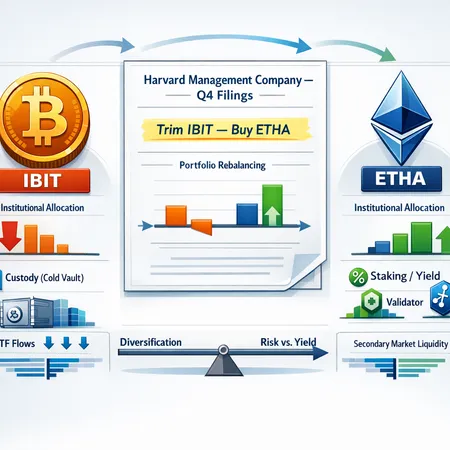

Institutional Allocation

Harvard Management Company’s Q4 filings show a notable trim in IBIT and a fresh position in ETHA, highlighting an institutional shift toward Ethereum ETFs. This article parses the motivations, ETF mechanics, market impact, and portfolio-level takeaways for allocators.

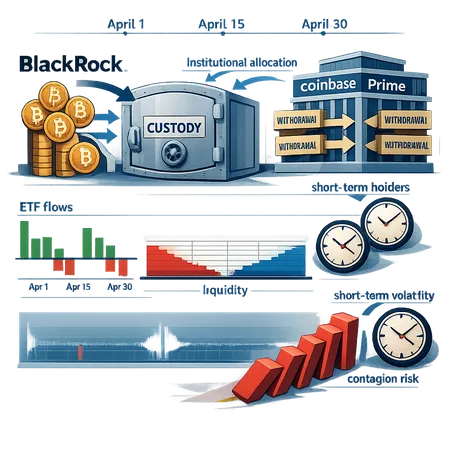

BlackRock’s recent withdrawals from Coinbase Prime during a short-term BTC dip exposed how large custodial moves, ETF flows and short-term holder behavior interact to shape liquidity and price risk. This piece unpacks the timeline, market-structure implications and actionable scenarios for asset managers and advanced traders.

Bitwise CIO Matt Hougan argues Bitcoin is more likely to produce steady, lower-volatility gains over the next decade than explosive, headline-grabbing rallies. This piece unpacks his assumptions, contrasts the super-cycle narrative, and lays out portfolio and trading guidance for allocators and wealth managers.