Chainlink vs Hyperliquid: Who Could Win the DeFi Leadership Race in 2026?

Summary

Why 2026 is a different kind of DeFi leadership contest

The old DeFi scoreboard — TVL headlines and price spikes — is no longer a reliable predictor of who endures. Today’s competitive edge is built from repeatable revenue, robust product primitives, and incentive designs that don’t cannibalize protocol economics. That matters for both protocol teams designing sustainable products and traders sizing risk around token-backed business models.

For many teams, and for on‑chain observers at platforms like Bitlet.app, the contrast between Chainlink (ticker: LINK) and Hyperliquid (ticker: HYPE) reads like a classic incumbent vs. insurgent duel: a widely integrated infrastructure provider with deep network effects on one side, and a capital‑efficient, revenue‑oriented DeFi protocol on the other.

Product and price momentum: LINK vs HYPE

Market signals and product adoption

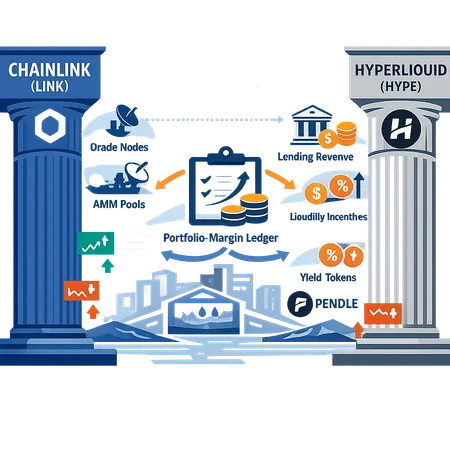

Chainlink’s moat remains its pervasive oracle footprint — price feeds, VRF, and cross‑chain messaging bridges. That entrenched usage translates into contractual demand for oracle services from lending, derivatives, and insurance products. By contrast, Hyperliquid has been growing around derivatives, portfolio margining, and liquidity provisioning models that extract explicit fees from margin activity.

On price charts and short‑term momentum, analysts have contrasted LINK and HYPE performance to infer narrative strength. For a focused look at price and chart comparisons, see this recent analysis comparing Chainlink and Hyperliquid’s market behavior and technical positioning. The takeaway: LINK often moves on macro and oracle‑demand narratives, while HYPE reacts more sensitively to product launches and revenue announcements.

Product momentum — breadth vs. depth

- Chainlink: breadth of integrations across DeFi stacks — lending, spot AMMs, derivatives, and NFTs — which creates steady, diversified oracle query volume.

- Hyperliquid: depth in capital efficiency and margin products; revenue is concentrated but potentially higher yield per unit TVL when margin utilization is strong.

Macro risk appetite (often signaled by Bitcoin flows) still influences both tokens, but the structural product differences determine how those macro moves translate into protocol revenue.

Hyperliquid’s portfolio‑margin revenue model and neutrality stance

Hyperliquid’s portfolio‑margin model bundles margin across positions to lower capital requirements and unlock incremental revenue. Unlike spot AMM fee dependence, portfolio margin generates recurring fees tied to open interest, funding rates, and margin usage. As documented in reporting on Hyperliquid’s business model, portfolio‑margin can turn active traders’ capital efficiency into predictable protocol income streams when utilization is high.

The founders have been explicit about a stance of credible neutrality while commercializing margin revenue — a public posture designed to attract market makers and institutional flows without tokenized governance interventions that might distort markets. That argument and its revenue implications are explained in depth in coverage of Hyperliquid’s revenue and neutrality stance.

Why this matters: predictable revenue from portfolio margin reduces reliance on token inflation or temporary LP subsidies. For traders, it means HYPE’s price is more tightly coupled to active trading and margin demand than pure liquidity metrics. For product managers, it’s a template: design products where users pay for utility (margin/funding) rather than rely on token‑heavy incentives.

How yield token subsidy models like PENDLE’s reshape AMM and LP economics

PENDLE introduced a nuanced model where yield tokens are used to subsidize liquidity in a targeted way — effectively decoupling subsidy issuance from raw token emission. This approach changes the calculus for LPs and AMMs by allowing protocols to buy specific yield flows or temporally concentrate incentives where they’re most needed.

The mechanics have two practical effects on LP economics:

- Targeted subsidy efficiency: Instead of broad, continuous emissions, subsidies can be focused on specific pairs, durations, or behaviors, reducing wasted incentives and lowering long‑term inflationary pressure. Coverage of PENDLE’s model outlines how yield token subsidization changes on‑chain liquidity dynamics and tests critical supports.

- Surgical mitigation of impermanent loss: When subsidies are paired with duration and yield targeting, LPs are compensated more precisely for the risks they take. That can improve net effective yields and make AMM participation more palatable without unsustainably burning the token treasury.

For DeFi product managers, PENDLE’s architecture is a playbook: design incentive flows that are measurable, decaying, and aligned with desired user behaviors rather than flat emission curves.

Comparative implications for competitive dynamics

- Revenue durability vs. network effects: Chainlink’s network effects produce steady demand for oracles across many applications, which is a defensive moat. Hyperliquid’s revenue model can be faster to monetise and scale when derivatives or margin activity grows, but it may be more cyclical.

- Capital efficiency: Hyperliquid’s portfolio‑margin design is inherently capital efficient, meaning the protocol can extract higher fees per unit TVL in active market regimes. That makes HYPE attractive to traders who value leverage and tight funding; but it also ties token performance to trading velocity.

- Incentive engineering: PENDLE‑style subsidy designs reduce the need for blanket token inflation, creating healthier LP economics. Protocols that adopt such mechanisms can preserve token value while still bootstrapping liquidity.

Metrics product managers and traders should watch in 2026

To evaluate which protocol gains long‑term leadership, monitor these interlinked metrics rather than relying on TVL or price alone:

- Revenue per TVL (or revenue yield): Protocol revenue divided by TVL — higher and stable ratios indicate sustainable business models. For Hyperliquid, split out margin revenue vs. lending revenue.

- Margin utilization and open interest: For portfolio‑margin platforms, utilization rates and average leverage indicate revenue runway and sensitivity to volatility.

- Oracle query growth and fee share: For Chainlink, watch query volume, new product usages (e.g., VRF, CCIP), and the share of total protocol fees that oracles capture across the ecosystem.

- Subsidy run‑rate and decay profile: For PENDLE‑like incentives, measure how fast subsidies are paid out, where they’re concentrated, and whether net effective APR for LPs remains positive after decay.

- Token velocity and staking economics: High velocity without commensurate revenue implies speculative demand; look for staking, buybacks, or fee flows that soak up velocity.

- User concentration and counterparty risk: A small number of vaults or traders providing the majority of fees is a red flag for fragility.

- On‑chain flows: deposits vs. withdrawals ratio: Rapid outflows under stress test a protocol’s revenue model.

- Effective fee yield to LPs (post‑impermanent loss): Important to assess real economic returns from AMM participation after targeted subsidies.

Watch these metrics across both Chainlink and Hyperliquid. Chainlink’s strength will show up in broad usage metrics and predictable oracle‑fee accruals; Hyperliquid’s will show in margin revenue resilience and high revenue per active trader.

Practical trading and product takeaways

- Traders: if you expect derivatives and margin trading to expand in 2026, HYPE could capture disproportionate upside through revenue multiple expansion. But that bet requires close monitoring of margin utilization and open interest.

- Product managers: consider designing revenue‑first products (portfolio margining, subscription‑style fees, or funding rate capture) that avoid reliance on perpetual token emissions. Take lessons from PENDLE’s targeted subsidy model to optimize LP economics without long‑term inflation.

- Risk management: diversity of revenue streams matters. A protocol with oracle integrations across lending, AMMs, and derivatives is less exposed to a single market regime collapse than one dependent primarily on margin volume.

For many teams, combining sustainable revenue primitives with surgical incentive engineering is the path to a defensible moat.

Final framework: how to decide the next DeFi leaders

- Start with revenue quality: is income recurring and tied to user utility (fees, funding, margin) or to token emissions?

- Measure incentive efficiency: are subsidies targeted with decay and measurable outcomes (PENDLE pattern), or broad and inflationary?

- Evaluate distribution and decentralization: is usage distributed across many counterparties, and does governance/neutrality preserve market confidence (the way Hyperliquid has signalled it will)?

- Stress‑test for volatility: how do revenue and TVL behave under a 30–50% market drawdown?

- Monitor product breadth vs. specialization: Chainlink’s integrations offer diversification; Hyperliquid’s specialization can be a strength if margins are sticky.

If you’re building or evaluating DeFi products in 2026, prioritize protocols that can monetize utility cleanly and control subsidy leakage while maintaining user trust and composability. That triad — revenue, efficient incentives, and trust — is what will separate durable leaders from short‑lived winners.

Bitlet.app users and DeFi teams should be watching these metrics and models closely; they matter more than narratives when allocating capital or designing the next generation of protocols.

Sources

- Coinpedia — Chainlink vs Hyperliquid price and chart comparison: https://coinpedia.org/price-analysis/chainlink-vs-hyperliquid-who-will-be-the-defi-leader-in-2026-heres-what-charts-say/

- Blockonomi — Hyperliquid founder reaffirms neutrality and explains portfolio‑margin revenue: https://blockonomi.com/hyperliquid-founder-reaffirms-credible-neutrality-as-portfolio-margin-unlocks-million-dollar-revenue/

- Blockonomi — PENDLE’s yield token subsidization and effects on DeFi liquidity: https://blockonomi.com/pendles-yield-token-subsidization-transforms-defi-liquidity-as-token-tests-critical-support/