What Grayscale’s Spot LINK ETF Means for Chainlink: Mechanics, Catalysts, Risks

Summary

Why Grayscale’s conversion matters

Grayscale’s announcement to convert its Chainlink Trust into a U.S. spot LINK ETF is notable for two reasons: it lowers the institutional barriers to owning LINK, and it formalizes an ETF vehicle for an infrastructure token rather than a pure store-of-value asset. Reports indicate Grayscale intends to convert its trust rather than launch a brand-new product, mirroring the pathway it used when taking GBTC toward ETF status (CoinCu, Cryptopolitan). For allocators, the change is not just symbolic — ETF wrappers bring custody standards, broker-dealer distribution, and a familiar interface for compliance-minded portfolios.

For many crypto allocators, the prospect of a regulated, tradable LINK ETF reduces operational frictions. Institutions wary of exchange custody, private keys, or new custody relationships can instead access LINK through brokerage rails. That matters because demand from traditional asset managers often hinges on product architecture as much as on underlying fundamentals. Also, note platforms such as Bitlet.app that make access strategies — whether via custody or trading products — easier for different investor types.

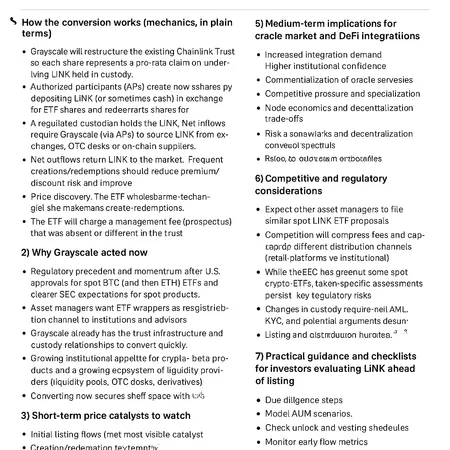

How the conversion works — mechanics explained

Converting a trust into an ETF typically involves legal re-registration, operational rewrites for authorized participants (APs), and the establishment of creation/redemption mechanics that keep ETF share prices aligned to the underlying asset. In practice, Grayscale will repurpose its existing supply of LINK held in the trust into ETF-eligible inventory, then enable APs to create and redeem ETF shares through in-kind or cash mechanisms. Those APs and market makers perform the arbitrage that keeps ETF NAV and market price in sync.

Key plumbing points investors should know: APs can create ETF shares by delivering LINK (or cash) into the fund and receive creation units (large baskets of ETF shares); they can redeem by returning shares and extracting LINK. This process reduces persistent premiums or discounts that trusts sometimes trade at because APs arbitrage them away. The conversion process also typically requires the SEC’s registration of the fund structure and adherence to surveillance and custody standards that are familiar to U.S. markets — details Grayscale has been negotiating in past ETF conversations (Cryptopolitan).

Why Grayscale acted now

Timing is a blend of regulatory opportunity and market strategy. The SEC’s grudging acceptance of spot crypto ETFs after the BTC ETF approvals set a template: issuers that already hold large baskets can convert trusts quickly and capture first-mover distribution across broker-dealers. Grayscale has precedent (notably with GBTC’s conversion history) and can leverage an incumbent trust balance to scale flows out of the gate.

Market conditions matter too. ETF providers often move when both retail and institutional interest align — when intermediaries can distribute and APs see profitable arbitrage opportunities. Third-party commentary suggests Grayscale saw a window to be first to market for LINK, a token with a growing narrative around oracle utility and potential staking demand (CoinCu). Being first gives Grayscale distribution leverage with brokerages that favor single-provider onboarding.

Short-term price catalysts and liquidity effects

Several levers could move LINK’s price and liquidity profile in the weeks and months after listing:

Initial ETF flows. Large inflows would increase bid pressure for spot LINK as APs and market makers accumulate inventory to satisfy creations. This is a classic ETF-driven demand story: sustained net inflows require actual token purchases. Conversely, outflows drive sales.

Arbitrage and spreads. The creation/redemption mechanism should tighten spreads and improve price discovery. Where trust structures once allowed persistent premiums/discounts, a liquid ETF market tends to compress those inefficiencies.

Trust unlocks and supply dynamics. If the trust conversion involves unlocking previously illiquid holdings or if there are scheduled releases of vested LINK from early investors or foundations, that could increase near-term supply. Markets will price in the expected net effect of ETF demand versus any incremental sell-side pressure. Market commentary has debated whether LINK can recover from prior drawdowns ahead of the ETF listing, emphasizing the interplay of flows and unlocking schedules (Coinspeaker).

Derivative and options markets. The ETF listing often expands options and futures interest. More liquid derivatives increase hedging capacity and can attract market makers who provide two-way liquidity on spot.

Practically, this means short-term volatility is likely. If ETF demand is front-loaded, the first weeks could see outsized upward pressure; if holders use the listing as an exit window, price action could be muted or negative.

Medium-term implications for the oracle market and DeFi integrations

A credible, liquid ETF for LINK has implications that go beyond price and into network effects. Chainlink is not just a token; it is the market-leading oracle network that supplies on-chain data and external inputs to many smart contracts. Broader institutional ownership can influence adoption in a few ways:

Network security and economics. Grayscale’s ETF doesn’t change node economics directly, but increased institutional ownership can shift incentives around staking and long-term holding behavior — particularly if Chainlink’s planned staking mechanisms materialize and create on-chain demand for locking LINK as collateral or reputation. That long-term locked supply is bullish for protocol security and node operator revenue models.

DeFi integrations. Greater confidence from allocators can translate into more capital in DeFi protocols that rely on Chainlink oracles. Institutional partners and funds that now hold LINK might be more willing to engage with projects that leverage Chainlink for price feeds, verifiable randomness, or external data bridges, accelerating product-level adoption in DeFi.

Data marketplace growth. If ETF-driven capital enables or coincides with new commercial partnerships, Chainlink could see growth in paid data services, cross-chain oracles, and real-world asset feeds — all of which reinforce utility and token demand.

These medium-term impacts depend on fundamentals: node performance, security incidents (or the lack thereof), and whether Chainlink’s roadmap (e.g., staking design) lands as intended.

Competitive and regulatory considerations

Competition is real. Oracle networks such as Band Protocol, API3 and newer entrants position themselves as lower-latency or specialized solutions. A LINK ETF reduces access frictions but does not erase technical competition. Investors should treat ETF availability as access — not a guarantee of sustained market dominance.

Regulatory lenses will also matter. The SEC’s approach to spot ETFs has evolved, but scrutiny remains around market surveillance, custody, and manipulation risk. ETFs require surveillance-sharing agreements and transparent NAV calculation; issuers must show how they will detect and deter spoofing or wash trading in underlying markets. Any questions about market integrity for LINK trading venues could create friction for the product.

Additionally, regulatory treatment of oracle outputs — especially where off-chain data feeds have real-world legal or financial consequences — could attract attention. Investors should be alert to policy shifts that affect how on-chain data is used in regulated financial contracts.

Practical guidance for allocators evaluating LINK ahead of the listing

If you are a crypto asset allocator or a mid-level investor considering LINK as an ETF-driven play, treat the opportunity with a checklist mindset:

Clarify your objective. Are you allocating to capture short-term ETF-driven alpha, or to gain long-term exposure to oracle adoption and staking economics? Time horizon determines position size and instrument choice (ETF vs spot custody).

Watch filings and creation mechanics. Read the fund prospectus and details on creation unit size, AP identity, and custody arrangements. These operational details affect liquidity and arbitrage efficiency.

Monitor on-chain indicators. Look at exchange balances, concentrated holder flows, active node counts, and staking/vesting schedules (where available). A falling exchange balance combined with rising staking or long-term lockup signals tightening supply.

Assess derivatives liquidity. Check options and futures open interest — better derivatives markets improve hedging and institutional participation.

Stress-test scenarios. Build bear, base, and bull cases. Consider: (a) strong inflows and limited unlocks = tight market and higher price; (b) weak inflows and large vesting/unlocks = supply pressure; (c) mid-case where ETF adoption is gradual.

Position sizing & risk controls. Given the possibility of short-term volatility and regulatory shifts, use appropriate sizing, stop-losses or option hedges. ETFs offer simplicity but not immunity from market risk.

Tax and custody implications. ETF holdings differ tax-wise from direct token holdings in some jurisdictions; consult tax professionals. Also, weigh counterparty exposures inherent to ETF holders versus self-custody.

A short watchlist to track in the coming weeks: fund prospectus and SEC filing dates, AP identities and initial creation activity, exchange on-chain balances for LINK, major vesting or unlock reports, and options volume.

Final takeaways

Grayscale’s conversion of its Chainlink Trust into a spot LINK ETF is an inflection point for access and distribution. In the short term, ETF flows and any trust-related supply events will drive price action and liquidity. Over the medium term, improved institutional participation could reinforce Chainlink’s role in the oracle layer, accelerate DeFi integrations, and alter token economics if staking and lock-up trends follow.

That said, ETF availability is a distribution and accessibility story more than a fundamental rewrite. Competitive pressure from other oracle providers, the technical performance of Chainlink’s network, and regulatory scrutiny will continue to determine long-term outcomes. For allocators, the prudent path is to combine on-chain diligence with careful review of the ETF mechanics and to size exposure according to clear scenario plans.

Sources

- Grayscale to convert Chainlink Trust into spot LINK ETF — CoinCu: https://coincu.com/news/grayscale-to-launch-first-spot-chainlink/?utm_source=snapi

- Grayscale to launch U.S. spot Chainlink ETF — Cryptopolitan: https://www.cryptopolitan.com/grayscale-to-launch-us-spot-chainlink-etf/

- Market commentary on LINK recovery ahead of ETF — Coinspeaker: https://www.coinspeaker.com/chainlink-etf-coming-this-week-will-link-price-recover-from-crash/