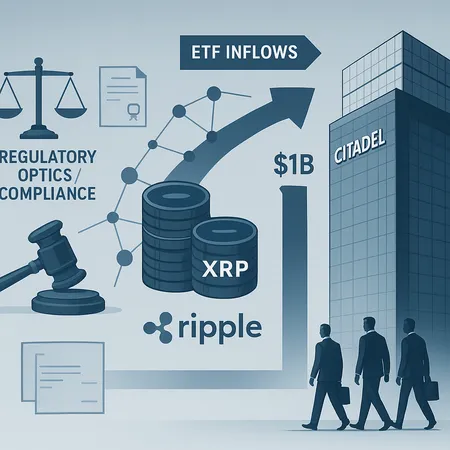

Why Institutions Are Pouring Cash Into Ripple: Citadel, ETFs, and the Regulatory Trade-Off

Summary

Executive overview

Institutional money is rotating into Ripple and XRP with a speed and concentration that demands sober assessment. From a headline-grabbing capital injection with Citadel to a fleet of new spot ETF subscriptions pulling assets into XRP exposure, the net effect is more than price pressure: it's a structural shift in who supplies liquidity, where inventory sits, and how regulators will view market integrity.

This piece unpacks the Citadel paradox, documents ETF inflows closing in on the $1 billion threshold, explains how institutional flows alter liquidity and tradability for XRP, and flags the primary compliance and regulatory optics institutional investors must consider.

Citadel’s dual role: public stance vs. private exposure

Institutional investors increasingly play both sides of the aisle: lobbying for clear rules while simultaneously chasing alpha in nontraditional assets. The most illustrative example here is Citadel Securities. Publicly, Citadel opposed certain DeFi-focused exemptions even as it co-led significant investment into Ripple-associated capital — a contrast that raises questions about motives, timing, and regulatory signaling. See reporting that explains Citadel Securities' public opposition to DeFi exemptions while co‑leading a large investment into Ripple for background.Citadel’s public posture and the Ripple deal.

Why this matters: firms that press for stricter regulatory boundaries in one arena while taking concentrated positions in another foster a perception — and sometimes reality — of regulatory arbitrage. For compliance teams, the key due-diligence questions should include counterparty transparency, trade execution channels, and whether internal lobbying activities could be construed as influencing market rules in a way that benefits proprietary exposures.

A note on incentives and market-making

Market makers and broker-dealers that have operational ties to large holders can shape spread dynamics and inventory burdens. If an institution both helps fund a protocol and participates in secondary-market operations, the incentives around inventory placement, borrowing terms, and warehousing of token supply deserve scrutiny.

ETF inflows: the sprint toward $1 billion and what it means

Two reporting threads show XRP-linked spot ETFs are gathering assets rapidly. Coverage indicates these ETFs have surged amid Bitcoin's rebound and the broader macro backdrop, and industry trackers put them on a clear path toward a $1 billion cap in assets under management.AmbCrypto explains how XRP ETFs are closing in on the $1B milestone, while market updates emphasize the speed of fundraising and the prospect of a looming $1 billion inflow cap for certain vehicles.DailyCoin reports on ETFs rapidly gathering assets and the $1B approach.

Why the $1B psychological and structural milestone matters:

- Scale changes market impact: larger ETF allocations require execution liquidity and create more persistent delta in the underlying spot market. Large authorized participants (APs) will need to source XRP supply reliably.

- Tighter free float: as ETFs accumulate and institutional holders prefer cold storage or custodial arrangements, tradable liquidity can shrink, increasing slippage for large orders.

- Price discovery shifts: ETFs can centralize price signals through creation/redemption mechanics rather than dispersed OTC markets.

The near-term implication is a feedback loop: inflows reduce immediate spot supply, which steepens the marginal cost to acquire XRP for both arbitrageurs and APs — which in turn can support sustained spreads and more volatile intraday liquidity.

On-chain signals: velocity and exchange flows

On-chain metrics are corroborating the institutional narrative. Recent analysis shows XRPL velocity hitting record highs in 2025 while exchange outflows have increased — a pattern consistent with institutions siphoning tradeable balances into custody or long-term holdings rather than leaving them on exchanges for liquidity provision.Coinpedia's on-chain data shows rising XRPL velocity and outflows.

Interpretation for investors and compliance teams:

- Rising velocity can reflect more active settlement and use cases but, paired with exchange outflows, may signal concentration of supply in fewer hands. That concentration elevates market-impact risk.

- Reduced exchange inventory means APs may face execution bottlenecks when creating ETF shares or facilitating large client redemptions.

Market-structure consequences: tighter liquidity, higher slippage, and concentrated counterparties

When institutional capital centralizes around one protocol, several structural effects typically follow:

- Compressed available float: a higher share of total supply becomes illiquid or custodial. Execution for large blocks gets harder.

- Widened effective spreads for large trades: retail spreads could remain narrow, but institutional-sized lots experience more slippage.

- Increased systemic counterparty risk: if a limited set of custodians or APs control the bulk of ETF flows, the ecosystem’s operational resilience depends on those entities.

These dynamics turn what once might have been a fragmented, OTC-heavy market into one where exchange and custodian behavior materially influence price. For example, APs coordinating creation/redemption can buffer shocks — but they can also concentrate credit exposure.

Potential conflicts of interest and regulatory red flags

Several red flags that compliance teams should model and monitor:

Dual roles and lobbying: if an institution funds protocol development or ecosystem grants while lobbying regulators on market definitions, regulators may scrutinize whether policy positions were advanced for self-serving market access. The Citadel-Ripple situation is exactly this tension in action.Beincrypto covers Citadel's public opposition vs. its investment role.

Concentrated custody or AP concentration: reliance on a few custodial banks or APs for ETF mechanics increases systemic operational risk and may draw examiner interest regarding custody segregation and resilience.

Information asymmetry: large institutional holders can receive early flow information or preferential execution. Supervisory bodies will watch for front-running, wash trading, or failed disclosure around large block allocations.

Market manipulation vectors: with thinner exchange supply, abnormal trading patterns can have outsized price effects. Compliance teams must enhance surveillance for layering, spoofing, and cross-venue coordination.

Regulators will likely evaluate both the actions of the asset managers (ETF sponsors, APs) and the institutions that provide financing or operational support to the protocol.

What this means for tokenized-asset ETFs beyond XRP

The XRP case functions as a template for other tokenized-asset ETFs (whether crypto-native or tokenized real-world assets):

- Any single-protocol concentration invites similar liquidity compression and regulatory focus.

- Sponsors must document access to spot supply and robust AP networks pre-launch — failure to do so invites operational strain under inflow pressure.

- Jurisdictions may demand stronger custody segregation and proofs of provenance for underlying assets.

In practice, a successful ETF launch without surprise requires coordinated disclosures about who holds custody, where liquidity will be sourced in stressed scenarios, and how conflicts of interest are mitigated.

A pragmatic risk/reward framework for institutions and compliance officers

For institutional investors and compliance teams assessing large allocations to Ripple/XRP, consider the following checklist:

- Counterparty map: Who are the dominant custodians, APs, and strategic investors? How concentrated are holdings? Can any single counterparty materially impede redemptions?

- Execution playbook: Where will APs source large tranches of XRP in a stress event? What is the documented pipeline for creation baskets?

- Regulatory posture: Does any shareholder or strategic investor have regulatory engagement that could be perceived as self-serving? Document lobbying and public comments alongside investments.

- Surveillance and controls: Ensure trade surveillance is cross-venue, looking at orderbooks, OTC prints, and custody movements. Set thresholds for escalation when exchange balances drop below operational minima.

- Stress tests: Model scenarios where ETF inflows accelerate 2–5x baseline — what happens to spreads, slippage, and time-to-settle on redemptions?

Applying this framework helps quantify not just upside exposure to a protocol narrative, but the operational and compliance cost of concentrated flows.

Conclusion: concentrated capital brings both opportunity and scrutiny

Institutional investment into Ripple and XRP — exemplified by Citadel’s involvement and lightning-fast ETF inflows — changes the game from retail-driven price discovery to an institutionalized market structure. That transformation can support deeper long-duration holdings and stronger infrastructure, but it also tightens tradable liquidity, elevates counterparty concentration, and draws regulatory attention.

For compliance-minded investors, balancing the potential performance upside against operational fragility and political/regulatory optics is essential. Documented safeguards, transparent disclosures, and robust stress-testing are not optional — they are central to responsibly allocating large capital into a single protocol.

Bitlet.app users and institutional allocators alike should watch on-chain velocity, exchange inventory, and ETF creation patterns closely; these indicators will tell you whether the market is becoming more resilient — or more brittle — under institutional pressure.

Sources

- BeInCrypto — Citadel opposes DeFi exemptions while co‑leading Ripple investment

- DailyCoin — XRP hoovers up Wall Street cash as $1B ETF cap looms

- AmbCrypto — Here’s how XRP spot ETFs are closing in on the $1B milestone

- Coinpedia — XRPL velocity hits record 2025 high; exchange outflows analysis

For broader context on how centralized institutional flows have altered other crypto markets, see discussions around DeFi design decisions and how macro flows often follow Bitcoin trends.