AXS Rally: Is Axie Infinity’s 20% Spike a Genuine Revival for Gaming Tokens?

Summary

Quick recap: what happened in the AXS rally

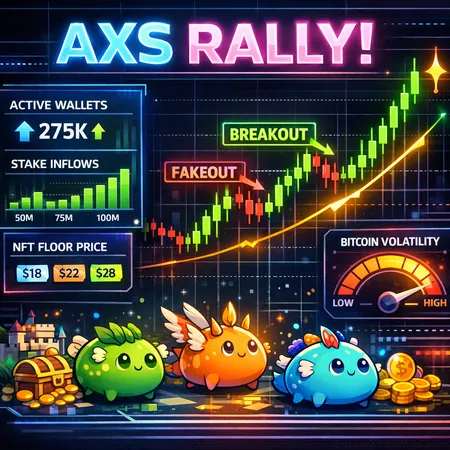

In early February AXS spiked more than 20% in a short window, a move picked up by coverage like INVEZZ that attributes the pop to concentrated on-chain buying and narrative rotation back into gaming tokens. The speed of the advance caught traders’ attention — it wasn’t a slow re-accumulation but a sharp short-term impulse that invites two questions: what drove this rally, and can it become a sustainable revival for play-to-earn and gaming tokens?

Understanding both the on-chain context and the macro backdrop matters here. This piece unpacks the short-term drivers, reviews the technical structure (is this a breakout or a fakeout?), explains how Bitcoin’s volatility can amplify or erase gains, and gives the concrete metrics altcoin traders and Web3 game investors should monitor before re-entering AXS or broader gaming-token exposure.

Short-term drivers behind the spike

On-chain buying and whale flows

Large, concentrated buys — often visible as off-exchange or OTC-like accumulation — are the fastest way to move a mid-cap token like AXS. On-chain explorers and exchange-flow dashboards showed a net reduction of available sell-side liquidity during the initial surge, which magnified the price impact of subsequent buys. In plain terms: fewer coins listed + aggressive bids = outsized moves.

A key early indicator was an uptick in wallet-to-wallet transfers into smaller centralized and decentralized liquidity pools, which suggests accumulation rather than routine redistribution. Traders should keep watching exchange inflows/outflows: persistent outflows paired with higher open interest often precede multi-week rallies, while the opposite typically signals short-lived spikes.

Narrative and catalysts

Narrative matters in gaming tokens. Headlines like renewed interest in play-to-earn mechanics, improved tokenomics discussions, or protocol announcements create FOMO among retail and spec funds. The INVEZZ report noted the immediate narrative lift as a partial explanation for the rally — when traders see catalysts (or rumors of them), they often front-run potential demand.

But narratives can be transient. A good narrative pulls capital only if product-level fundamentals (active users, NFT demand, developer activity) back it up.

Macro flow and liquidity (the Bitcoin connection)

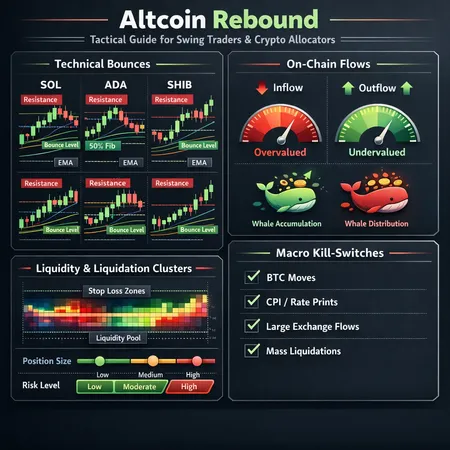

Macro liquidity and risk appetite drive altcoin rallies more than most people admit. When broad liquidity is available and BTC is stable or rising, capital tends to flow down the market-cap ladder into thematic trades like gaming tokens. Conversely, a volatile or falling Bitcoin can quickly suck liquidity out of risk assets, turning rallies into retracements.

If the AXS spike happened during a benign BTC phase, it could be sustainable; if BTC was rallying and then reversed, AXS could be vulnerable to a washout.

Technical structure: breakout or fakeout?

Technical analysts flagged a potentially bullish structure for AXS in recent coverage. CoinPedia’s breakdown highlights a breakout setup forming after a rebound, but stresses the need for confirmation before declaring a new uptrend. Their analysis focuses on price consolidating into a breakout range with improving momentum indicators.

From a trader’s checklist, a valid breakout should show:

- A decisive close above the breakout zone on higher-than-average volume (not just a quick wick).

- Follow-through buying across the next 48–72 hours (sustained net inflows or continued whalish accumulation).

- Reduced selling pressure on exchanges (net outflows or stagnant exchange balances).

- Momentum tailwinds: rising RSI without extreme overbought readings and increasing on-chain activity.

Warning signs of a fakeout include a spike with immediate profit-taking, a return into the prior range within a day, or a divergence between on-chain activity and price (price up while active wallets decline). CoinPedia’s piece walks through these technical nuances and why traders should wait for volume confirmation rather than assume the move is permanent.

Which metrics prove a sustainable recovery? (what to monitor)

A repeatable, durable recovery for Axie and gaming tokens must rest on both market structure and product health. Here are the highest-signal metrics and what to look for:

Active wallets (daily/weekly active users): Look for a sustained increase in DAU/WAU over several weeks. A one- or two-day spike does not cut it. For play-to-earn tokens, higher active wallets correlate with recurring in-game economic demand.

NFT floor prices and marketplace volume (Axie NFTs): Floor price stabilization with rising weekly volume is a strong sign that collectors and players are returning. Watch both median sale price and number of distinct buyers — breadth matters more than a few outsized sales.

Staking flows and tokenomics changes: Net staking inflows suggest holders are committing capital long-term, reducing circulating supply. Conversely, sudden unstaking spikes or vesting unlocks can swamp demand and trigger sell pressure.

Exchange flows (net inflows/outflows): Net outflows indicate accumulation off-exchange (bullish). Large, sustained inflows often precede sell-offs. Track both quantity and the destinations (CEX vs. DEX liquidity pools).

On-chain transfers and whale behavior: Repeated movements from whale addresses to DEXes or OTC addresses can signal distribution. Watch for clusters of small-to-medium addresses buying in — that’s retail participation — versus a single wallet unloading.

Developer activity and roadmap progress: Active Github commits, announced partnerships, and live roadmap milestones re-ignite organic demand. Token rallies without dev activity are fragile.

Derivatives open interest and funding rates: Elevated long-biased open interest and steep positive funding can indicate crowding and vulnerability to liquidations if BTC corrects.

A durable recovery is more likely when multiple metrics align: rising active wallets, improving NFT market health, staking inflows, and dwindling exchange liquidity — all sustained over a multi-week window.

How Bitcoin’s volatility influences the thesis

Altcoins travel in BTC’s wake. For many traders, Bitcoin remains the primary market bellwether. Even a structurally sound token-level rally can be undone by a sudden BTC liquidity event. Two scenarios matter:

- BTC supportive environment: If Bitcoin is in an uptrend or quiet consolidation, risk-on flows can push capital into gaming tokens, helping sustain an AXS breakout.

- BTC shock or rapid drawdown: High-leverage alt positions get liquidated, funding rates unwind, and capital flees to perceived safe-haven assets — often wiping out nascent alt rallies.

Correlation metrics matter: track AXS-BTC correlation and relative strength. If AXS is outperforming BTC by a wide margin while correlation remains high, the move is likely leverage-driven and prone to reversal when BTC wobbles.

A practical trade plan for re-entering AXS exposure

If you’re considering re-entry, treat this like any altcoin trade: define timeframe, entry, and stop. Example framework:

- Entry: Wait for breakout confirmation — a daily close above the breakout zone on elevated volume and positive on-chain signals (e.g., rising active wallets or net staking inflows).

- Staggered sizing: Use pyramiding — enter partial size on first confirmation, add on a second confirmation or sustained volume. This reduces front-running bad breakouts.

- Stop-loss: Place stops below the breakout range or critical support levels. Consider volatility sizing: wider stops for higher volatility tokens.

- Time horizon: Decide if you’re trading a momentum swing (days–weeks) or re-establishing a strategic position (months). For the latter, require stronger product signals (NFT market recovery, developer milestones).

- Risk management: Cap allocation to gaming-tokens exposure to a small percentage of portfolio. Monitor funding rates and derivatives OI — high leverage environments deserve tighter sizing.

Platforms like Bitlet.app can help with structured entries (e.g., recurring buys) if you prefer systematic re-entry rather than guessing short-term tops — but always align platform use with your risk plan.

Conclusion: checklist to confirm a lasting Axie revival

If you want to believe the AXS rally is the start of a sustainable revival, require convergence across these indicators:

- Sustained rise in active wallets (weekly trend) and stronger buyer breadth in Axie NFT markets.

- Floor price recovery plus rising marketplace volume and number of unique buyers.

- Net staking inflows or reduced exchange balances (less available supply).

- Technical confirmation: closing above breakout range with follow-through volume across 48–72 hours.

- Supportive BTC environment or at least muted BTC volatility.

Absent multi-week confirmation across on-chain, NFT, and technical metrics, treat the current rally as a tradeable pop, not a guaranteed narrative reset. For altcoin traders and Web3 game investors, patience and multi-factor confirmation are the difference between catching a real trend and getting chopped out by a fakeout.