Why Institutions Stay Bullish on Bitcoin: JPMorgan, ETFs, CPI, and 13F Shifts

Summary

Executive snapshot

Institutional interest in Bitcoin hasn't evaporated because price swings still make headlines. If anything, banks and asset managers are doubling down — not purely out of speculative fervor, but because structural supply constraints, ETF channels, and macro forces create a plausible path for outsized returns over a multi-year horizon. For many traders, Bitcoin remains the primary market bellwether: short-term volatility coexists with a long-term narrative that institutions find investable.

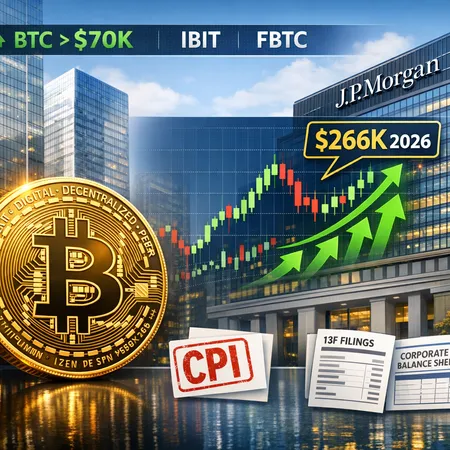

This deep-dive evaluates three pillars behind that conviction: the logic behind JPMorgan’s headline $266K 2026 call, the role of ETF flows plus CPI-driven macro tailwinds that helped BTC reclaim $70K, and what recent 13F disclosures and corporate holdings mean for market structure and liquidity. I close with practical takeaways for allocators and intermediate investors trying to reconcile institutional rhetoric with near-term risks.

Why some banks and asset managers project outsized BTC targets (dissecting JPMorgan’s $266K call)

JPMorgan’s bullish scenario — widely reported as a potential $266K BTC by 2026 — is best read as a conditional projection: it’s a target that emerges from a stack of favorable assumptions rather than a baseline guarantee. The bank’s case combines several drivers:

- Demand shock via institutional adoption. Continued inflows into spot ETFs and balance-sheet allocations by pension funds, endowments, and insurance could compress the free-float supply available to traders.

- Persistent supply constraints. Bitcoin’s issuance schedule and long-term hodling behavior reduce circulating supply growth, a scarcity story that amplifies price response to incremental demand.

- Macro tailwinds. Lower realized inflation, or at least a credible view that inflation is retreating, reduces the opportunity cost of holding non-yielding assets and makes Bitcoin a more attractive portfolio diversifier.

- Network and on-chain adoption. Greater usage — from custody to payments and DeFi rails — widens the institutional utility case beyond pure speculation.

JPMorgan effectively models an outcome where steady ETF flows, higher adoption, and limited sell-side supply combine over several years to produce very large upside. That makes the $266K figure useful as a scenario analysis: plausible only if inflows stay meaningful and regulatory/trust frameworks remain supportive.

Key assumptions and where they can break

No upside target survives scrutiny without assumptions. JPMorgan’s view hinges on: sustained ETF demand, continued retail and institutional accumulation, and an absence of large-scale deleveraging events that force holders to sell. If any of those assumptions fail — e.g., ETF flows reverse, a major credit event forces liquidity sales, or regulators substantially restrict product access — the upside compresses quickly.

Put simply, the $266K is not a forecast in the weather-report sense; it’s a conditional equilibrium under a set of constructive variables.

ETFs and CPI: how macro data amplified the short-term rebound above $70K

In the short run, macro data and product flows move the needle. The reclaim of $70K for BTC was not purely technical; it was a macro-driven event. Reports tying the rally to cooling US CPI prints and steady ETF flows explain the amplification mechanism: lower-than-expected inflation increases the probability of earlier Fed easing, which reduces real rates and the opportunity cost of holding Bitcoin.

Coverage after the rebound highlighted those linkages. FXEmpire tied BTC’s surge past $70K to a cooling CPI print and ongoing ETF inflows that roped in fresh marginal demand. Similarly, contemporaneous market write-ups charted how steady ETF subscriptions created a near-term bid that interacted with the rate repricing to lift prices. You can see that narrative in contemporaneous reporting and price chronology here and in the recount of the post-drawdown reclaim documented by Bitcoin Magazine.

Why ETFs matter for price dynamics

Spot ETFs (examples: IBIT, FBTC and others) act as predictable, programmatic demand sources. When large asset managers buy ETF shares, their counterparties must obtain underlying BTC, which tightens spot liquidity and pushes prices higher. That programmatic behavior differs from one-off buyer behavior and can be modeled into forward-looking supply/demand frameworks — which is exactly what banks and allocators are doing when they produce multi-year upside scenarios.

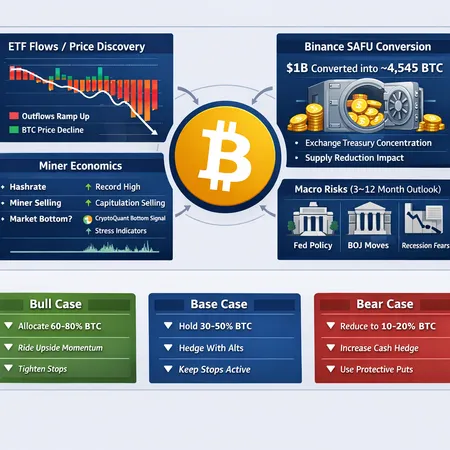

However, reliance on ETFs is a double-edged sword. Flows can go from tailwind to headwind quickly if sentiment reverses, or if redemptions accelerate during broader risk-off episodes. ETF-related 13F and institutional filings are therefore important early-warning signals that we discuss next.

13F filings and corporate holders: shifting exposures and market-structure implications

Recent reporting has put ETF managers and large institutional positions under a microscope via 13F disclosures. Coverage of ETF-related 13F scrutiny shows how institutional stakes in funds are evolving and how that affects market concentration and signaling. See this reporting for more context on the scrutiny into 13F filings and ETF stakes.

13F filings (quarterly disclosures for US institutional managers) reveal which firms hold which funds and, indirectly, the scale of concentrated exposures. Several structural implications follow:

- Visibility and signaling. When large managers appear in filings with growing ETF positions, other allocators read that as a validation and may follow, creating momentum.

- Concentration of demand. Larger, concentrated positions in ETFs or corporate treasuries increase the potential for a correlated sell-off if a few big holders need liquidity.

- Liquidity and market depth. Institutional participation generally improves liquidity under normal conditions, but it can also create brittle moments if mark-to-market pressures force rapid rebalancing.

A recent example: coverage showing how IBIT and other major ETFs are being scrutinized in relation to 13F positions indicates that institutional holdings are not static and that managers are actively rotating exposures. That rotation matters: the more BTC sits in ETF wrappers or corporate treasuries, the less is available to the marginal buyer or seller in the spot market.

Corporate holders and mark-to-market risk

Corporate treasuries and public companies that hold BTC (MicroStrategy is often cited in market commentary, though corporate positions vary) introduce a direct link between price moves and corporate balance-sheet strength. Mark-to-market losses or gains on crypto holdings can affect corporate decisions such as issuing equity, borrowing, or selling assets — creating potential feedback loops.

- Pros: Corporate and institutional holdings signal confidence and add a long-term bid.

- Cons: They can amplify sell pressure in a drawdown as CFOs manage liquidity and covenant risks.

This dynamic is why allocators should monitor not just headline ETF flows but also 13F filings and corporate treasury disclosures as a gauge of where supply is effectively locked up versus potentially forced onto the market.

Practical takeaways for allocators and long-term holders

Institutional bullishness is credible in its own terms, but it doesn’t make Bitcoin risk-free. Here are practical, actionable guidelines for asset allocators and intermediate investors who want to reconcile the big-picture institutional case with near-term macro and liquidity risks.

- Size thoughtfully. Treat initial allocations as a strategic exposure, not a tactical bet. Many institutions scale in over time; emulate that with phased purchases or dollar-cost averaging.

- Plan for liquidity events. Assume that in stress scenarios ETF flows can reverse and corporate holders may de-risk. Maintain liquidity buffers and set rebalancing rules tied to portfolio drawdowns rather than price thresholds alone.

- Use hedges where appropriate. Options and futures can protect large exposures, but they introduce basis and counterparty considerations. For allocators with public reporting obligations, structure hedges so they don’t trigger unwanted accounting consequences.

- Monitor ETF and 13F signals. Quarterly 13F filings, ETF weekly flows, and fund-level disclosures are a practical early-warning toolkit — especially when large managers materially change allocations.

- Match investment horizon to instrument. Spot BTC is a long-duration, high-volatility asset. If you need short-term liquidity for liabilities, don’t align that with a volatile allocation.

- Custody and operational risk. Institutional involvement increases the importance of custody choices, insurance, and governance. Bitlet.app and other custodial services illustrate how custody and product design matter when institutions take positions.

Reconciling bullish narratives with real risks: an honest assessment

Institutions are bullish because the structural case for Bitcoin — capped supply, growing adoption, and new distribution channels like spot ETFs — is credible and increasingly measurable. JPMorgan’s $266K scenario packages those factors into a high-upside equilibrium, but it is not a consensus forecast devoid of risk.

Short-term rebounds, such as the reclaim of $70K around CPI-driven rate repricing, show how macro variables and programmatic flows interact in powerful ways. Coverage connecting the CPI print and ETF flows to the rally helps explain the mechanics and reinforces why allocators should watch macro releases as much as on-chain indicators. See FXEmpire’s reporting on the CPI-and-ETF-driven move and the tracing of the $70K reclaim in reporting such as Bitcoin Magazine.

Finally, 13F filings and corporate treasuries matter because they change the effective float and create potential feedback loops. Institutional demand can be stabilizing when it’s patient, but it can also be brittle if leverage, mark-to-market, or redemption dynamics reverse.

Conclusion: a conditional optimism

Institutional bullishness on BTC is not blind faith — it’s a conditional optimism based on observable channels: ETF adoption, macro repricing (CPI and rates), and the evolving inventory held by corporates and funds. That optimism is real, but it carries conditions and caveats.

For allocators, the balanced approach is clear: respect the long-term structural case, but size, hedge, and maintain liquidity as if volatility and episodic reversals are the norm. Monitor ETF flows and 13F filings for changes in the institutional posture, watch macro data (especially CPI) for short-term catalysts, and use custody and governance best practices when building meaningful exposures.

Sources

- JPMorgan analysis on Bitcoin targets: https://ambcrypto.com/bitcoin-why-j-p-morgan-believes-that-btc-can-reach-266k-in-2026/

- FXEmpire on BTC surge tied to CPI and ETF flows: https://www.fxempire.com/forecasts/article/bitcoin-btc-surges-past-70k-as-inflation-cools-etfs-steady-1579605

- Coverage of ETF 13F scrutiny and IBIT stakes: https://coincu.com/news/bitcoin-etfs-see-scrutiny-as-avenir-13f-shows-ibit-stake/?utm_source=snapi

- Bitcoin Magazine recount of BTC reclaiming $70K: https://bitcoinmagazine.com/markets/bitcoin-price-reclaims-70000-after-feb