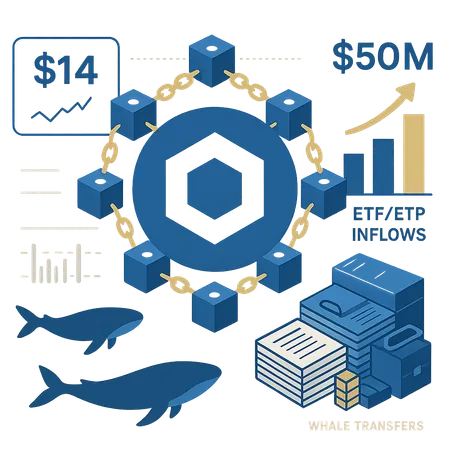

Chainlink’s Resilience in the ETF Era: Why LINK Holds Near $14 as ETP Flows Hit $50M

Summary

Snapshot: LINK near $14 as ETP flows accelerate

Chainlink (LINK) has shown notable resilience around the $14 mark while its exchange‑traded product (ETP) is approaching the $50 million inflow milestone. The headline looks simple — institutions are buying — but beneath that number lies a set of mechanics and on‑chain behaviors that matter for allocators trying to estimate sustainable demand vs. short‑term headline moves.

Analysis from market commentators points to steady ETP inflows and a drop in exchange supply as key bullish cues; these flows are large enough to matter for liquidity but so far modest relative to the global crypto market cap, which helps explain why price action has been muted rather than explosive (Chainlink’s steady market position analysis). Another market writeup highlights falling exchange supply and on‑chain signs associated with whale accumulation as corroborating evidence of institutional demand (CryptoNews report).

For many allocators, the immediate question is not whether buying is happening — it is how that buying interacts with supply mechanics, node economics, and cross‑chain utility to become a durable price support.

How ETP/trust conversions actually affect LINK supply

Creation, custody and the liquidity channel

ETPs rarely appear out of thin air. Creation typically involves an asset manager or custodian acquiring spot LINK to back units of the product. Two important consequences follow:

- Custodial purchases remove coins from the open market and, if those coins are retained in custody rather than re‑sold, they reduce available exchange float.

- The timeline for purchases matters: steady, programmatic buys smooth price impact; front‑loaded blocks can spike short‑term volatility.

A recent summary of catalysts driving LINK’s momentum called out ETP conversion mechanics — and a new bridge project — as twin drivers that pulled Chainlink into focus for allocators, because conversions create real spot demand while interoperability expands long‑term utility (Fool summary).

Does ETP buying equal lasting scarcity?

Not automatically. There are countervailing flows: redemptions, market‑maker hedging (selling spot to hedge ETP exposure), and secondary liquidity provision. The true scarcity equation depends on net buys retained in cold custody versus coins recycled back into exchanges. Current reporting suggests net custody is material enough to dent exchange inventories — a bullish structural input — but not yet dramatic enough to create supply shock.

On‑chain indicators and whale activity: what’s bullish and what’s noise

If you want to move from narrative to a monitorable thesis, build a small dashboard with the following metrics:

- Exchange balances: the aggregate LINK held on centralized exchanges. A falling balance alongside inflows typically signals buying into custody rather than short‑term trading supply.

- Top wallet accumulation: large transfers into top N wallets or custody addresses. CryptoNews specifically points to visible whale accumulation concurrent with ETF flows (CryptoNews report).

- Net flow to custodians: flows into known custodial addresses used by ETP issuers.

- Oracle usage metrics: daily oracle requests, subscription counts and fee revenue trends. Rising usage is the clearest real‑economy demand for LINK (it is the token used to compensate node operators and, depending on governance, may be used in staking/bonding schemes).

- Node operator staking/lockup: any increase in tokens locked as performance bonds or staking commitments reduces liquidity and signals longer‑term economic alignment with node operation.

- Large transfer patterns (whales): frequency and size of whale transactions — and destination (custody vs. DeFi protocols) — changes the narrative from speculative accumulation to institutional custody.

On‑chain and market coverage have recently flagged both falling exchange supply and concentrated whale buying as bullish signals. Still, these are leading indicators, not guarantees; watch for sharp reversals in exchange flow if ETP arbitrage or hedging activity flips direction.

Cross‑chain interoperability and bridge projects: a demand catalyst

One of the more structural bullish cases for LINK is not just ETF flows but growing real‑world utility. Chainlink’s cross‑chain tools and new bridge integrations expand where oracle services are required. That matters because:

- Cross‑chain messaging and asset transfer increase the number of environments that need reliable price, identity and state oracles.

- More chains using Chainlink means more oracle calls, which can translate into fee revenue and economic demand for LINK (used to pay node operators or as part of economic security mechanisms).

A recent listing of catalysts included a new bridge project as a reason institutional desks re‑rated the asset; the logic is simple: interoperability increases the addressable demand for oracles, and sustained usage growth converts headline ETF demand into continuing utility demand (Fool summary).

Cross‑chain demand also changes the supply profile — nodes and integrators may hold tokens for operational needs, and protocols could lock LINK as collateral or for staking/insurance purposes (depending on design). That creates optional structural scarcity beyond custodian flows.

Scenarios: how flows scale and what alters the thesis

Think in scenarios rather than a single forecast. Here are three stylized paths and what to monitor for each:

- Modest, sustained inflows + rising usage: exchange balances decline, custodial holdings rise, oracle query volumes climb. Thrust: structural appreciation as both scarcity and utility grow.

- Front‑loaded inflows + hedging strain: rapid buys push price, market‑makers sell into the rally, inflows cool and exchanges refill. Thrust: volatile price action with limited follow‑through.

- Large inflows + redemption shock/regulatory event: redemptions or forced selling (e.g., from an issuer) could create outsized volatility despite earlier buying. Thrust: correlation with macro/regulatory headlines becomes dominant.

Key triggers to watch (alerts you can set):

- ETP inflow pace: daily/weekly rate and whether new issuers enter the market.

- Exchange balance delta: multi‑day sustained drops are more meaningful than one‑off moves.

- Large inbound transfers to known custodians: this confirms ETP buying converted to spot custody.

- Oracle request growth and bridge usage: rising consumption converts flow into revenue.

- Whale wallet distribution changes: clustering of coins in fewer hands can amplify volatility.

Practical checklist for allocators and on‑chain analysts

- Build a flow tracker: watch ETP inflows, exchange balances and custodial addresses daily.

- Monitor oracle usage dashboards: an increase in request counts and subscription volume signals real demand for LINK’s services.

- Set whale alerts: tags for known custodians vs. private wallets help separate institutional custody from speculation.

- Stress test exposure: model scenarios where ETP inflows slow or reverse and estimate liquidation pressure.

- Keep an eye on cross‑chain integrations: new bridge traffic often presages steady fee generation.

Even as allocators use tools and dashboards, products and services such as Bitlet.app are becoming part of institutional workflows for managing exposure and understanding custody flows.

Conclusion: thesis in one paragraph

LINK’s stability around $14 amid approaching $50M in ETP inflows is best read as a multi‑factor story: institutional buying via ETPs is reducing available supply, visible whale accumulation corroborates demand, and cross‑chain bridging increases long‑term utility for oracle services. That combination creates a constructive backdrop — not a guarantee of price rallies — and demands active monitoring of flows, oracle usage, and custody movements to distinguish durable structural demand from ephemeral headline buying.

Sources

- Chainlink’s steady market position reflects investor optimism amid ETP growth

- Chainlink price eyes rebound as LINK ETP nears $50M milestone as whales buy

- These 2 closely watched catalysts pulled Chainlink

For context on how on‑chain indicators and flows typically interact with institutional products, see the on‑chain dashboards used by allocators and custodians in industry reports and exchange filings.