Why Institutions Pushed Ethereum Toward $4,000 in December 2025 — Drivers, On‑Chain Signals, and Allocation Playbook

Summary

Introduction: why December’s ETH move matters

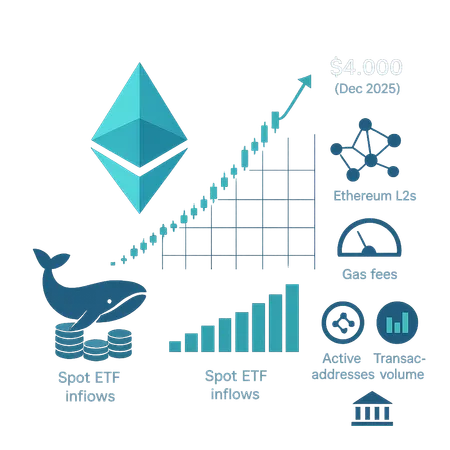

December 2025 felt different. Ethereum’s push toward $4,000 wasn’t just another meme‑driven squeeze; market structure was shifting. Institutional inflows, visible whale accumulation, and a softer macro narrative combined with improving on‑chain health and lower Layer‑2 fees to create a more coherent bullish case.

For many traders, Bitcoin remains the primary bellwether, but the rotation into ETH this cycle signals institutions are broadening crypto allocations beyond BTC. The practical question for intermediate and advanced investors: is this rally sustainable, and how should one size ETH exposure over the next 6–12 months?

This article walks through the drivers, the on‑chain evidence, technical upside targets and credible risk scenarios, then concludes with an actionable allocation playbook for both institutional and retail allocators. Expect nuance, tradeable ideas, and where Bitlet.app and modern custody solutions fit into execution choices.

What drove ETH toward $4,000?

Three pillars explain the December move: concentrated whale accumulation, renewed spot ETF inflows and a macro tailwind around Fed easing expectations. Each contributed differently to price, liquidity and volatility.

1) Whale accumulation and concentrated buying

On‑chain trackers showed sizable deposits into exchange cold storage—or into institutional custody vehicles—consistent with concentrated buying rather than diffuse retail FOMO. Large addresses increased net ETH holdings in the weeks leading to the breakout, while exchange balances trended lower, a classic sign of accumulation and reduced sell pressure.

Concentrated accumulation matters because it changes how liquidity responds to order flow. When a few large players control more of the supply, they can support price through stable bids or through OTC fills rather than exchange market orders, which reduces short‑term volatility from forced liquidations.

2) Spot ETF inflows and institutional product adoption

December’s ETF narrative was a clear catalyst. Spot ETF inflows created predictable, recurring demand that required sourcing large amounts of ETH. The currency analytics coverage that month highlighted institutional interest and inflows as a primary push toward the $4,000 level, underscoring that demand wasn’t merely speculative but product‑led (Currency Analytics).

Spot ETFs change market mechanics: they channel fiduciary capital, induce buying outside of crypto native venues, and often require custodial relationships and compliance checks that bring institutions into on‑chain custody paths. That structural demand tends to be more persistent than retail buying, though it’s not immune to redemptions.

3) Macro and the Fed: a window for risk assets

The Fed‑rate narrative shifted toward easing expectations late in 2025. Even the hint of a rate pivot reduces the opportunity cost of holding non‑yielding assets like ETH. As The Block and other commentators linked macro indicators with the idea of a broader “ETH supercycle,” lower rates and improved liquidity conditions gave institutions greater comfort to increase crypto allocations (The Block).

Macro matters because it affects leverage, repo conditions and the comparative attractiveness of risk assets. Combined with ETF product flows, it created the perfect environment for larger, more durable allocation shifts into Ethereum.

On‑chain metrics and falling L2 fees: signs of sustainable demand

Not all rallies are equal. The difference here: several on‑chain indicators pointed toward healthier market structure.

L2 adoption and fees falling to multi‑year lows

A key part of the sustainability thesis is that transaction costs — especially on Layer‑2s — have fallen, enabling higher utility without fee friction. CryptoSlate reported Ethereum fees hitting a 7‑year low, a stat that underpins the L2‑led adoption thesis and suggests network usability is improving even as price rises (CryptoSlate).

Lower fees on Ethereum L2s reduce one of the main barriers for both retail and institutional usage (smaller ticket sizes, active trading strategies, and product primitives like order books or derivatives on L2s). Reduced friction promotes on‑chain activity that can support valuation beyond pure speculation.

Other on‑chain signals: deposit flows, active addresses and staking dynamics

- Deposit and custody inflows: Custody providers reported steady ETH inflows rather than episodic spikes—consistent with recurring ETF buys.

- Active addresses: While not at the 2021 peak, active addresses and smart contract interactions rose on L2s, indicating real usage in areas like AMMs, liquid staking and derivatives.

- Staking and supply: Staked ETH continued to take incremental supply off the market, tightening float available for trading.

Taken together, these metrics make the rally look less like a short squeeze and more like a demand‑led move with a structural component: better UX (lower fees), demand from institutional products, and constrained circulating supply.

Technical upside targets and plausible risk scenarios

Technical analysis complements on‑chain evidence. Multiple studies in December suggested clear upside levels but also defined stop points if liquidity conditions flipped.

Near‑term targets

Technical analysts pointed to a near‑term impulse target range between $4,200–$4,600 if momentum sustained above $4,000 and macro liquidity remained supportive, with extensions toward the prior all‑time highs if volume continued to confirm the move (CoinSpeaker). The logic: breakouts on higher timeframes attract trend‑following flows, and ETF flows can supply consistent bid pressure.

Bull case

- Continued spot ETF inflows at scale.

- L2 adoption keeps fees low and on‑chain activity rises, legitimizing valuation multiple expansion.

- Macro continues to ease, enabling risk asset rallies.

This scenario could justify multi‑month outperformance versus Bitcoin and push ETH into new cyclical highs.

Bear and base risk scenarios

- ETF redemption shock: if macro sentiment turns quickly, ETF products can see stop‑loss driven redemptions that cascade into selling pressure.

- Liquidity drain: large sell blocks from concentrated holders or a rapid unwind of leveraged positions could spike volatility.

- Macro re‑acceleration: if core inflation surprises and rates re‑tighten, risk assets typically sell off hard.

TheBlock’s macro commentary suggests that market structure can flip quickly if economic indicators shift, so risk management is essential (The Block).

Actionable allocation strategies: institutions and advanced retail

How should allocators respond? The path depends on time horizon, regulation, custody needs and risk budget. Below are practical frameworks for both institutions and advanced retail.

Institutional playbook (6–12 months)

- Stage entries via dollar‑cost averaging tied to ETF inflows: build exposure in tranches aligned with expected ETF schedules to avoid chasing price.

- Prioritize custody and operational due diligence: choose providers that support L2 custody and efficient settlement (reduces slippage for large fills).

- Risk layering: use a core allocation (longer‑term, cold custody, liquid staking exposure) plus a tactical sleeve (shorter‑term, hedged, possibly using options or futures to express view).

- Use volatility‑aware sizing: when concentrated whales hold supply, liquidity can vanish; size tactical positions to withstand 30–40% drawdowns.

Institutions should also stress test scenarios for ETF redemptions and establish lines with market makers and OTC desks to manage block executions.

Advanced retail and allocators (6–12 months)

- Define an allocation band, not a point estimate: e.g., target ETH exposure at 2–8% of crypto portfolio depending on risk tolerance.

- Use phased buys on weakness: with volatility high, plan purchases on pullbacks to moving averages or on increased L2 activity as a confirmation signal.

- Consider derivatives for hedging: protective puts or collars can limit downside while keeping upside exposure.

- Prefer platforms that allow efficient L2 access and staking options; lower fees on L2s materially improve compounding for active strategies.

Bitlet.app and other custody/execution platforms that support L2 routing can reduce friction for retail and smaller institutions executing this playbook.

Portfolio sizing and volatility rules

Volatility in ETH remains materially higher than many traditional assets. Practical rules:

- Never size passive allocations beyond what you can hold through 40% drawdowns.

- Use a tactical sleeve no larger than 25–30% of your total crypto allocation, and hedge tactically.

- Rebalance on drawdowns: add to core positions at predefined levels, not on emotion.

These simple rules account for ETH’s higher realized volatility while allowing participation in the institutional rotation.

Conclusion: sustainable rally, but not frictionless

December 2025’s move toward $4,000 was more than hype: institutional rotation via spot ETFs, concentrated whale accumulation and a friendlier macro backdrop combined with genuine improvements in on‑chain health and L2 fees. Lower transaction costs and rising custody inflows mean demand is better anchored than in prior cycles.

That said, the market is not immune to sharp reversals. ETF dynamics can accelerate both the up and the down moves, and macro surprises remain the single largest systemic risk. The prudent path for allocators is staged exposure, thoughtful custody and tactical hedging — a playbook that accounts for volatility, fees, on‑chain metrics and evolving institutional behaviors.

For allocators and traders who want to act, focus on execution quality, L2 cost efficiency, and clear rules for sizing and rebalancing over the next 6–12 months.

Sources

- https://thecurrencyanalytics.com/other-news/ethereum-nears-4000-as-institutional-interest-and-key-market-dynamics-drive-surge-228336

- https://cryptoslate.com/ethereum-fees-just-hit-7-year-low-as-it-finally-outperforms-bitcoin-one-hidden-data-point-proves-rally-is-sustainable/

- https://www.coinspeaker.com/ethereum-eth-price-ready-for-9-16-move-amid-bullish-divergence-buy-the-dips/

- https://www.theblock.co/post/382149/ethereum-bottom-tom-lee-bitmine-eth-treasury