is concurrent ETF outflows and collapsing futures volumes: that combination increases the probability of disorderly price moves because demand is retreating while the market’s ability to absorb sells is impaired.

Thresholds and simple triggers (practical)

Below are pragmatic, illustrative thresholds you can track as part of a tactical framework. Calibrate these to your book size and execution tolerance.

ETF flows: watch for net outflows > $300–500M in a single week or > $1B over a rolling 4-week window as a material red flag for tails of selling pressure (BlackRock’s ~ $528M print is in that one-week material range).

Futures volume: treat a drop to >50% below seasonal median or a monthly volume at multi-month lows as a liquidity alert; add higher spreads and thinner orderbook depth on top of that to confirm risk.

Open interest: >25–40% drop in open interest over 2–4 weeks signals leverage and speculative appetite are evaporating.

Cross-confirmation: if ETF outflows cross the threshold at the same time futures volume and open interest breach theirs, move from monitoring to active risk reduction (scale-down, hedge, or use limit executions).

Corporate confidence plays: signal or noise?

Large corporate allocations — exchanges or firms putting BTC on their balance sheets — give confidence but have limits as systemic absorbers. Binance’s $1B SAFU conversion into BTC is tactically meaningful: it reduces the supply of BTC available to the market and functions as a signaling device that may stabilise sentiment among retail and some institutional circles. Yet:

A $1B corporate reserve is meaningful but small relative to global ETF flows over a quarter. It can stabilize short-term sentiment but is not a structural substitute for broad, sustained institutional allocation.

Corporate buys can be strategic (PR, confidence) rather than allocational (long-term treasury policy), so assess intent and transparency. In other words, treat these moves as supportive but not decisive unless repeated across many large corporate treasuries.

Scenario planning: three paths for BTC price

Scenario design helps translate signals into execution. Below are three plausible scenarios with assumptions and expected BTC reactions. These are illustrative frameworks, not precise forecasts.

- Risk-off / Institutional withdrawal (Tail risk)

- Assumptions: Spot ETFs record persistent net outflows (> $1B rolling 4-week), futures volumes and open interest drop >30–40%, macro risk-off (equities down, rates spike).

- Mechanism: Reduced allocation demand + thinner liquidity => aggressive price declines as sellers slosh through shallow markets.

- Likely BTC behavior: Rapid drawdown 20–40% over 2–8 weeks, higher intraday volatility. Wider spreads and execution costs. Consider hedges (put structures, short futures) or staging passive liquidity reductions.

- Base case / Choppy re-pricing

- Assumptions: Episodic ETF outflows (single-week prints like the $528M case) but futures liquidity remains serviceable (volumes stable relative to seasonal norms). No material macro shock.

- Mechanism: Price corrections driven by allocation shifts but absorbed by active market makers and derivatives desks.

- Likely BTC behavior: 5–20% corrective moves with mean-reversion over 1–3 months. Tactical re-entry opportunities as funding rates normalize.

- Institutional-return / Renewed adoption

- Assumptions: ETF flows resume consistent net inflows (rolling 4-week positive), futures volumes and open interest recover, and corporate treasuries add incremental BTC buys.

- Mechanism: Renewed demand + recovered liquidity lowers execution risk and supports price discovery to the upside.

- Likely BTC behavior: Gradual appreciation with tightening volatility; potential for breakout rallies if flows concentrate into spot ETFs (10–50% rally over multiple months depending on flow magnitude).

Which scenario plays out depends on the interplay between allocation shifts (ETF flows), market plumbing (futures liquidity), and macro backdrop.

Practical watchlist for allocators and macro strategists

Track these metrics daily/weekly and set automated alerts around the thresholds above:

- Net ETF flows (by provider) — rolling 1-week and 4-week aggregates (spot ETF flows move underlying demand).

- Futures monthly trading volume and 30-day changes — compare to seasonally adjusted medians.

- Open interest across major venues — sudden drops signal deleveraging.

- Funding rates and basis spreads — persistent negative funding or contango in futures can indicate structural demand/supply imbalances.

- Option skew and put-call ratios — rising skew indicates fear and potential for larger downside moves.

- Orderbook depth & spreads on major venues — real-time liquidity for large executions.

- Macro overlays: equity risk premia, USD strength, interest rates and geopolitics — these often drive the institutional sentiment shifts discussed in recent analyses.

Tools and platforms that combine on-chain custody flows, ETF creation/redemption reports and derivatives market metrics will be most valuable; platforms like Bitlet.app can be useful as part of a broader toolkit to monitor allocation signals and execution risk.

Reading the recent headlines in context

The BlackRock outflow (~$528M) is a clear, actionable datapoint — but by itself it is not definitive evidence of a systemic collapse in institutional demand. Paired with low futures volumes and prominent commentaries about institutional exodus, the risk profile rises: even modest outflows can have outsized price effects if liquidity is thin. Conversely, corporate buys like Binance’s SAFU conversion are confidence-building and matter for sentiment, but they are not a wholesale replacement for broad, diversified institutional allocations.

In short: ETF flows are a near-term directional gauge of allocation; futures liquidity is a structural gauge of execution risk. Both must be monitored together.

Conclusion — a pragmatic stance for allocators

Treat the current data as a mixed signal that warrants active monitoring and contingency planning rather than panic. Use ETF flow thresholds to detect directional allocation shifts and futures liquidity metrics to manage execution and volatility risk. Prepare buckets of response: tactical hedges if both signals flash red; measured rebalancing during choppy, base-case conditions; and scale-in posture when flows and liquidity recover.

For macro strategists, the clearest lesson is that liquidity matters as much as demand. A return of institutional demand without a concurrent return of market-making capacity would still risk sharp, disorderly moves. Conversely, robust liquidity with stable or modest inflows tends to absorb shocks and permit orderly price discovery.

Sources

- BlackRock spot Bitcoin ETF sees roughly $528M outflows (Cryptonomist)

- Why smart money is deserting Bitcoin amid geopolitical turmoil (Crypto-Economy)

- Bitcoin futures trading volume falls to lowest level since 2024 (Bitcoinist)

- Binance converts $1B SAFU fund into Bitcoin (Bitcoinist)

For broader context on historical ETF-flow impacts and derivatives liquidity, consult primary exchange flow reports and derivatives venue data when making execution decisions. For monitoring, combine custody flow feeds with futures and options market metrics to form a real-time picture.