Could Zcash (ZEC) Be a ‘Next Bitcoin’? Privacy, Supply, and On‑Chain Funding Explained

Summary

Executive snapshot

Zcash (ticker: ZEC) attempts something that few other cryptocurrencies do: pair a Bitcoin‑like monetary policy with strong privacy by default (when users choose it) and a built‑in funding mechanism for developers. That combination attracts a tempting narrative—could ZEC become a privacy‑first store of value, even a “next Bitcoin” in the eyes of some investors? The short answer: it’s plausible as a narrative, but practical, regulatory, and adoption barriers make it a very different proposition from BTC.

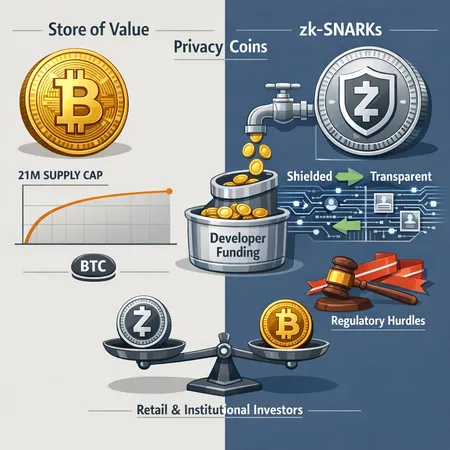

How Zcash’s monetary policy stacks up against Bitcoin

Zcash was designed with a limited supply and an issuance model that deliberately echoes Bitcoin’s scarcity story. Like Bitcoin, ZEC has a maximum supply cap and a declining issuance schedule, which helps it tap into the same scarcity-based narratives that drive BTC demand. That similarity is one pillar of the “next Bitcoin” pitch: investors looking for a scarce, non‑inflationary asset can understand ZEC’s basic monetary logic quickly.

There are important differences beyond shared scarcity. Bitcoin’s monetary story is reinforced by a large, decentralized miner/validator set and an ecosystem that treats monetary policy changes as near-sacred. Zcash, by contrast, introduced protocolized funding and different early distribution choices that affect both perception and economic incentives. Those trade‑offs are part of the reason ZEC’s store‑of‑value claim is stronger on paper than in market reality.

For many traders and institutional allocators, Bitcoin remains the primary monetary benchmark—any candidate for a “next Bitcoin” must not only be scarce but also build equivalent institutional trust and resilience.

Privacy tech: zk‑SNARKs, shielded vs transparent transactions

At the heart of Zcash’s proposition is zk‑SNARK cryptography. zk‑SNARKs (zero‑knowledge Succinct Non‑Interactive Argument of Knowledge) let a sender prove the validity of a transaction — that they own funds and aren’t double‑spending — without revealing sender, receiver, or amount. That’s a meaningful privacy upgrade over pseudonymous ledgers.

Zcash implements two address types: transparent addresses (t‑addresses), which behave similarly to BTC addresses, and shielded addresses (z‑addresses), which can hide transaction metadata. Importantly, privacy is opt‑in: users must choose shielded transactions. Historically, wallet support, performance, and UX barriers limited shielded adoption, leaving much of ZEC’s on‑chain activity visible. That matters because the privacy value of the network depends on the size and diversity of the shielded pool: the more participants use it, the stronger the anonymity set.

The industry is evolving toward selective disclosure mechanisms that preserve privacy while enabling compliance when required. This trajectory — discussed in broader privacy‑coin coverage — could make privacy tech more palatable to exchanges and institutions if it gives them a way to audit or selectively reveal transactions under defined conditions. See the recent discussion of this trend for context on how privacy coins are adapting to real‑world regulatory constraints (and the potential compliance pathways that come with selective disclosure) From anonymity to selective disclosure: The next era of privacy coins.

Developer funding: on‑chain support and long‑term sustainability

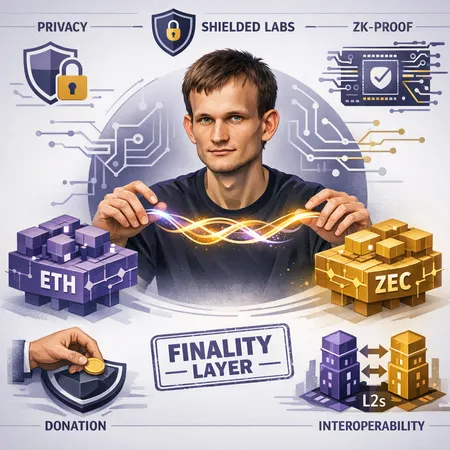

One structural distinction between Zcash and Bitcoin is the presence of a protocolized funding pathway for development. Zcash’s early economics included mechanisms that directed a portion of issuance or block rewards toward founders, developers, or a community fund. That on‑chain funding gives teams predictable resources to advance cryptography, wallets, and interoperability — a practical advantage when heavy R&D (like zk‑SNARK improvements) is required.

Predictable funding lowers one source of uncertainty for ongoing protocol work, which is especially important for maintaining and improving privacy tech. But it also introduces governance and concentration questions: who controls the funds, how transparent are allocations, and how does that influence trust? Those questions contrast with Bitcoin’s more decentralized and donation‑heavy funding ecosystem, where development is supported by a mix of corporations, foundations, and voluntary sponsorship.

A recent analysis highlights how Zcash’s combination of supply design, privacy features, and funding was intentionally structured to support long‑term protocol work while retaining scarcity characteristics—an important input when weighing ZEC’s place in investors’ portfolios (see: Could Zcash Be the Next Bitcoin?).

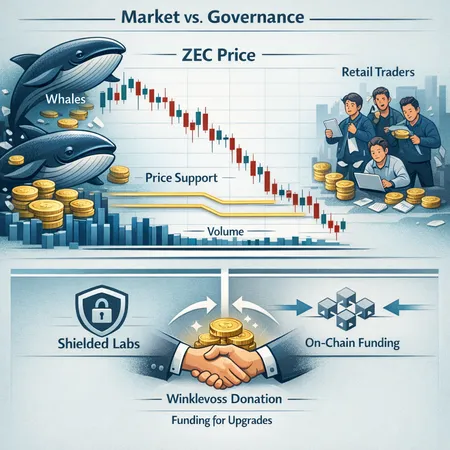

Regulatory and market adoption hurdles

Privacy coins face special scrutiny. Several centralized exchanges delisted or limited trading for privacy tokens in past regulatory waves. The reasons are straightforward: anti‑money‑laundering (AML) laws and know‑your‑customer (KYC) obligations make privacy by default harder to reconcile with exchange compliance.

Two practical pathways could mitigate this: (1) Selective disclosure and view keys that allow users to reveal transactions to auditors or counterparties, and (2) robust on‑ and off‑ramp compliance tooling that satisfies custodians and institutional compliance officers. The trend toward selective disclosure — where privacy can be preserved broadly but selectively waived — is already influencing the privacy‑coin thesis and could ease institutional adoption if implemented in a standardized, transparent way From anonymity to selective disclosure: The next era of privacy coins.

Liquidity and market infrastructure are other barriers. BTC benefits from deep liquidity, wide custody support, and VASP (virtual asset service provider) integrations. ZEC markets are thinner, custody options are fewer, and derivatives markets are limited. That increases transaction costs and slippage for large institutional allocations.

Could ZEC be a broad store of value?

The ingredients are present: scarcity + strong privacy primitives + sustained funding. But becoming a broad store of value requires more than compelling tech design. Institutional credibility, custody solutions that balance privacy and compliance, exchange support, and a broad user base using shielded transactions are all necessary.

Right now, ZEC is better thought of as a specialized monetary experiment that might fulfill a niche role: a privacy‑aligned scarcity asset for investors who value on‑chain confidentiality and for use cases where confidentiality is a primary requirement. That’s distinct from Bitcoin’s generalized, widely‑accepted store‑of‑value status.

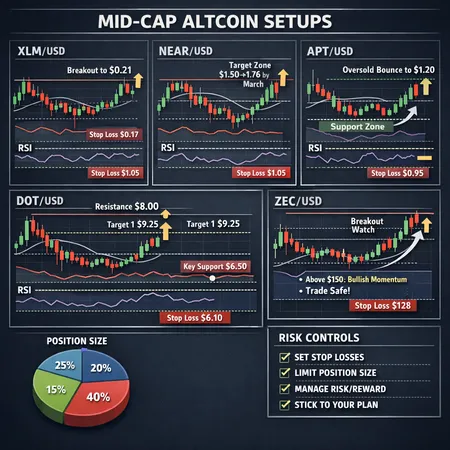

How investors should size ZEC exposure relative to BTC

Risk profile: ZEC combines technological optionality with regulatory and liquidity risk. For most portfolios, ZEC belongs to the satellite sleeve — a small, tactical allocation that provides exposure to privacy technology and governance experiments.

Suggested sizing framework (not financial advice):

- Retail investors curious about privacy tech: 0.25%–1% of investable crypto capital. Keep positions small, use noncustodial wallets if privacy is the goal, and have a compliance checklist for fiat on‑ramps.

- High‑net‑worth and family offices: 0.5%–2%, depending on compliance confidence and custody solutions. If you plan to hold materially larger positions, lock down a custody and legal compliance plan first.

- Institutions with strict AML/KYC mandates: typically 0%–0.5% until custody and auditing solutions for selective disclosure are standardized.

Why conservative sizing? Regulatory shocks (exchange delistings, legal clarifications) can produce outsized short‑term volatility or liquidity constraints. ZEC also carries concentrated protocol risk: breakthroughs or vulnerabilities in zk tech, or governance disputes over funding, can move price independently of macro crypto markets.

Consider ZEC as a hedge on specific narratives: if privacy regulation moves toward tolerating selective disclosure and custodians offer compliant shielded solutions, ZEC could materially re‑rate. Until then, small, disciplined exposure balances optionality with prudence.

Practical due diligence checklist for ZEC investors

- Confirm custody options and their approach to shielded assets. Does the custodian support selective disclosure?

- Review the current funding mechanism and transparency reports. How are funds allocated and audited?

- Look at shielded transaction adoption metrics and wallet support to gauge anonymity set growth.

- Model liquidity impact: how much slippage would a large trade incur on spot and OTC desks?

- Monitor regulatory changes affecting privacy coins in your jurisdiction.

Bitlet.app users should also ensure on‑ramp/off‑ramp compliance with local laws before taking meaningful positions.

Conclusion

Zcash packs an intellectually compelling package: Bitcoin‑like scarcity, advanced zk‑SNARK privacy, and an on‑chain funding model to sustain development. Those three pillars make the “next Bitcoin” headline understandable. But Bitcoin’s lead is as much sociopolitical and infrastructural as it is technical. For ZEC to move from niche privacy asset to mainstream store of value, adoption of shielded transactions must rise, custodians and exchanges must adopt compliant workflows (likely via selective disclosure), and regulatory clarity must improve.

For investors, ZEC is interesting — a high‑alpha, high‑risk position that deserves only modest, well‑managed exposure relative to BTC. It’s a place to gain exposure to privacy tech and governance experiments, not a substitute for Bitcoin in a core store‑of‑value allocation.

Sources

- Could Zcash Be the Next Bitcoin? — The Motley Fool: https://www.fool.com/investing/2026/01/18/could-zcash-be-the-next-bitcoin/

- From anonymity to selective disclosure: The next era of privacy coins — Bitcoin.com: https://news.bitcoin.com/from-anonymity-to-selective-disclosure-the-next-era-of-privacy-coins/