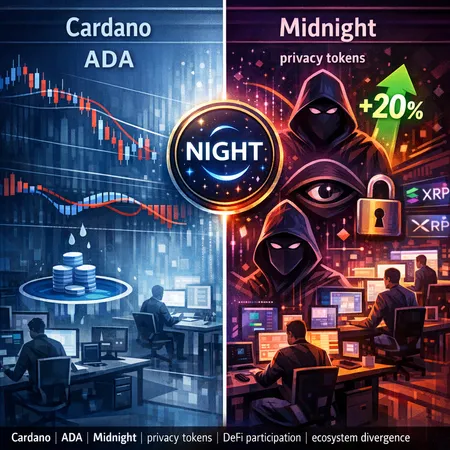

Cardano’s Bifurcated Moment: ADA’s Bearish Technicals vs. Midnight’s Privacy-Fueled Rally

Summary

A split narrative: why Cardano feels both stale and suddenly interesting

Cardano is living through a bifurcated moment. On one side you have ADA — the chain’s native token and the obvious market gauge — showing technical cracks and sliding share in decentralized finance. On the other, you have emergent projects, led by privacy‑focused applications, that are drawing active speculation and developer attention. That disconnect matters because it reveals where capital and talent are moving: toward differentiated product narratives rather than broad platform optimism.

For many investors tracking platform health, Cardano is no longer a single thesis. It’s two competing stories — conservative, research‑driven layer‑one ambitions versus nimble, narrative‑led app layer experiments — and the market is pricing them differently.

ADA’s technical setup: MACD crossover, downside targets and market psychology

Technicals have the near‑term narrative. Several analysts flagged a bearish MACD crossover for ADA this month, a classic momentum signal that often precedes extended pullbacks in highly correlated crypto markets. CryptoPotato summarized the development and highlighted a potential downside toward roughly $0.23 as traders hunt for the next significant support band. That level isn’t a magic floor; it’s a reference point informed by recent trading ranges and on‑chain liquidity pockets.

A bearish MACD doesn’t guarantee capitulation, but combined with weaker DeFi TVL and dwindling new‑project launches, the signal heightens the risk profile. Market-makers are less inclined to provide deep liquidity when momentum turns; retail holders can become sellers, and derivatives desks tighten funding. In short: the technicals create an environment where narrative‑driven rallies (like those for privacy tokens) can coexist with general downward pressure on ADA.

How price risk feeds into behavior

When ADA looks vulnerable, protocol teams feel it in several ways: slower treasury inflows, lower staking additions, and reduced capital for incubating new DeFi primitives. That forces projects to either chase short‑term token narrative plays or wait for clearer market conditions — and many opt for the former. This dynamic helps explain why pockets of activity appear on the margins (privacy tokens, NFTs) even as core DeFi momentum softens.

Midnight (NIGHT): technical drivers and the privacy narrative behind the ~20% pop

Midnight (NIGHT) recently surged by roughly 20%, a move largely tied to renewed investor focus on privacy as an architectural differentiator. Coverage of the spike pointed to mounting hype around privacy tokens on Cardano and the perception that Midnight offers something distinct: privacy tooling built specifically for Cardano’s eUTxO model. U.Today reported on that ~20% jump, attributing it to the broader narrative tailwind for privacy projects and short‑term rotation of speculative capital.

Price moves of this size are often a cocktail of low liquidity, concentrated holdings, and narrative headlines. For NIGHT, the catalyst mix included: social media amplification, concrete roadmap updates from the team, and a market environment where some traders seek asymmetric bets off the beaten path. The move doesn’t yet prove product‑market fit, but it does show how narrative + scarcity + on‑chain novelty can generate outsized short‑term returns.

Technical posture behind NIGHT’s run

From a purely technical perspective, NIGHT’s breakout followed a brief consolidation on low volume — a typical setup for an outsized percentage move in smaller market caps. Momentum traders and liquidity takers amplified the breakout, but beware: such rallies frequently retrace if the underlying protocol activity (user growth, integrations, DEX listings) doesn’t follow through. That’s the difference between a speculative squeeze and sustainable demand.

Developer and DeFi engagement: Cardano versus Solana and XRP ecosystems

A core reason Cardano’s macro narrative feels split is developer dynamics. Multiple industry observers have documented that Cardano’s DeFi share has slipped relative to faster‑moving competitors. Commentators have contrasted Cardano’s cautious, peer‑reviewed rollout model with Solana’s rapid iteration and, in other contexts, growing activity around XRP‑centered projects. Coverage in Bitcoinist discussed how Cardano’s DeFi relevance has waned compared with Solana and XRP, citing the shift in active deployments and attention.

This isn’t just about transaction throughput. Developer engagement is influenced by tooling, onboarding friction, available SDKs, and economic incentives. Solana’s developer experience — despite network outages and spam concerns — has been rewarded with many consumer‑facing DeFi and Web3 apps. XRP‑adjacent projects benefit from concentrated liquidity areas and enterprise narratives. Cardano’s selection of formal upgrade processes and Haskell‑centric tooling appeals to certain teams but raises the ramp for rapid experimentation.

Metrics that matter

Watch these signals to judge whether Cardano’s divergence is structural or temporary:

- Active developers and GitHub activity per month.

- New smart contracts and deployed dApps interacting with liquidity pools.

- TVL and composability metrics within DeFi primitives on Cardano.

- Token distribution and on‑chain concentration for projects like NIGHT.

If developer activity and composability tighten, Cardano risks becoming a platform of isolated successes rather than an interoperable DeFi hub. Conversely, if privacy projects pull more devs and integrations, Cardano could carve a niche where privacy‑aware applications attract a stable user base.

Possible outcomes for Cardano’s on‑chain economy

There are a few plausible scenarios over the next 6–18 months. Each has distinct implications for ADA holders, project teams, and investors.

Scenario A — Recomposition toward differentiated niches: Cardano doesn’t regain a broad DeFi crown but becomes the leading home for privacy tokens, identity primitives, and high‑assurance financial rails. Projects like Midnight scale meaningfully, attracting steady liquidity and developers who prefer Cardano’s formal guarantees. ADA’s price may remain rangebound but benefits from selective utility around staking and treasury governance.

Scenario B — Re‑acceleration and composability revival: A wave of tooling improvements, cross‑chain bridges, and incentive programs reignite developer interest. TVL and DeFi participation recover, ADA regains momentum, and isolated rallies (like NIGHT) fold into a larger ecosystem expansion. This outcome requires targeted developer incentives and faster iteration without sacrificing security.

Scenario C — Narrative fragmentation and short‑termism: Speculative rotations continue — privacy tokens and NFTs pump while core DeFi languishes. The ecosystem fragments into a handful of tokenized narratives without deep, composable markets. ADA suffers from weaker macro correlations and could be vulnerable to deeper technical selloffs if liquidity drains further.

How to watch the transition

For investors and protocol strategists tracking Cardano’s health, prioritize on‑chain and off‑chain signals rather than price alone: treasury deployments, new integrations with cross‑chain routers, developer grants issuance, and the pace of meaningful dApp launches. Tools and platforms like Bitlet.app provide a window into liquidity flows and peer activity; combine that with repository analytics and TVL tracking.

Takeaway: divergence is not destiny — but it’s a warning

Cardano’s current bifurcation — ADA’s bearish technicals and slumping DeFi share against the backdrop of privacy‑driven rallies for tokens like NIGHT — signals a market reallocation of capital and attention. That reallocation can create opportunity, but it can also mask deeper fractures in composability and developer momentum. For strategic actors, the priority is clear: either lean into a differentiated niche with conviction (privacy, identity) or accelerate the infrastructural work that restores broad DeFi composability.

If you’re positioning around this thesis, keep risk management tight. Narrative rallies are useful market signals, but sustainable ecosystem health is measured in repeatable user flows, developer engagement, and capital depth — not just headline percentage gains.