MarketStructure

A recent linked-wallet dump of PUMP tokens exposed how concentrated tokenomics and coordinated wallets create asymmetric exit risk. This article explains how to spot linked-wallet behavior, practical safeguards for traders and projects, and market lessons as capital rotates toward Bitcoin.

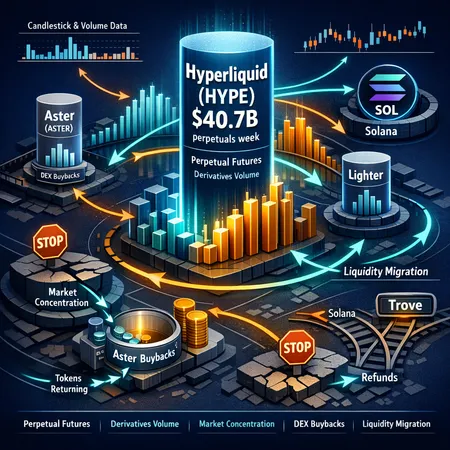

Hyperliquid posted roughly $40.7B in perpetual futures volume in a single week, exposing acute concentration and integration risks across crypto futures venues. Traders and analysts should reassess counterparty, liquidity migration, and treasury-response risks after the Aster buyback and Trove pivot episodes.

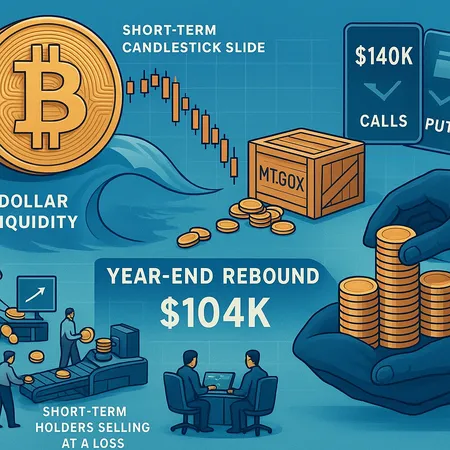

A liquidity-driven unwind, an options-market flip toward puts, and on-chain selling by short‑term holders — amplified by Mt. Gox outflows — point to a near-term slide for BTC before conditions set up a possible year‑end rebound toward $104K. Here’s how traders and institutions can position.

Canary Capital's filing to launch a memecoin ETF tied to MOG re-frames how retail flows can be channeled into highly speculative tokens. This explainer examines the filing, the near-term price response, the precedent it creates, and practical guardrails exchanges and issuers should adopt.

Explore the key points from the Senate Banking Committee's recent discussion draft on crypto market structure and what it means for investors and the future of digital assets.

Learn about the impact of new market structure legislation on crypto investing and discover how Bitlet.app's innovative Crypto Installment service can help you navigate these changes by allowing you to buy cryptocurrencies now and pay monthly.

The recent market structure legislation proposed by Senate Democrats aims to enhance investor protection while balancing the growth of crypto innovation. This blog post explores the potential effects of these regulations and how platforms like Bitlet.app can help investors navigate the evolving landscape.

Senator Cynthia Lummis is spearheading a bipartisan initiative to establish clear digital asset market structure legislation in 2025. This push aims to create a robust regulatory framework for cryptocurrencies, fostering innovation and investor protection. Platforms like Bitlet.app are set to benefit by providing users flexible options such as Crypto Installment services to buy digital assets conveniently.