Cardano

Cardano’s current valuation gap, staking utility, and improving market structure create a plausible pathway for ADA to attract institutional flows as spot ETFs broaden altcoin exposure. This article examines the mechanics behind that thesis, realistic upside, timeline, and a practical checklist for investors.

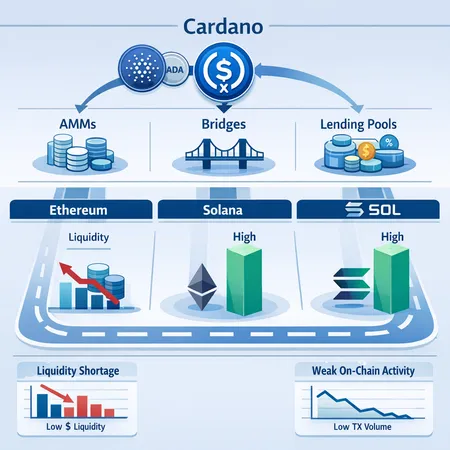

Cardano plans to launch USDCx to address dollar liquidity shortages—this article evaluates the product timeline, mechanics, and whether a native USDC-like stablecoin can materially change DeFi liquidity dynamics for ADA. We compare models on Ethereum and Solana and outline likely short-term effects for projects and holders.

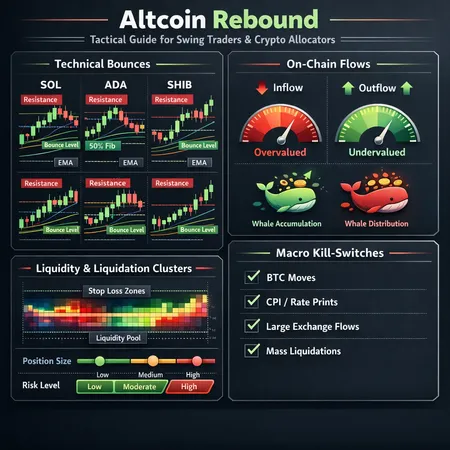

A tactical playbook for swing traders and allocators to navigate recent altcoin rebounds, blending technical levels, on-chain flow, whale signals and liquidation-cluster risk. Practical sizing rules and a macro watchlist identify what will sustain — or kill — these short-term rallies.

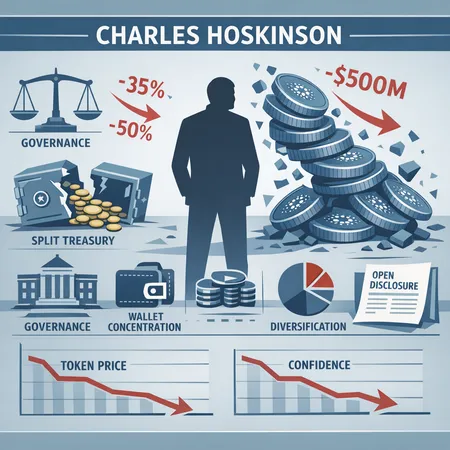

Charles Hoskinson’s public claim of losing over $3 billion in crypto holdings shines a light on founder balance-sheet concentration, market signalling and the gap between personal and project risk management. This article unpacks the facts, historical parallels, best-practice disclosure rules and what ADA holders should demand from Cardano’s governance.

CME Group will list Cardano (ADA), Chainlink (LINK) and Stellar (XLM) futures beginning Feb. 9, expanding regulated altcoin access for institutions. This explainer reviews why CME is making the bet, contract design (micro vs standard), market‑maker and liquidity implications, and concrete hedging and exposure strategies for professional allocators.

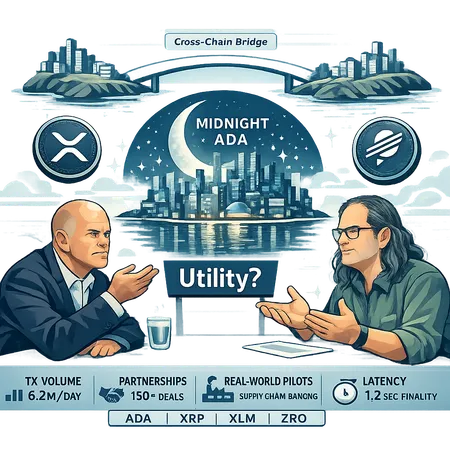

As markets demand measurable utility, critics single out XRP and Cardano — but cross‑chain primitives and partnerships are shifting what 'utility' even looks like. This piece unpacks the Novogratz critique, Ripple CTO responses to Cardano Midnight, and a pragmatic metric set for judging on‑chain utility.

Cardano faces a split narrative: ADA is flashing bearish technicals and losing DeFi share, even as privacy-focused projects like Midnight (NIGHT) attract speculative flows. This feature explains the MACD signal, NIGHT’s surge, developer trends versus Solana/XRP, and plausible on‑chain outcomes for the ecosystem.

NIGHT’s sudden breakout into the top-10 by market cap and >$1B 24h volume reshapes how investors view privacy tokens and Cardano’s DeFi narrative. This article unpacks what happened, why Cardano became the host, how NIGHT compares to XMR and ZEC, and the risks and opportunities ahead.

PYTH Network’s pivot to a revenue‑backed reserve and Cardano’s first PYTH oracle integration sharpen the debate over oracle value capture. This explainer breaks down the technical and economic shifts, governance wrinkles, and the realistic price catalysts and risks for PYTH token investors and DeFi developers.

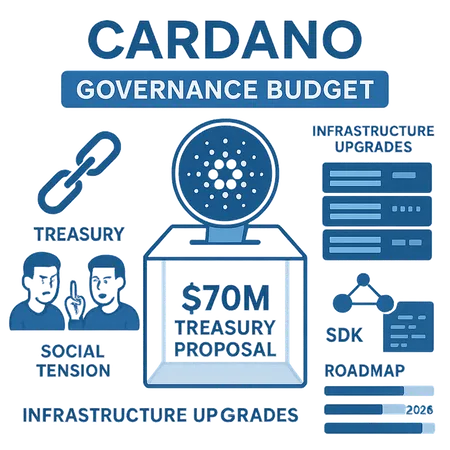

A deep dive into the $70M ADA treasury proposal — the Cardano Critical Integrations Budget — and why community trust, measurable KPIs, and tranche-based accountability will decide whether this reboot delivers real infrastructure upgrades or more stagnation.