Institutions

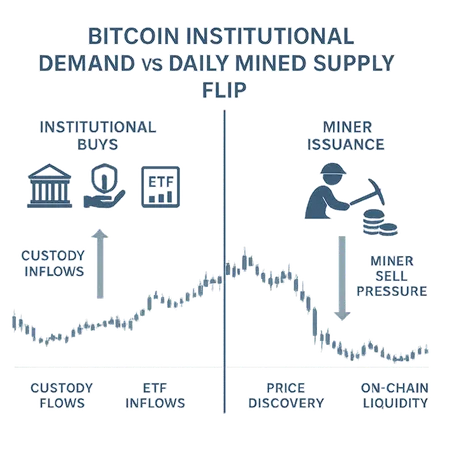

Institutional buy-side flows have recently outpaced daily miner issuance for the first time since early November, a signal that can tighten on-chain liquidity and reshape near-term price discovery. This article explains the on-chain flip, how banks and custodians are quietly increasing BTC exposure, and the practical signs allocators and traders should watch.

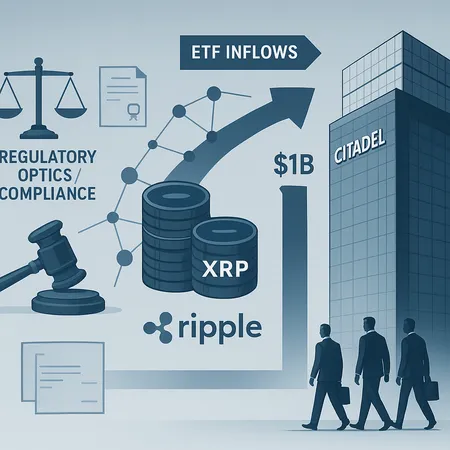

A wave of institutional capital — from Citadel’s investment to surging XRP spot ETF inflows — is reshaping XRP’s market structure and raising complex regulatory questions. This article breaks down the mechanics, liquidity effects, and compliance red flags institutional investors should weigh.

Singapore Exchange’s new exchange‑cleared BTC and ETH perpetual futures promise institutional-grade access in Asia, combining perpetual-style exposure with central clearing and MAS-aligned oversight. This piece dissects how SGX perpetuals differ from US spot ETFs and existing derivatives, the likely flow implications for Asian allocators, margin/clearing benefits, interactions with global liquidity, and near-term arbitrage plays.

Explore how institutional and government acquisitions of Bitcoin are impacting supply and market dynamics.