Why Harvard’s Move from IBIT to ETHA Signals a Broader Institutional Rotation

Summary

Harvard’s Q4 trade: what the filings actually show

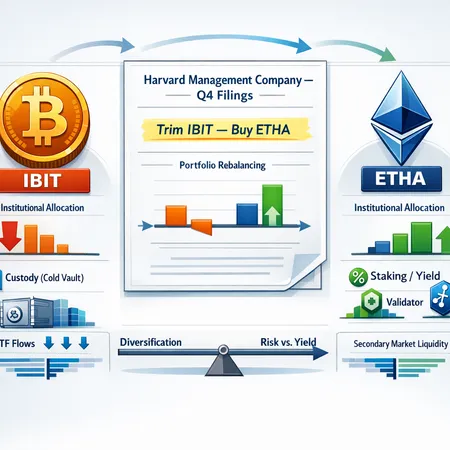

Harvard Management Company’s latest filings reveal two concrete moves: a reduction in IBIT exposure and a newly reported position in BlackRock’s iShares Ethereum Trust (ETHA). Reporting outlets summarized the filings and the headline number — an $86.8 million purchase of ETHA — which corroborates a reallocation away from a heavier Bitcoin ETF posture to include spot Ethereum exposure (Daily Hodl; Coincu).

The scale is meaningful for interpretation but not monstrous in absolute terms for markets; what matters more is the signal — a sophisticated, long-horizon allocator rebalancing away from a pure Bitcoin weighting into ETH exposure inside regulated ETF wrappers. Industry coverage has correctly framed this as part of a broader institutional rotation in which allocators reassess the relative roles of BTC and ETH in strategic portfolios (DailyCoin context).

What the rotation signals about institutional thesis shifts

Institutional allocators don’t trade on headlines; they rebalance around explicit theses. Harvard’s trim of IBIT and adoption of ETHA implies at least three overlapping shifts:

Risk-budgeting and diversification: Bitcoin long occupied the single-largest liquid crypto allocation for many endowments and family offices. Adding ETHA suggests a move to diversify protocol-level exposure rather than increasing concentration in a single asset. ETH often has different economic drivers than BTC (smart contract activity, DeFi/NFT demand), so a portfolio-level hedge or diversification benefit is plausible.

Yield optionality and cash flow expectations: While both are spot ETFs, Ethereum’s post-Merge economics and the potential for staking-derived yield (dependent on ETF manager policy and regulatory constraints) make ETH exposure more attractive to allocators thinking beyond pure price appreciation. Even if ETHA doesn’t enable staking internally, the narrative around ETH includes yield more so than BTC, and that narrative influences allocation decisions.

Tactical risk/reward and correlation views: Some institutions are betting that ETH offers a higher expected return or different drawdown profile relative to BTC over the next cycle. That view could be tactical (near-term macro and product-cycle catalysts) or structural (greater utility capture by ETH). Whatever the motive, Harvard’s trade signals an accepted view that adding ETHA complements a Bitcoin-heavy stance.

For many readers this looks like a recalibration of the classic BTC-versus-ETH debate: both assets coexist in modern institutional allocations, but weightings are being actively revisited.

How ETF mechanics and custody differences can drive reallocations

ETF wrappers look similar on paper, but subtle differences in custody, lending, staking potential, and regulatory stance alter the economics for big allocators.

Custody and counterparty exposure

Spot BTC ETFs like IBIT and spot ETH ETFs such as ETHA typically rely on large custodians to hold underlying assets. However, institutional allocators care about custodian choice, insurance levels, and segregation practices. Counterparty risk and operational resilience matter when positions scale to tens or hundreds of millions.

Securities lending and yield

Some ETF managers lend assets to generate incremental yield, which can change net returns and tax character. Institutions weigh the incremental yield against tracking risk and counterparty exposure. If an ETH ETF offers a clearer or more lucrative lending program (or the manager signals potential staking/derivative strategies), allocators may prefer ETHA for its net-yield profile.

Staking and protocol optionality

Ethereum’s protocol design post-Merge introduces a conceptual path to staking yield. Whether ETF managers enable staking (and how they share revenue) is an open operational and regulatory question. Even the option of staking economics exists in conversations, and that optionality can tilt demand toward ETH exposure. Importantly, managers have been conservative about staking within ETFs due to regulatory clarity — institutions must model scenarios where staking remains unavailable to ETF holders.

Liquidity and creation/redemption mechanics

Creation/redemption mechanics determine how ETF shares convert to underlying spot and vice versa. During stress periods, these mechanics affect tracking error, spread, and secondary market liquidity. For large allocators executing rebalances, predictable creation/redemption and deep AP (authorized participant) networks matter. If ETHA’s AP ecosystem or custodian network looks more robust or cost-effective for large blocks, reallocations will follow.

Market impact: ETF flows, secondary liquidity, and price implications

Harvard’s trade is small on a market scale, but if it reflects a broader tilt, the cumulative effect can be significant.

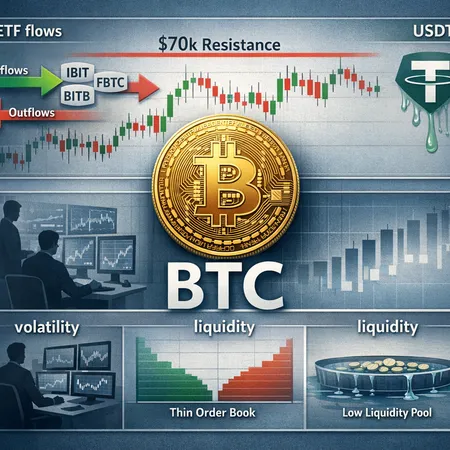

ETF flows will concentrate demand and supply dynamics. Net inflows into ETH ETFs raise spot ETH demand through creation baskets, tightening secondary market spreads and potentially generating positive price pressure. Conversely, outflows from BTC ETFs convert into secondary supply. The net across both markets matters for relative performance.

Secondary market liquidity and spreads. As institutional demand broadens to ETHA, secondary market spreads for ETH-related ETFs and futures might compress, improving execution for block trades. For Bitcoin products, trimming by large allocators can widen spreads temporarily, especially if sell-side block liquidity is limited.

Correlation and volatility regime shifts. A material rotation toward ETH could reduce the historical tight correlation between BTC and ETH at times, particularly if flows into ETH are driven by protocol-specific narratives (DeFi, infrastructure upgrades, staking optionality). That decoupling changes hedging and overlay strategies for allocators.

Market structure and arbitrage. More institutional presence in ETH ETFs enhances arbitrage efficiency between the ETF, spot, and derivatives markets, lowering tracking error over time. But during extreme volatility, creation/redemption frictions still risk wider divergences.

Practical takeaways for institutional and family-office allocators

If you’re managing a multi-million-dollar allocation, Harvard’s move offers operational and strategic lessons:

Treat ETF rotations as portfolio decisions, not ticker trades. Evaluate how adding ETHA affects overall exposure to protocol risk, smart contract adoption, and macro cyclicality. Recalculate stress scenarios and correlation matrices rather than assuming one-for-one substitution.

Perform operational due diligence on ETF mechanics. Understand custody specifics, AP networks, securities-lending policies, and any manager statements about staking or income strategies. These details can materially change net returns and risks for sizeable positions.

Size moves to market capacity. Use OTC/prime-brokered block trades or phased execution to avoid market impact. Even ETFs that look liquid can suffer slippage on large orders; coordinate with sell-side desks and APs.

Manage tracking and rebalancing rules explicitly. If your policy uses calendar rebalances, tactical bands, or risk-parity overlays, define triggers that account for ETF-specific spreads and creation costs. Avoid mechanical rebalances that don’t consider ETF liquidity.

Tax and accounting considerations. ETF structures create different tax treatment than holding spot via custody or via futures. Confirm implications for realized/unrealized gains and reporting — this matters for endowments and family offices with unique tax profiles.

Keep an eye on narrative-driven flows. Institutional shifts often feed on themselves. If allocators broadly reinterpret ETH’s role (yield/utility vs. BTC’s store-of-value narrative), flows can amplify price moves and affect portfolio risk budgets.

And a practical note: allocators increasingly use ecosystem tools and platforms to manage execution and custody; firms evaluating crypto allocations should consider how infrastructure (including services like Bitlet.app) integrates with their operational workflows.

Conclusion

Harvard Management Company’s Q4 filing — trimming IBIT and taking a position in ETHA — is both a specific allocation decision and a useful case study in how institutions are rethinking crypto exposures inside regulated vehicles. The move underscores three themes: a search for diversification and yield optionality, a focus on ETF operational details (custody, lending, staking potential), and the need to manage market-impact risk when reallocating sizable positions.

For institutional allocators and sophisticated investors, the actionable implication is clear: treat ETF-based crypto rebalances as multi-dimensional decisions that combine portfolio strategy, execution planning, and operational due diligence. If more large allocators follow suit, expect evolving ETF flows, tighter arbitrage in ETH markets, and a more nuanced landscape for balancing BTC and ETH exposures.

Sources

- Harvard adds ETHA and trims IBIT coverage: Harvard endowment slashes Bitcoin investment, buys $86.8M worth of Ethereum ETF shares

- Detail on IBIT trimming and ETHA position: Coincu reporting on Harvard filing

- Context on institutional reallocation and implications: DailyCoin analysis of Harvard endowment reallocation