Layer-2

Vitalik Buterin’s critique of “copy‑paste” Layer‑2 projects landed as reports surfaced of ETH sales and declining DeFi TVL — a moment to reappraise what real L2 differentiation should look like. This piece parses the signals and lays out concrete priorities for builders, investors, and protocol strategists.

Ethereum is seeing a sustained jump in active addresses even as ETH trades down. This article unpacks whether rising on-chain activity supports a near-term bull case or instead flags risk amid the layer-2 scaling debate.

Ethereum’s January 2026 breakout combined with record on‑chain activity has traders eyeing $3.6k–$4k. This piece synthesizes price momentum, technical indicators, and the medium‑term zk‑EVM roadmap to assess whether a durable re‑test is realistic.

zkSync Lite’s planned shutdown in 2026 signals a decisive consolidation toward zkSync Era and the Elastic Network. This analysis explains the technical and economic drivers, migration challenges, competitive effects, security implications, and a step-by-step migration checklist for PMs and developers.

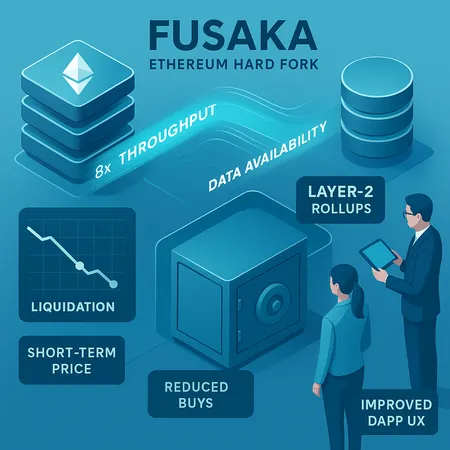

Fusaka delivers material data availability and throughput gains for Ethereum, but protocol upgrades alone rarely stop short‑term selling. Traders and protocol analysts need to separate technical improvements from real token demand.

A deep-dive into the Fusaka upgrade and emerging zero-knowledge privacy tooling, how they reshape Layer‑2 economics and builder incentives, and why recent ETH spot ETF outflows and falling open interest complicate the near‑term narrative.

RISEx and RISE Markets aim to become specialized foundations for global on‑chain markets by offering order‑book primitives and market infrastructure tuned for execution and settlement. Combined with rising ETH staking and whale accumulation, a purpose‑built L2 can shift liquidity dynamics, reduce sell pressure, and improve fees, execution and DeFi composability.

Layer-2 Ethereum solutions are poised to enhance scalability and reduce transaction costs, potentially sparking significant crypto price increases in 2025. Discover how these innovations can impact the market and how platforms like Bitlet.app make crypto investing more accessible with their Crypto Installment service.

Layer-2 solutions on Ethereum are key to improving scalability, reducing fees, and enhancing user experience. These advancements could ignite significant price surges in 2025. Platforms like Bitlet.app offer innovative crypto services to help investors capitalize on these trends.