Are Bitcoin Markets Pricing a 'Quantum Discount'? ETF Outflows, On‑Chain Supply and Risk Premiums

Summary

Executive overview

The last month brought a fresh reminder that narrative risk matters as much as fundamentals. Over a recent four‑week window crypto funds recorded meaningful outflows while Bitcoin grappled with volatile action; that flow backdrop is one reason some market participants are asking whether investors are beginning to price a quantum discount — an enduring valuation haircut reflecting long‑term cryptographic risk. This piece walks through the evidence (ETF flows, on‑chain supply assumptions), the intellectual case from Willy Woo and others, how miners and hodlers interact with these signals, and what systematic investors should do if a quantum risk premium is being embedded.

For many traders, Bitcoin remains the primary market bellwether, but the valuation now depends not only on short‑term demand and issuance but also on how the market treats rare, high‑impact structural risks like quantum cryptography.

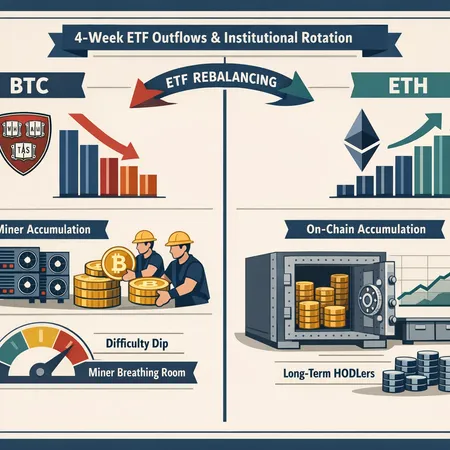

ETF outflows and the institutional demand signal

In the simplest macro view, ETF flows act as a base‑rate for institutional marginal demand. A recent Cointelegraph report documented roughly $173 million of net outflows over a four‑week stretch as BTC slipped below psychological levels — a clear short‑term sign that ETF buying was not providing the price floor it had in prior cycles (see the Cointelegraph flow analysis).

Why this matters for the quantum‑discount question: if institutional flows are the primary marginal buyer of last resort, persistent outflows or weak inflows lower the market’s tolerance for structural, long‑horizon risks. Institutional allocators are more likely to demand a higher long‑term discount rate (or a haircut) for an asset with a non‑zero probability of cryptographic obsolescence. In short: soft ETF demand increases the cost of carrying tail risk in portfolios.

Willy Woo’s quantum‑risk thesis in plain terms

Data‑driven analyst Willy Woo framed the discussion by arguing markets are starting to price ‘quantum risk’ — i.e., the possibility that advances in quantum computing could weaken public‑key cryptography and thereby make some previously unusable ("lost") coins effectively recoverable or vulnerable. His thread (covered by U.Today and Cointelegraph) reframes two core valuation inputs:

- The effective circulating supply: many valuation models assume a subset of BTC is permanently lost. If markets believe quantum advances could reverse that assumption (or change its probability), the expected effective supply increases.

- The discount applied to future cash‑flow equivalents: allocators may add a persistent risk premium to compensate for long‑tail cryptographic uncertainty.

Willy Woo’s point is not that quantum computers are imminent doom for Bitcoin today; it’s that even a small change in the market’s priors about recoverable supply or cryptographic vulnerability materially affects discounted expectations. See his thread for the argument and nuance (U.Today analysis and secondary coverage at Cointelegraph).

How on‑chain lost‑coins assumptions change valuation frameworks

Valuation for Bitcoin is rarely a pure discounted cash‑flow exercise, yet many models — stock‑to‑flow variants, realized cap adjustments, and per‑unit metrics — rely implicitly on effective supply rather than nominal supply. If S_total is nominal supply and S_lost is the market’s estimate of permanently inaccessible coins, then effective supply S_eff = S_total − S_lost.

A shift in the market’s belief toward a lower S_lost (i.e., the idea that some coins may be recoverable or reintroduced) increases S_eff and thus reduces per‑unit value all else equal. There are two channels:

- Supply shock channel — a perceived increase in long‑term available supply lowers scarcity premia used in valuation models.

- Risk premium channel — even if expected supply changes are small, investors may increase the long‑term discount rate to compensate for the non‑diversifiable, catastrophic nature of a quantum event.

Both channels are relevant. For example, if markets revise down S_lost by 2–5% on a probabilistic basis, models that rely on scarcity will adjust immediately; simultaneously, allocators may add a few hundred basis points to the long‑run discount rate for Bitcoin, which compresses present value further.

Miners, hodlers and difficulty dynamics: supply‑side buffers

On‑chain activity shows one counterweight to demand shocks: supply behavior from miners and long‑term holders. A recent report highlighted that during February’s slump miners and hodlers signaled accumulation even as price declined — an important stabilizer for circulating supply dynamics (CryptoPotato coverage).

Why miner and hodler behavior matters for the quantum discount debate:

- Miners: sustained accumulation (or reduced selling) tightens short‑to‑medium term effective supply, muting the immediate impact of any market‑implied increase in S_eff. Conversely, miner capitulation increases selling pressure and magnifies ETF outflow effects.

- Hodlers: long‑term wallets that do not transact defend realized supply measures; if hodlers continue to accumulate, the scarcity story remains intact despite an elevated long‑term discount for cryptographic risk.

Difficulty dips can temporarily reduce issuance pressure and indicate miner stress. But the market reaction to difficulty adjustments is nuanced: a difficulty drop often coincides with miner selling or re‑optimisation; yet, if miners use lower revenue periods to accumulate (instead of selling), that behaviour weakens the linkage between ETF flows and price declines.

Do ETF outflows + on‑chain signals equal a market‑priced quantum discount?

Put together, the evidence is mixed but plausible. ETF outflows are a short‑term negative for marginal demand; Willy Woo’s thesis provides a narrative that could rationally change effective supply priors; miner/hodler accumulation can offset supply increases but only up to a point. What a reasonable investor should do is treat the question probabilistically and run scenario analysis rather than assume binary outcomes.

Consider three simplified scenarios:

- Base case (market ignores quantum risk): institutional flows normalize, S_lost priors unchanged, no persistent quantum premium.

- Risk‑priced case (partial market discounting): markets raise the probability of recoverable coins and tack on a small persistent risk premium — the ‘quantum discount’ is modest but persistent.

- Tail case (market prices high probability of exploit/recovery within decades): large discount to valuation, deep re‑rating of long‑duration allocations.

ETF outflows increase the odds of the middle and tail cases in the short run because weaker marginal demand makes the market more sensitive to structural narratives.

Practical implications for risk management and allocation

If you accept that markets may be embedding a quantum discount (even partially), how should intermediate/advanced allocators respond? Here is a pragmatic framework.

Scenario‑weighted sizing. Rather than a single point estimate, use a probability‑weighted allocation. If you assign a small but non‑zero probability to a long‑term quantum event, reduce your base allocation by the expected loss from that tail — i.e., position_size = target_allocation × (1 − P_tail × severity).

Phased entry and rebalancing. Use dollar‑cost averaging or volatility‑targeted tranches. If ETF flows remain weak, stretch buys over longer windows and rebalance at predefined thresholds instead of averaging blindly.

Hedging via options. For large concentrated positions consider buying long‑dated put protection to limit left‑tail exposure. Options are expensive, so focus protection on the sizing that would materially impair your portfolio.

Prefer rolling‑probability adjustments to outright de‑risking. Monitor signals: sustained ETF outflows, widening of on‑chain realized supply estimates, and narrative momentum around post‑quantum vulnerability should increase your probability weight for a quantum discount when sizing.

Adjust for time horizon. Short‑dated traders care more about ETF flow and miner behavior; long‑dated allocators should explicitly model beliefs about technological timelines for quantum advantage. If you believe cryptographic breakthroughs are >20 years away, the practical impact on a typical multi‑decade allocation may be limited.

Tactical tilt toward mitigants. Allocate a small portion of capital to projects or instruments focused on post‑quantum crypto research or diversified crypto strategies that include assets with different threat profiles (while noting that most public‑key‑based assets share vulnerability).

Use on‑chain metrics as signal, not gospel. Watch realized supply, vintage analyses, miner outflows, and large whale movements. These on‑chain inputs are useful to update priors about S_lost and immediate selling pressure, but they cannot perfectly forecast long‑dated technological breakthroughs.

Concrete allocation examples (rules of thumb)

- Conservative allocator (low tolerance for cryptographic tail risk): cap direct BTC exposure at 1–3% of portfolio, use phased DCA across 6–12 months, allocate 0.5–1% to long‑dated put protection if cost‑effective.

- Balanced allocator (moderate tolerance): 3–8% BTC, tranche entries with volatility thresholds, monitor ETF flows and increase hedges if outflows persist beyond a month.

- Risk‑seeking allocator: 8–15% BTC, accept that a quantum discount might be priced in already; keep a buffer of liquid assets to buy dislocations in case of panic‑driven repricing.

These are rules of thumb for thinking about position size in the presence of a putative long‑run cryptographic premium; adjust for individual risk budgets and investment mandates.

Monitoring checklist: signals to watch

- ETF flows and fund‑level flows (weekly): persistent outflows increase the chance markets price a risk premium.

- On‑chain S_lost estimates and vintage analysis: any shift in the market’s estimate of lost coins should be treated as a material input.

- Miner supply and difficulty: track miner outflow ratios and whether miners are accumulating or selling into volatility.

- Narrative momentum: public discussion among allocators and the media (e.g., Willy Woo’s thread and subsequent coverage) can accelerate repricing.

- Progress on post‑quantum cryptography research and deployments: institutional adoption of quantum‑resistant standards would materially lower the tail probability.

Closing thoughts

Is the market already pricing a quantum discount? The honest answer is: partially, and unevenly. ETF outflows create a receptive environment for the quantum‑risk narrative, and if allocators update beliefs about lost coins and cryptographic timelines, you should expect some persistent haircut in market valuations. That said, miner accumulation and hodler behavior remain powerful stabilizers for effective supply in the medium term.

For professional allocators the right stance is not panic but probabilistic thinking: explicitly model the tail, size positions to the severity you’d tolerate, use hedges where appropriate and keep watching flows and on‑chain signals. Tools, exchanges and services (including solutions available on Bitlet.app for phased buys and P2P flexibility) can help implement these strategies without emotional timing.

Sources

- Cointelegraph — Crypto ETF four‑week outflows: https://cointelegraph.com/news/crypto-etf-4-week-outflows-173-million-btc-below-70k?utm_source=rss_feed&utm_medium=rss&utm_campaign=rss_partner_inbound

- U.Today — Willy Woo on Bitcoin's 'quantum discount': https://u.today/bitcoins-quantum-discount-why-willy-woo-says-btc-is-breaking-12-year-trend-against-gold?utm_source=snapi

- Cointelegraph — Willy Woo: quantum risk and lost coins: https://cointelegraph.com/news/willy-woo-bitcoin-quantum-risk-gold-lost-coins-post-quantum-upgrade?utm_source=rss_feed&utm_medium=rss&utm_campaign=rss_partner_inbound

- CryptoPotato — Miners and hodlers amid February slump: https://cryptopotato.com/bitcoin-slumps-in-february-yet-hodlers-and-miners-signal-support/