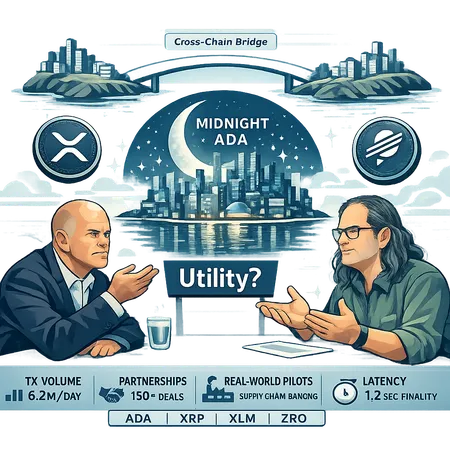

Do ADA and XRP Still Need to ‘Prove Utility’? A Contrarian Take on Novogratz, Midnight, and Cross‑Chain Reality

Summary

Why the cry of “prove utility” matters now

The market’s mood has shifted. After multiple cycles of hype, token communities are no longer content with optimism alone; investors and counterparties want demonstrable outcomes. That demand—summarized in phrases like XRP utility or on‑chain utility—is blunt and sometimes unfair. Projects that grew on narrative and loyal fandom must now translate sentiment into measurable flows, integrations and revenue.

This pressure played out publicly when veteran investor Mike Novogratz voiced skepticism about both ADA and XRP, questioning whether either can prove consistent utility beyond dedicated user bases. His comments forced a debate that is less about insults and more about standards: what counts as utility when cross‑chain tools make many previous “unique” features fungible?

The Novogratz critique — substance over spin

Mike Novogratz’s critique is straightforward: as capital flows concentrate into projects that demonstrate recurrent usage, tokens that rely primarily on community enthusiasm face re‑rating risk. In plain terms, a blockchain isn’t safe merely because its community is large or vocal. Novogratz argued that ADA and XRP need clearer, repeatable economic use cases if they want institutional mindshare and real liquidity to grow sustainably (Novogratz doubts XRP and Cardano relevance).

That critique lands hardest when you compare narrative claims to measurable activity. Saying a token will power payments, remittance or identity is one thing; showing persistent payment rails, integrations with banks, or real settlement flows is another. For strategists, the takeaway is blunt: narrative must be paired with verifiable KPIs.

Ripple CTO David Schwartz’s reaction to Cardano Midnight

When Cardano unveiled Midnight—a sibling product aiming at privacy‑friendly, account‑based smart contracts—the conversation touched Ripple’s space as well. Ripple CTO David Schwartz responded in measured terms, highlighting technical differences and emphasizing that plurality of approaches is healthy for the ecosystem (Ripple CTO finally reacts to Midnight).

Schwartz’s posture is worth noting: rather than dismissing Midnight outright, he focused on comparative capabilities and realistic expectations. That reaction embodies a constructive line for project communicators: contrast, don’t caricature. When new entrants claim utility, the best responses are factual, technical, and oriented toward outcomes — not just loud rebuttals.

Cross‑chain interoperability is rewriting the utility playbook

One of the biggest reasons the ‘prove utility’ debate intensifies now is interoperability. Projects no longer need to be end‑to‑end monopolists to show value. Bridges, messaging protocols and cross‑chain primitives allow assets and services to compose across ecosystems, changing where and how utility is captured.

A concrete example: Stellar’s partnership with LayerZero. That deal illustrates how a payments‑oriented ledger (XLM) can plug into a universal messaging and transfer layer to reach liquidity elsewhere, creating new measurable flows and use cases (Stellar partners with LayerZero).

LayerZero’s architecture—and its token ZRO as a governance/utility layer—lowers the technical bar for projects to interoperate. Suddenly, the argument “we’re unique because of X” has less force: uniqueness can be achieved via composability rather than monopoly. That’s a double‑edged sword: interoperability increases potential utility but also raises the bar for projects to differentiate in ways that survive cross‑chain abstraction.

What this means for ADA, XRP and others

- ADA: Cardano’s roadmap (including Midnight) emphasizes modularity and privacy primitives. Cross‑chain rails can let Cardano‑based apps reach liquidity and services off‑chain faster than before — if developer tooling and bridges are reliable.

- XRP: Ripple’s payments focus historically hinged on On‑Demand Liquidity (ODL). Interoperability can expand ODL’s reach, but it also exposes XRP to competition from bridged liquidity and stablecoin rails.

- XLM: Stellar’s pragmatic pairing with LayerZero is an example of pursuing utility via partnership rather than attempting to vertically integrate every use case.

All three outcomes show the same trend: utility increasingly looks like collaboration plus measurable flows, not isolated protocol superiority.

Practical metrics to judge “utility” beyond fandom

For strategists and project communicators, rhetoric should be replaced by empirics. Below is a pragmatic framework you can use when assessing claims of utility:

- On‑chain transaction volume (value and count), normalized for transfer batching and wash trades; look for sustained trends, not spikes.

- Real settlement use cases: number and quality of counter‑parties (e.g., exchanges, remittance firms, custodians) using the token for settlement or liquidity.

- Bridge throughput and cross‑chain message volume: how much value moves via LayerZero‑style primitives (ZRO denominated activity when relevant).

- Revenue capture: fees, staking yields, settlement fees, and other protocol revenue streams that actually accrue to the ecosystem or token holders.

- Developer activity and deployments: active repositories, releases, grant programs, and verifiable mainnet dApps (not just testnet demos).

- Custody and institutional readiness: presence of regulated custodians, AML/KYC integrations, and compliance tooling.

- Token velocity and economic sinks: are tokens being burned, locked, or used as productive collateral, or are they merely circulating without economic sink?

- Third‑party integrations and partnerships: real integrations (banks, PSPs, merchant adoption) versus marketing commitments.

These metrics favor objectivity. A good communications strategy highlights a few leading indicators and publishes them regularly. Bitlet.app’s suite of products shows how measurable outcomes (transactions processed, liquidity moved) can be more persuasive than rallying cries.

How projects should reposition their messaging

A contrarian but practical communications approach:

- Publish the KPIs you think prove utility and commit to a cadence for reporting them.

- Demonstrate cross‑chain compatibility with verifiable flows (on‑chain TX IDs, partner attestations, relayer metrics).

- Emphasize composability: show how your protocol adds unique value when combined with others (not just how it replaces them).

- Avoid binary claims of superiority; show comparative advantages backed by data (latency, cost, settlement finality, privacy guarantees).

- Invest in developer SDKs and bridge reliability; real utility lives in predictable developer experiences.

This posture addresses the Novogratz critique without getting defensive: if you claim utility, make it visible, measurable and repeatable.

Conclusion — utility is being redefined, not revoked

Novogratz’s skepticism is a useful reminder: markets reward repeatable outcomes more than narratives. David Schwartz’s measured public response to Cardano’s Midnight shows the debate can be technical and constructive rather than purely adversarial. Meanwhile, cross‑chain interoperability—exemplified by LayerZero partnerships with networks like Stellar—means utility is increasingly realized via collaboration and measurable flows.

For strategists and communicators, the assignment is clear. Replace slogans with metrics. Use interoperability as an amplifier, not an excuse. And when you claim the token has utility, publish the data that proves it.

For those tracking these shifts, keep an eye on cross‑chain throughput, counterparty adoption, and revenue capture: those are the signals that separate fandom from sustainable utility. And yes, where appropriate, look at how DeFi primitives and even Bitcoin narratives interact with these metrics — the broader market’s behavior still matters.

Sources