Is Bitcoin’s Recent Weakness Capitulation or a Late‑Cycle Drawdown? A Data‑Driven Reconciliation

Summary

Snapshot: what happened and why it matters

Over the past weeks, several on‑chain loss metrics for BTC have moved to levels that some analysts compare to parts of the 2022 stress period around the Terra/Luna collapse. The raw comparison — metrics at similar numeric values — is a useful alarm bell, but it requires context: market microstructure, leverage, and macro conditions are very different today.

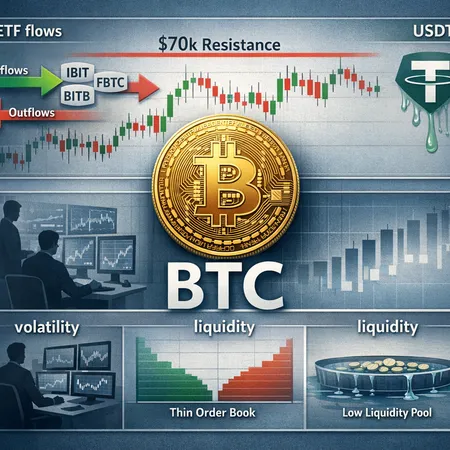

Two recent pieces illustrate the tension. Crypto.News reported that on‑chain loss metrics hit 2022 Luna‑collapse levels at higher prices, highlighting the scale of realized pain on chain. At the same time, the CryptoQuant CEO argued BTC is “not pumpable right now” — a liquidity/flow view that explains why prices can remain weak despite heavy realized losses. And a stronger‑than‑expected jobs report has re‑set rate‑cut expectations, which AmbCrypto notes could push BTC lower and test psychological levels like $60k.

These three forces — on‑chain realization of losses, flow/liquidity structure, and macro pressure — must be reconciled before deciding whether this is a capitulation (clearing of supply and the start of a recovery) or a late‑cycle drawdown (protracted weakness with possible further downside).

What on‑chain loss metrics measure (and what they don’t)

On‑chain loss metrics aggregate where coins move and at what cost basis. Key concepts for traders:

- Net Realized P/L (Net Realized Profit & Loss): captures profit or loss when coins change hands. When a large volume of UTXOs move at prices below their acquisition cost, realized losses rise.

- SOPR and Realized Cap: SOPR (Spent Output Profit Ratio) shows whether spent outputs are transacting at a profit or loss; Realized Cap converts network value to actual realized price levels over time.

- NUPL (Net Unrealized Profit/Loss): measures unrealized gains or losses across holders — useful for gauging latent selling pressure.

What these metrics tell you: they reveal who is losing money and when losses crystallize. A spike in realized losses often coincides with weak hands selling or forced liquidations.

What they don’t tell you directly: market liquidity, derivatives positioning, exchange solvency, or institutional bid strength (for instance, spot ETF inflows). Two events can show identical realized‑loss numbers yet have very different market outcomes depending on those off‑chain variables.

Why hitting ‘2022 levels’ numerically doesn’t guarantee the same systemic risk

A numeric match to 2022 metrics is an important signal, but it’s not a one‑to‑one map to contagion or systemic collapse. Key differentiators:

- Different source of stress: The 2022 shock involved a stablecoin peg collapse (UST/LUNA) and direct contagion into centralized counterparties and lending desks. Today’s losses reflect trading and position unwind rather than a systemic peg failure.

- Leverage and derivatives footprint: The degree and distribution of leverage matters. If leverage is concentrated in a few vulnerable desks, the systemic risk rises; if leverage is modest and hedged, realized losses may simply redistribute coins between wallets.

- Exchange balances and liquidity: Lower exchange reserves and thinner order books amplify price moves. But the presence of large passive buyers (spot ETFs) can provide a structural bid unseen in 2022.

- Stablecoin and lending sector health: In 2022 weak spots in lending and stablecoins transmitted shocks. Current stablecoin and CeFi balance‑sheet health is different — still risky, but not identical in mechanism.

- Investor base and institutional participation: Today’s ETF infrastructure and regulated access channels change who provides marginal liquidity and how persistent demand can be.

Put plainly: equal pain on chain can arise from different forces and end in different outcomes. That’s why traders must layer on flow and macro analysis before inferring capitulation.

CryptoQuant’s ‘not pumpable right now’ — unpacking the liquidity view

When CryptoQuant’s CEO says BTC is “not pumpable right now,” he’s pointing to market‑structure realities: order‑book thinness, low taker demand, muted futures funding signals, and a general lack of fresh aggressive bids. Practical implications:

- Price moves without follow‑through: Even if spot price bounces, limited buyer depth means rallies can be sold into.

- High cost to create sustained rallies: Without organic spot flow or leveraged longs willing to step in, any rally requires real cash (e.g., ETF purchases) rather than short squeezes.

- Time to recovery can lengthen: Liquidity shortages translate into prolonged ranges; this matters for sizing and stop discipline.

This view aligns with the observation that on‑chain realized losses can accumulate without triggering the classic capitulation pattern (violent washout followed by sustained accumulation). Instead, workmanlike selling and contained liquidation can produce a slow bleed.

Macro risk: why a strong jobs report matters

Macro matters because it sets the funding backdrop for risk assets. A stronger jobs report lifts expectations for rate persistence, reduces the probability of near‑term rate cuts, and can push nominal yields higher. AmbCrypto’s analysis shows this dynamic can exert downward pressure on BTC, especially when markets had been pricing aggressive easing.

Why rates influence BTC:

- Higher real yields increase the opportunity cost of holding non‑yielding assets like BTC.

- Risk‑sensitive liquidity (carry, repo, USD flows) tightens, making it harder for marginal buyers to leverage into spot bids.

- Equity correlations can reassert, turning risk‑on flows away from crypto.

That said, macro is not destiny. Persistent spot demand (ETF inflows, corporate treasuries, HNWI allocations) can offset rate pressure. The balance between these forces will determine whether the current weakness is a temporary capitulation or the start of a deeper drawdown.

Reconciling the signals: capitulation or late‑cycle drawdown? A decision framework

For intermediate traders, the question should be less binary and more conditional. Use this framework:

- Check on‑chain clearing indicators: Are realized losses concentrated among short‑term holders and non‑institutional wallets, or is there distribution from long‑term holders? A capitulation often features cleaning out of short‑term holders and large on‑chain accumulation by long‑term entities.

- Assess liquidity and flow: Monitor exchange inflows/outflows, order‑book depth, and futures funding. CryptoQuant’s liquidity indicators are useful to confirm whether rallies have structural bid support.

- Monitor macro tailwinds: If rate‑cut odds fall sharply after jobs prints, expect pressure to persist unless offset by ETF or institutional flows. AmbCrypto’s analysis highlights the linkage between macro prints and BTC downside risk.

- Watch ETF/spot demand: Steady or growing spot ETF inflows materially raise the probability of recovery even amid weak macro prints.

- Look for a capitulation signature: a sharp washout (large volume, extreme negative funding, broad realized losses), followed by elevated accumulation on chain and declining exchange balances.

If the answer to 1–3 is “clearing and accumulation,” treat recent weakness as capitulation. If liquidity remains poor, macro risk is rising, and realized losses continue without exchange drains or accumulation, treat it as a late‑cycle drawdown and plan for more rangebound or lower prices.

Practical risk management steps (for traders and analysts)

Below are concrete actions to translate the analysis into portfolio choices. These are oriented to intermediate traders who can access spot, derivatives, and options:

- Reduce gross leverage: Cut leverage sized to the volatility regime — if funding/futures open interest is high, reduce exposure. When CryptoQuant flags low pumpability, leverage is especially dangerous.

- Stagger re‑entry (dollar cost averaging with conditional buckets): Instead of one large buy, allocate into multiple tranches and only deploy later tranches if on‑chain indicators improve (declining exchange balances, steady ETF inflows, falling realized losses).

- Use options for defined risk: Buy protective puts or construct collars to limit downside while keeping upside. Cost‑effective hedges make sense if macro risk is elevated.

- Hedge tactically with short futures: If you expect a further drawdown and prefer not to sell spot, short futures with tight risk controls; monitor funding and roll costs.

- Monitor stop levels by volatility, not price: Set stops based on ATR or implied volatility to avoid being whipsawed in low‑liquidity bounces.

- Watch miner selling and exchange inflows: An uptick in miner flows to exchanges can add persistent selling pressure; treat it as a red flag for further downside.

- Size for recovery time: If you believe ETF flows will eventually lift prices, size positions so you can withstand an extended range (weeks–months) without being forced out.

- Keep cash dry for opportunistic buys: If macro prints remain weak and on‑chain capitulation signatures appear, having dry powder lets you buy into confirmed accumulation.

What to watch next — a short checklist of signals and thresholds

- Exchange balances: continuous decline supports recovery; stabilization or inflows signal more selling.

- Net Realized P/L trend: high sustained realized losses with no exchange drain = late‑cycle drawdown risk.

- SOPR & NUPL: move from negative extremes toward neutral as a sign of pain clearing.

- Futures open interest & funding: falling OI and neutral/negative funding suggest weak leverage demand; a sharp spike in OI with positive funding can fuel rallies.

- Spot ETF flows: consistent net inflows materially raise recovery odds.

- Macro releases: jobs, CPI, and Fed commentary. A string of strong prints that reduce rate‑cut odds keeps downside pressure on BTC.

Practical thresholds (illustrative, not absolute): sustained exchange outflows of >5–10% of exchange balances over several weeks is constructive; repeated weekly ETF inflows above recent averages are also telling. AmbCrypto discussed the risk that a strong jobs report could push BTC below $60k — treat $60k as a psychological and technical level to monitor in this macro regime.

Conclusion: balance data with structure

On‑chain loss metrics are invaluable — they quantify where pain is realized. But equal numeric levels to 2022 do not automatically mean identical systemic risk. You need to layer liquidity/flow analysis (the point behind CryptoQuant’s ‘not pumpable’ view) and macro context (the rate outlook shaped by jobs prints) to reach a trading decision.

For intermediate traders: presume conditional risk. Reduce leverage, use defined‑risk hedges, and base fresh buys on improving on‑chain accumulation and structural spot demand (ETF inflows). Monitor the checklist above and update position sizing as liquidity and macro signals evolve.

Traders who combine on‑chain insights with flow and macro discipline — and who use platform tools such as Bitlet.app judiciously for execution and risk controls — will be better positioned whether this episode resolves as capitulation or a protracted drawdown.

Sources

- Bitcoin on‑chain loss metrics hit 2022 Luna collapse levels at higher prices — Crypto.News

- Bitcoin not pumpable right now, according to CryptoQuant CEO — Daily Hodl

- Strong jobs report shakes the market — could Bitcoin drop below $60k next? — AmbCrypto

For more onflow and technical on‑chain indicators, see the Bitcoin tag on our blog for related pieces.