What Charles Hoskinson’s $3B Paper Loss Reveals About Founder Exposure and Treasury Risk

Summary

Introduction

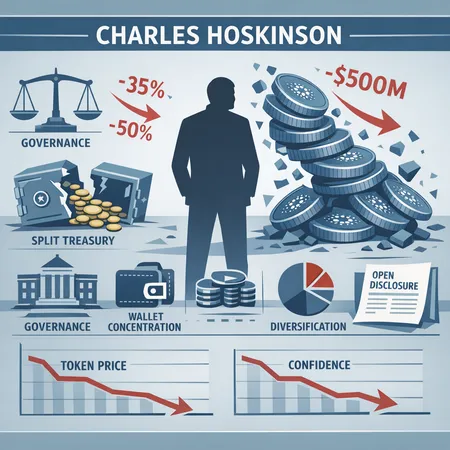

When a high-profile founder publicly states a multi-billion-dollar paper loss, the statement does more than narrate a personal balance sheet: it alters market perceptions, tests governance frameworks and forces token-holders to re-evaluate systemic risk. In late reporting Charles Hoskinson — the founder associated with Cardano and ADA — disclosed he’d lost over $3 billion in crypto value but said he declined to cash out. That revelation is a useful case study for governance researchers, token-holders and project executives assessing founder exposure, treasury policy and disclosure norms.

The facts as disclosed

Charles Hoskinson confirmed a massive unrealized loss in a public forum; he also stated he did not liquidate those holdings. This account was reported directly by The Block, which documents Hoskinson saying he’s lost more than $3 billion but declined to cash out. The distinction between realized and unrealized losses matters: an unrealized loss signals mark-to-market exposure but not necessarily a change in circulating supply. Still, the mere public acknowledgement changes the informational landscape for ADA holders and market participants.

Why founder balance-sheet concentration matters

A founder’s concentrated token holdings are both an asset and a liability. On one hand, large founder stakes can align incentives: founders have skin in the game. On the other, concentration amplifies several risks:

Market signalling and volatility: When a founder with a large paper loss states they won’t sell, markets receive ambiguous signals. Is the founder signalling confidence, or simply unable to find buyers without crashing the price? Either way, price discovery becomes noisier and risk premia rise.

Liquidity and price impact: Founder sell-offs — or credible threats of one — impose asymmetric downside. Even the possibility of future liquidation can compress bid-side liquidity and create steeper price declines on bad news.

Governance centralization: Large founder holdings translate directly into voting power in on-chain governance models unless countermeasures exist. That concentration can stifle genuine decentralization and pose conflicts of interest when treasury allocations or protocol changes affect personal balance sheets.

These dynamics are not theoretical. For many market participants, lessons from big-cap crypto like Bitcoin treasuries — and the headlines about corporate treasury losses — are fresh reminders that balance-sheet concentration can ripple through markets. The recent reporting showing major treasury holders going deeply underwater highlights how concentrated exposures strain institutions and can lead to stop-loss cascades when leverage is involved.

Market signalling and governance specifics for ADA/Cardano

Cardano’s design and the ADA market have unique contours: staking, delegation, and the role of the Cardano Foundation and IOHK in ecosystem development. When a public founder like Hoskinson discloses large personal losses, ADA delegators and voters ask legitimate questions: does the founder’s personal risk tolerance influence roadmap choices? Could personal liquidity needs translate into future token sales or governance pushes that advantage insiders?

Governance theory suggests several failure modes. A founder with concentrated holdings may resist proposals that dilute their economic upside, or conversely, push for monetization strategies that prematurely capture value at the expense of long-term protocol health. Without transparent constraints, markets price in an implicit risk premium for founder behavior.

Historical precedents and comparable episodes

There are multiple cases where founder or executive exposure materially affected markets and community trust:

Terraform Labs / Terra/Luna: The concentrated control and undisclosed leverage around the project’s treasury and stablecoin mechanics were central to the collapse. The founder’s actions and the opaque treasury interactions worsened contagion throughout the crypto space.

FTX / Sam Bankman-Fried: The commingling of user funds and centralized control over treasury-like assets demonstrated how executive actions can instantly destroy counterparty trust and market liquidity when discovered.

Executive sales and token unlocks: In several projects, material token unlocks or concentrated executive sell-offs have produced multi-week drawdowns, as market liquidity failed to absorb large blocks. These episodes prompted markets to demand clearer lockup schedules and public vesting disclosures.

Corporate / treasury losses: More broadly, reporting that major BTC treasury-holding companies went billions underwater shows how even ostensibly diversified institutional treasuries are vulnerable when valuations fall rapidly. CryptoSlate’s reporting on firms bracing for massive drawdowns illustrates the wider market context in which founder disclosures occur.

Each precedent emphasizes a common thread: lack of transparency and concentrated control increases tail risk for token-holders and counterparties.

Recommended disclosure and treasury diversification policies

For governance researchers and project executives building robust frameworks, the objective is to reduce informational asymmetry and align incentives while preserving founder motivation. Below are practical, implementable policies:

Public, periodic disclosure of sizable personal holdings tied to the project. Frequency and granularity (e.g., quarterly filings with ranges or on-chain addresses) should be standardized so markets can model potential sell-side pressure.

Clear vesting and lockup schedules for founders and early team allocations. These schedules should be on-chain where possible and enforced via multisig or time-lock contracts.

Multi-signature, committee-based treasury management. Move from single-executive custody to a committee with independent members and rotating seats, with published decision rules.

Formal treasury diversification policy. Define acceptable asset classes, concentration limits, and hedging strategies (e.g., stablecoins, revenue-generating assets, hedges using financial instruments). Regular reporting on diversification should be mandatory.

Pre-committed sale limits and execution rules. If founders may need to realize value, establish market-aware execution protocols (volume caps, algorithmic VWAP execution, public notices) to reduce market-impact risk.

Independent audits and attestation. Regular third-party audits of treasury holdings and proof-of-reserves help rebuild trust after shocks.

On-chain governance proposals for material changes. Major reallocations of treasury assets, or founder personal sales beyond predefined thresholds, should require explicit governance approval from token-holders.

Emergency escalation playbook. Define triggers (e.g., catastrophic price moves, regulatory seizure) and response steps agreed in advance by governance to avoid ad-hoc decisions.

These policies are complementary: transparency without enforcement is weak; enforcement without transparency risks community backlash. The goal is to create verifiable, predictable rules that reduce speculation about founder behavior.

Practical checklist for ADA holders and governance participants

If you hold ADA or participate in Cardano governance, consider this checklist to assess founder-exposure risk:

- Demand published on-chain addresses or attestations for founder holdings, even if broken into sub-addresses to avoid single-point price impact.

- Review the public vesting schedule for founder allocations and ask for timeline certainty.

- Push for multisig treasury controls and an independent treasury committee with rotating members.

- Watch for pre-commitment mechanisms for founder sales and insist that large moves pass governance votes.

- Delegate to stake pools with transparent governance stances and participate in governance forums—silence is itself a signal.

Platforms that facilitate staking and peer-to-peer exchange — including services like Bitlet.app — may see heightened user scrutiny and should incorporate these governance expectations into their custody and reporting practices.

What this means for Cardano specifically

For ADA holders, Hoskinson’s disclosure is not an immediate operational threat if the holdings remain unrealized, but it is a reputational and governance stress-test. Cardano’s community-run governance can react by codifying clearer treasury and founder rules; doing so would reduce the risk premium the market charges and strengthen decentralization claims. Governance researchers should watch whether the community moves toward mandatory disclosure policies, multi-sig treasuries, or transferable escrow mechanisms.

If the community fails to act, markets will increasingly price founder concentration as a persistent risk factor, which could raise capital costs for future development funding and complicate ecosystem growth.

Conclusion

Founders inevitably carry a dual role: visionary builders and large token-holders. When a founder like Charles Hoskinson openly acknowledges a multibillion-dollar paper loss, it creates an urgent, practical conversation about disclosure, treasury diversification and governance safeguards. The solution isn’t to demonize concentrated holdings — which can align incentives — but to manage them transparently and institutionally so that individual financial fortunes don’t become systemic vulnerabilities.