Cardano's $70M Governance Reboot: What Voters Must Demand

Summary

Quick framing

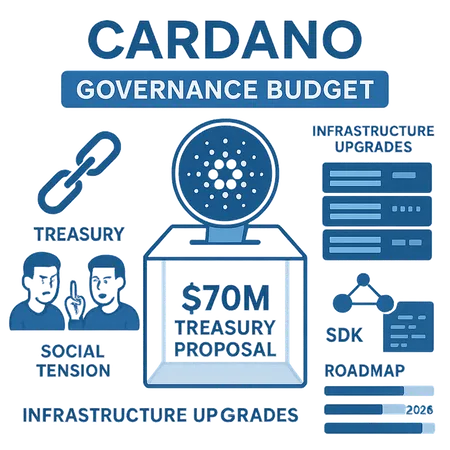

For many investors, Cardano has long been synonymous with methodical research-driven upgrades rather than headline-grabbing rallies. The recently proposed Cardano Critical Integrations Budget — often summarized in headlines as a 70M ADA governance proposal — is an explicit attempt to convert that methodical roadmap into funded action for 2026 infrastructure work. This article unpacks what the budget is, why it’s being proposed now, the political hurdles tied to the chain split and frustrated holders, the specific technical priorities and measurable milestones to demand, and governance best practices to rebuild trust.

What exactly is the Critical Integrations Budget and the 70M ADA proposal?

The package being debated is effectively a large treasury allocation designated to accelerate core infrastructure and integration work ahead of a planned 2026 overhaul. Coverage of the proposal frames it as a multi-year push to shore up tooling, SDKs, node performance, and cross-project integrations — not just one-off marketing money. Blockonomi explains how the proposal reframes longer-term upgrades into a funded program aimed at critical integrations, while reporting shows the proposal’s specific positioning for 2026 readiness Blockonomi.

BeInCrypto and other outlets report that the governance budget being discussed is in the ballpark of 70M ADA and that much of the narrative is recovery-oriented: an attempt to stabilize ecosystem confidence and rebuild momentum after recent governance turbulence BeInCrypto. Practically, the budget would pay developers, fund integrations with wallets and exchanges, support SDK development, and underwrite testing programs and audits.

How the treasury mechanics work matters: this is not a simple grant spend. Voters must understand tranche schedules, reporting cadence, and what deliverables trigger disbursement. Without those guardrails, large treasury allocations frequently become de facto operating budgets with weak accountability.

Why now: the chain split, political fallout, and rising social pressure

The request for significant funding doesn't come in a vacuum. Cardano recently experienced a chain split and accompanying community fragmentation that left many long-term ADA holders frustrated. That social risk — documented by outlets chronicling holder impatience and vocal disappointment — colors how any major governance ask will be perceived and voted on Coinpedia.

A few political realities to keep in mind:

- Visibility of past failures: Voters remember missed timelines and underdelivered roadmaps. That memory amplifies skepticism for large asks.

- Governance fatigue: High-frequency proposals with fuzzy KPIs reduce turnout among serious stakeholders and increase the influence of concentrated voting blocs.

- Split risk: Any perception that funds will entrench particular teams or fork-preferred directions can amplify factionalism and even invite further splits.

Given that context, the proposal faces two linked hurdles: technical credibility (can teams deliver?) and social legitimacy (do voters trust them to spend treasury funds wisely?). Both must be addressed in parallel.

What technical priorities should the budget target — and what are measurable milestones?

The broad aims in the Critical Integrations Budget are reasonable: get the platform ready for the next major epoch by fixing tooling gaps, improving performance, and expanding integrations. But "reasonable" needs to translate into measurable, time-bound milestones. Below are prioritized areas and concrete KPIs voters should insist on.

Priority areas

- SDK and developer tooling: production-ready SDKs for major languages, official client libraries, improved documentation, sample apps, and developer onboarding flows. Metric: active SDK downloads, successful third-party dApp builds, and number of unique developer wallets using SDKs.

- Node and consensus performance: lower latency, faster block propagation, and measurable TPS/confirmation improvements under realistic loads. Metric: average block propagation time, median confirmation latency, and stable TPS under stress tests.

- Integration and interoperability: integrations with major wallets, exchanges, indexers, and cross-chain bridges. Metric: number of certified integrations (wallets/exchanges) and successful on-chain transfers via integrations in a staging window.

- Indexers, explorers, and tooling resilience: reliable data availability for analytics and DeFi stacks. Metric: indexer uptime % and query latency.

- Security and audits: third-party audits of critical components and a public bug bounty cadence. Metric: completed audits, time-to-fix for high/critical findings, and bug bounty payout/ticket closure metrics.

Suggested measurable milestones (example tranche triggers)

- Tranche 1 (15–25%): Delivery of SDK alpha releases, two independent third-party audits commissioned, and public roadmap with timelines and KPIs.

- Tranche 2 (25–35%): Production SDKs with >100 integrated dApps using SDKs in testnet, at least three major wallet integrations certified, and performance benchmarks demonstrating X% improvement in latency/TPS.

- Tranche 3 (30–40%): Mainnet-ready client updates deployed with rollback plans, indexer reliability at >99% uptime over 60 days, and security audit remediation verified by independent auditors.

- Final tranche (remainder): Verified ecosystem metrics (developer growth, integration count, on-chain activity) meet pre-agreed thresholds and a public post-mortem with financial reconciliation.

These are illustrative; the key point is that voters should only approve a large governance budget if milestones are clear, measurable, and independently verifiable.

Scenarios for recovery versus continued stagnation — and the metrics that decide which path wins

Two broad scenarios will likely play out depending on execution and community oversight.

Scenario A — Recovery and renewed momentum

What success looks like:

- SDK adoption crosses a meaningful threshold: dozens of quality projects shipping and >X monthly active developer users.

- Integrations: several top-10 exchanges and most popular wallets show certified support; indexers and explorers report high reliability.

- Performance: measurable reductions in confirmation latency and policies prove resilient under load.

- Social signal: holder sentiment improves (measured via governance turnout, positive sentiment on developer forums, and reduced sell pressure).

If these conditions are met within agreed timelines, the 70M ADA could be seen as catalytic funding that accelerates Cardano's infrastructure and ecosystem participation.

Scenario B — Stagnation and trust erosion

Warning signs to watch for:

- Money flows without milestone-based releases or third-party verification.

- Little to no growth in developer activity or on-chain integrations despite significant treasury burn.

- Reappearance of fragmentation or new governance fights because disbursements appear politically motivated.

If that happens, the treasury spend will likely deepen divides and accelerate capital flight rather than reversing it.

Metrics voters should demand (short checklist)

- SDK adoption: number of active developers and integrated projects on testnet/mainnet.

- Integrations: count of certified wallets/exchanges and live integrations.

- Performance: TPS, median confirmation latency, and indexer uptime.

- Security: completed audits and time-to-resolution for critical issues.

- Governance health: voter turnout %, proposal approval timelines, and community sentiment indices.

These metrics map directly to utility: real developer activity and seamless integrations drive real economic value, which stabilizes ADA price and rebuilds confidence.

Governance and communication best practices Cardano teams should adopt to rebuild trust

Trust is rebuilt through predictable processes, transparent data, and accessible communication. Here are recommended practices for teams asking for large treasury allocations:

- Tranche-based disbursements tied to independent KPIs: never approve a lump sum without verifiable milestone triggers and an independent verification mechanism.

- Independent audits and external verifiers: use reputable auditors and publish full findings publicly. If auditors flag issues, there must be clear remediation timelines and consequences.

- Public, machine-readable dashboards: a live dashboard showing KPI progress (SDK installs, integration counts, uptime, audit status) reduces ambiguity.

- Clear communication cadence: monthly technical reports, quarterly financials, and open AMAs where engineers—not just PR—answer technical questions.

- Community oversight committees: a rotating, representative committee with veto or review authority over tranche releases helps balance large stakeholders and retail voters.

- Post-mortems and financial reconciliation: at project completion, publish a full post-mortem with line-item financial accounting and lessons learned.

- Contingency plans for political risk: include dispute-resolution mechanisms and a defined process if parts of the ecosystem prefer alternative upgrade paths to avoid further splits.

Platforms and services in the ecosystem — including on-ramps and exchanges like Bitlet.app — will watch these governance practices closely when deciding how to integrate or list new features, so transparent progress matters for real-world adoption.

Recommended vote structure (practical example)

- Approve the existence of the 70M ADA fund but link each tranche to a ballot that requires an independent verification report.

- Require 2/3 majority for releasing each tranche only if KPIs are met; otherwise funds revert to a holding account with a community-administered remediation program.

- Use time-limited mandates: if teams do not meet core milestones within defined windows, remaining funds are reallocated via new proposals.

Conclusion: how DAO strategists and voters should approach the decision

The Critical Integrations Budget and the 70M ADA ask can be catalytic — but only if governance voters treat it like an investment with deliverables, not a discretionary grant. Demand tranche-based releases, independent verification, clearly defined technical KPIs (SDK adoption, integrations, performance), and continuous public reporting. If teams can commit to those guardrails, this budget could accelerate Cardano’s 2026 upgrade readiness. If they cannot, approving a large lump-sum spend risks deepening mistrust and prolonging stagnation.

For DAO strategists, the choice is procedural as much as technical: design the vote to minimize moral hazard and maximize verifiability. For ADA holders, insist on transparency and measurable outcomes before endorsing a governance reboot.

Sources

- Blockonomi — Cardano Critical Integrations Budget proposal and 2026 aims: https://blockonomi.com/cardano-critical-integrations-budget-proposal-sets-stage-for-2026-overhaul/

- BeInCrypto — Coverage of the 70M ADA governance budget and chain-split recovery framing: https://beincrypto.com/cardano-70-million-budget-chain-split-recovery/

- Coinpedia — Reporting on long-term holder frustration and social risk: https://coinpedia.org/news/cardano-holders-are-losing-patience-as-ada-sinks-toward-the-top-10-edge-can-it-recover/