Why Dogecoin Keeps Moving: Derivatives Open Interest, ETF Droughts, and Retail Catalysts

Summary

Quick thesis: why DOGE still jumps despite an ETF drought

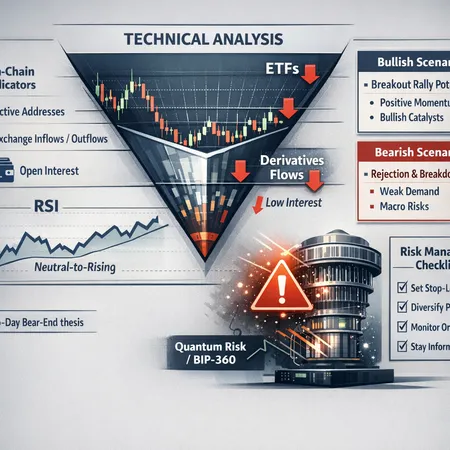

Dogecoin’s price action in 2025 has a split personality. On longer timeframes, an ETF drought — little to no durable institutional allocation — removes a stable bid. On shorter timeframes, however, derivatives open interest and retail-driven events can spark outsized moves. That means squeezes and flash rallies remain likely, but they’re fragile and risky to trade without a ruleset.

For traders sizing event-driven DOGE trades, this piece walks through the mechanics: what open interest spikes tell you, how scarce ETF appetite changes the backdrop, why retail promotions (like the Robinhood giveaway) matter more than they should, and which DOGE technicals validate or invalidate a trade idea.

Derivatives open interest: a real-time thermometer for squeeze risk

Open interest (OI) is the live count of outstanding futures or options contracts and it matters for two reasons: concentration and liquidity.

- When OI rises steeply, large short positions often get built up — these are the positions vulnerable to a squeeze. U.Today reported a notable jump in Dogecoin open interest over a 24-hour window, which often signals increased derivatives activity and potential for short-term volatility U.Today.

- High OI concentrated in a narrow range creates asymmetric risk. If spot buying (retail or otherwise) erodes the margin buffer on shorts, forced liquidations push the price higher, which triggers more liquidations — classic reflexivity.

Practical takeaways for desks and traders:

- Track OI by exchange and instrument (perpetual vs quarterly futures vs options). Perpetual swaps with stretched funding and concentrated short OI are the most squeeze-prone.

- Watch the term structure and basis: steeply negative basis and elevated implied vol in short-dated options mean the market is pricing event risk.

- Size positions relative to average daily volume (ADV) and the notional OI you see. A small retail buy can cascade if OI is large and concentrated; conversely, plowing into DOGE against a diffuse OI can be a slow bleed.

ETF drought: why the institutional bid is not yet supporting DOGE

Despite the memecoin narrative and episodic attention, institutional appetite for a Dogecoin spot ETF remains muted compared with blue-chip cryptos. Without predictable ETF inflows, there is no steady, structural buyer to absorb large derivatives-driven squeezes once the dust settles.

This matters because ETFs can convert episodic demand into lasting flows — smoothing the post-squeeze reversion. In a drought:

- Price moves are more likely to be mean-reverting once leverage unwinds. The pop may be dramatic, but the follow-through depends on new, sustainable capital.

- Dealers and market-makers price options and futures with higher skew and shorter defensive horizons, increasing hedging costs.

For context: when larger-cap assets attract ETF demand, derivatives desks can hedge inventory against predictable flows. With DOGE that predictability is missing, so desks must treat event-driven positions as short-duration, high-convexity trades.

Retail promotions and flow dynamics: the Robinhood example

Retail activity still moves Dogecoin more than many expect. A recent Robinhood Dogecoin giveaway is a clean case study: promotions that seed wallets or create attention spikes lead to concentrated buy-side pressure and temporary increases in spendable balances — the kind of immediate liquidity that can trigger squeezes.

CryptoBriefing covered how the Robinhood giveaway illustrated retail liquidity spikes and the flow they generate in DOGE markets CryptoBriefing. Key mechanics:

- Retail inflows tend to be clustered in time and price — promotions create a concentrated footfall of buyers.

- Retail trades are more likely to be spot buys executed into order books, which directly lift spot prices and force hedges on derivative books.

- Social media and FOMO multiplex these effects: a giveaway + a short-heavy OI profile = recipe for sharp intraday moves.

Retail-driven events are short-lived but high-impact. Traders should not assume they mark the start of sustained institutional rotation.

Technical setup: patterns and levels that matter now

Technicals still provide the practical triggers for trade entries and risk limits. Recent technical analysis has warned of patterns that suggest downside susceptibility in DOGE absent a sustained bid Crypto.news. Synthesize the following into your decision tree:

Key levels and indicators

- Support and resistance bands: identify 24–72 hour liquidity pools on on-chain and exchange orderbook heatmaps; these are likely pause points during squeezes.

- Moving averages (50/100/200) on intraday and daily: crossovers still matter for desk risk limits.

- Volatility regime: implied volatility skew in short-dated options often spikes ahead of retail events; monitor the front-end implied vol for sudden jumps.

- Momentum and breadth: an RSI divergence or failure to reclaim a prior high on volume suggests a squeeze will struggle to stick.

Read the tape for confirmation

Spot buying alone doesn't equal a sustainable breakout. Look for one or more confirmations:

- Funding rates compressing from extreme negative territory (indicating shorts deleveraging) while OI is declining — that’s capitulation.

- Option flow: heavy call buying in the front-month suggests directional conviction; heavy put-buying or elevated put-call skew suggests downside protection demand.

- Exchange flows: net inflows to spot exchanges after a rally imply potential sell-side pressure; withdrawals to custodial/staking platforms suggest real accumulation.

Combine technical triggers with derivatives signals — don’t trade on a pattern or an OI read alone.

Trade sizing and risk rules for event-driven DOGE trades

This is where theory meets P&L. Below are actionable rules tailored to retail traders and derivatives desks.

- Size to ADV and OI: cap a trade at a fraction of average daily traded volume and no more than a small percentage of the concentrated OI you observe on the highest-liquidity venue.

- Timebox trades: treat event-driven plays as time-bound — often 1–5 days. If you’re holding past the event window, reduce size and hedge.

- Use asymmetric structures: long call spreads, calendar spreads, or put hedges reduce cost and gamma exposure compared with naked bets.

- Monitor funding and liquidation ladders: avoid being the residual liquidity in the rear of a long liquidation queue.

- Define exit triggers: hard stop-loss in spot terms, delta-threshold for options, or gamma exposure caps for desks.

- Stress-test with scenario P&L matrices: model a 20–50% intraday move and the path-dependence of liquidations and implied vol.

For retail traders, being cautious with leverage is crucial; for desks, hedging speed and margin buffers should be baked into strategy. Bitlet.app traders who use installment or leverage products should pay special attention to margin-tail risks and time horizons.

What this all implies for squeezes and the post-event market

In short, squeezes are likely to remain a recurring feature for DOGE — especially around retail promotions and short-term increases in derivatives open interest. But the absence of a deep ETF bid changes the outcome probabilities:

- Squeezes can be sharper but shorter-lived. Without long-term institutional inflows, mechanical unwind is more likely once immediate buying pressure fades.

- Derivatives desks can still profit by being nimble: trading gamma and selling premium into manic short-covering rallies while protecting against sudden overshoots.

- Retail traders are best positioned with defined time horizons, conservative leverage, and a clear view of how option skew and funding will change around events.

Practical monitoring checklist (quick)

- Exchange-level OI and funding rates (perps vs futures)

- Short-interest proxies or concentrated short positions visible in options

- Front-month implied vol and put-call skew

- Spot orderbook depth and ADV

- Scheduled retail promotions or platform giveaways (social media + app announcements)

- Key technical levels and on-chain exchange flow

Conclusion: trade the micro, respect the macro

Dogecoin’s price action today is driven more by short-term derivatives mechanics and retail flow than by durable institutional demand. That makes DOGE fertile ground for event-driven trading — but also unforgiving for poorly sized, high-gamma bets.

The prudent playbook is straightforward: watch open interest and funding, respect the ETF drought as a macro limitation, price in retail promotional flow, and front-load risk management. When these elements align, squeezes can offer asymmetric opportunities — but only when entered with clear size, a stop, and contingency plans for fast reversals.

Sources

- U.Today — Report on Dogecoin open interest spike: https://u.today/12140000000-doge-committed-in-24-hours-key-metric-signals-resurgence?utm_source=snapi

- Crypto.news — Technical warning on DOGE patterns amid ETF drought: https://crypto.news/dogecoin-price-forms-scary-patterns-as-doge-etf-drought-continues/

- CryptoBriefing — Robinhood Dogecoin giveaway and retail flow example: https://cryptobriefing.com/robinhood-dogecoin-giveaway/

For traders who want to broaden context: follow macro cues and larger market bellwethers like Bitcoin and the behavior of the Dogecoin social cycle to anticipate when retail attention might flip the derivatives landscape.