Altcoin Rebound Playbook: Tactical Setups for SOL, ADA, SHIB and WLD

Summary

Why a focused altcoin rebound playbook matters

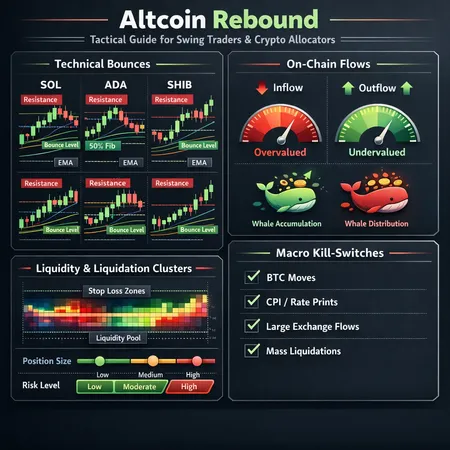

Altcoin rebounds rarely move in isolation. Short-term strength in tokens like SOL, ADA, SHIB and WLD has been obvious in price charts recently, but on-chain signals often tell a different — sometimes more cautionary — story. This playbook combines classic support resistance analysis with on-chain flows, MVRV snapshots, whale accumulation cues and liquidity structure to build practical trade setups for swing traders and allocators.

For many traders, macro moves in Bitcoin still dictate risk-on behavior, but token-specific on-chain flows and whale actions can create tradeable divergences. We'll reference recent on-chain reporting — for example, Solana reclaiming above $85 while on-chain metrics urge caution — and use those patterns as templates you can apply across other altcoins.

How to read this playbook

Structure: each token section covers (a) the technical bounce and levels to watch, (b) the on-chain evidence that supports or undermines the rally, and (c) sizing and stop heuristics around fragile liquidity and liquidation clusters. After the token deep-dives you'll find general sizing rules, a macro watchlist of bounce killers, and an actionable checklist.

A note on sources and context

Several recent reports capture these short-term rebounds: Solana's return above $85 and the caveats in on-chain flows, Cardano's sharp jump amid talk of institutional buying, Shiba Inu's recovery tests tied to a BTC rebound above $60k, and Worldcoin's momentum surge back toward $0.40. These are used as case studies and linked where relevant.

SOL — technical bounce, but on-chain caution

Technical bounce and levels to watch

- Short-term: SOL recently reclaimed the

85 area, which acts as immediate proof-of-life for bulls. Watch **support near the reclaimed zone (80–85)** — losing it would likely invalidate the bounce. - Resistance cluster: expect sellers between the prior swing high and the next Fibonacci extension; if price clears that, the path to a cleaner rally opens.

- Liquidity map: the most dangerous zones are thin order books under the reclaimed support and a concentration of stop-losses just below recent lows.

On-chain flow and MVRV / whale behavior

- On-chain data in recent coverage suggests inflows to exchanges slowed even as price recovered, which is a cautious sign: limited exchange outflows imply the rally lacks broad accumulation momentum. See the analysis highlighting on-chain caution when SOL reclaimed above $85 for a more detailed on-chain read.Solana price reclaim above $85 — on-chain caution

- Check short-term MVRV for a quick gauge: a modest jump in short-term holder profits often precedes distribution; if ST-MVRV crosses into extended profit territory while whale wallets mark fresh sells, that undermines the rally.

Sizing and liquidation clusters

- Conservative entry: scale in 25/25/50 across the reclaimed support — buy a small core at support, add on confirmed hold, and use the remainder to add on breakout above the nearby resistance.

- Risk per trade: 1–2% of portfolio for allocators; 0.5–1% for aggressive swing traders on highly illiquid pairs.

- Stops: put stops just below the liquidation cluster (not just the recent candle low) to avoid being clipped. Use order-book depth tools to map where stops and liquidations are likely concentrated.

ADA — institutional headlines vs real flow

Technical bounce and levels to watch

- ADA's recent spike (a quick ~10% jump in headlines) created a short-term gap that often acts as resistance until filled. Watch the gap high as near-term resistance and the on-chain accumulation band below as your primary support.

- If price holds above the new intraday pivot, the next leg targets prior resistance bands; failure to hold invites a return to the accumulation zone.

On-chain flow and MVRV / whale behavior

- Reports note debate whether institutional buying is behind the move; institutional inflows usually show as large, steady decreases in exchange reserves and large wallet accumulation. Monitor big transfers and CEX reserve trends to validate that narrative.Cardano institutional buying debate

- Watch MVRV across cohorts: if short-term holders flip to significant unrealized profits but long-term-holder accumulation stalls, rallies tend to fade quickly.

Sizing and liquidation clusters

- For ADA, liquidity tends to be deeper than smaller memecoins but can still concentrate around psychological decimals. Size positions using a two-layer approach: a base allocation at support and opportunistic additions above resistance breakouts.

- Keep stop-losses outside common retail clusters — retail stops often sit just below round numbers or daily lows.

SHIB — a recovery test tied to Bitcoin flows

Technical bounce and levels to watch

- SHIB’s short-term strength has tracked BTC momentum — recent tests aligned with BTC reclaiming $60k. If BTC loses that level, expect correlated pressure on SHIB.

- Technical levels are driven by tokenomics: large sellers can move price near thin liquidity levels, so mark on-chain whale sell zones and past accumulation bands.

On-chain flow and MVRV / whale behavior

- Recent coverage tied Shiba Inu’s recovery to Bitcoin’s rebound above 60k and identified key imbalances traders watch. That makes SHIB more correlation-dependent than fundamentals-driven in the short term.SHIB recovery and BTC link

- Monitor large wallet movements and DEX vs CEX flows — sustained DEX accumulation often precedes price resilience while exchange inflows often foreshadow selling pressure.

Sizing and liquidation clusters

- Trade SHIB with smaller notional exposure due to high volatility and shallow liquidity relative to larger caps. Use micro-scaling (e.g., 10–20% tranches) and tighten stops to limit drawdowns.

- Consider options or hedges if using larger notional exposure; when liquidation clusters are tight, a sudden BTC move can cascade stops.

WLD (Worldcoin) — momentum case study and mean reversion risk

Technical bounce and levels to watch

- Worldcoin reclaimed the ~$0.40 level in a big momentum run; that reclaim marks a psychological pivot. A clean hold above roughly that area signals momentum continuation; failure implies a retest to deeper buy zones.

- Expect volatility — early momentum trades commonly see a two-wave pattern: initial surge then a mean reversion into the high-volume node.

On-chain flow and MVRV / whale behavior

- Coverage of WLD’s ~20% surge highlights classic momentum resets: short-term inflows and high turnover can power rallies but also create quick profit-taking by early whales.WLD surge and momentum context

- Check whale behavior: if several large wallets accumulate and then show increased transfer-to-CEX activity, the rally is vulnerable.

Sizing and liquidation clusters

- Because WLD moves are momentum-driven, size trades smaller and rely on tight exits. Use layered buys on pullbacks to high-volume nodes rather than chasing breakouts.

- Place stops outside visible liquidation clusters and away from thin book edges to avoid being swept.

General sizing and risk-management rules for fragile altcoin rebounds

- Position sizing: cap exposure per altcoin to 1–4% of portfolio depending on liquidity and conviction. For funds, use the top of that range only when macro and on-chain flow align.

- Risk per trade: 0.5–2% of portfolio value — lower for high-volatility memecoins, higher for deeper-market caps.

- Scale entries: divide exposures into at least 2–3 tranches. Add on confirmed holds or institutional-validation signals (e.g., declining exchange reserves, sustained whale accumulation).

- Stop placement: avoid placing stops where most retail stops cluster. Instead, map liquidation clusters using open interest and order-book depth and put protective stops slightly beyond those zones.

- Use skew-aware hedges: short-dated BTC hedges or options can protect a concentrated altcoin bet if macro risk rises.

Macro and market triggers that can kill the bounce

- Bitcoin breakdown below key macro supports (e.g., a sustained break under the 60k area referenced in SHIB coverage) — if BTC loses a primary support, correlation-driven altcoin drawdowns tend to follow.

- Fed rate surprises or dovish-to-hawkish shifts that reset risk appetite quickly.

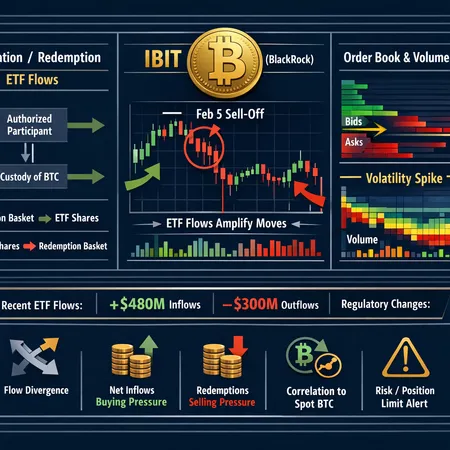

- ETF flows and large institutional outflows: rapid decreases in passive flows can drain liquidity across altcoins.

- Stablecoin stress or de-pegs that force deleveraging.

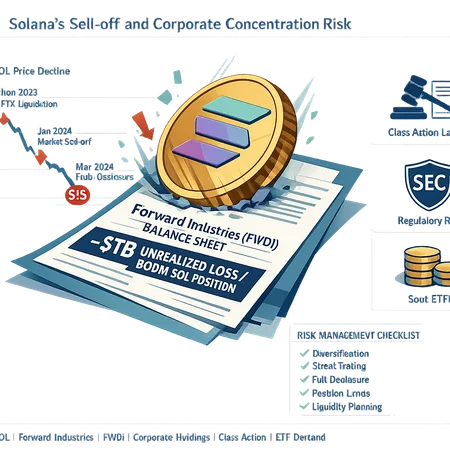

- Sudden token-specific negative on-chain events (large whale dumps, smart-contract exploits, or sudden CEX inflows).

Actionable checklist (for swing traders & allocators)

- Confirm macro: BTC in a neutral-to-bull regime and no rate shocks on the calendar.

- Validate on-chain: declining exchange reserves or sustained whale accumulation for the token. For ADA and SOL, look for institutional-sized flows; for SHIB, confirm BTC correlation strength.Cardano institutional signals

- Map liquidity: identify liquidation clusters and set stops beyond those zones.

- Size and scale: use tranche buys and cap exposure per token according to liquidity and conviction.

- Exit plan: define profit-taking bands and hedge triggers (BTC break, CEX inflows, ST-MVRV extremes).

Use tools and services that help you automate entries and dollar-cost average — for example, platforms like Bitlet.app can simplify recurring buys and position sizing while you monitor on-chain signals.

Final take

Short-term altcoin rebounds are highly tradeable, but they require a synthesis of technical structure, on-chain flows, and liquidity mapping. The SOL and WLD rebounds show momentum can lift prices fast, yet on-chain cautions and headline-driven ADA moves remind us rallies can be fragile. Use disciplined sizing, map liquidation clusters, and keep a tight macro watchlist to avoid being clipped when sentiment flips.

Sources

- https://coinpedia.org/price-analysis/solana-price-reclaims-above-85-but-on-chain-data-tells-a-more-cautious-story/

- https://coinpedia.org/news/cardano-ada-price-jumps-10-will-institutional-buying-trigger-a-bigger-rally/

- https://thenewscrypto.com/shiba-inu-eyes-recovery-as-bitcoin-rebounds-above-60k/?utm_source=snapi

- https://ambcrypto.com/worldcoin-reclaims-0-40-whats-next-after-wlds-14-surge/