BNBChain

FXRP topping 100M and ~70% deployed into the XRPFi DeFi stack signals a new chapter for tokenized XRP in on‑chain markets. This article breaks down how FXRP works, its implications for liquidity and price discovery, composability risks, and tactical ideas for yield farmers and LPs.

A practical guide for builders and growth teams to harness TON and Telegram’s massive user base to scale consumer Web3 apps—covering product hooks, onboarding UX, monetization, developer tools, compliance pitfalls and a month-by-month growth playbook.

A pragmatic market narrative assessing whether SUI’s recent price compression and growing institutional ETF activity could spark a new macro wave—plus a technical and on‑chain guide to sizing positions and managing risk.

U.S. spot Bitcoin ETFs show roughly $53B in cumulative net inflows even as funds experienced meaningful short‑term outflows. This article explains the chronology, ETF mechanics, and practical sizing rules for portfolio managers and swing traders navigating ETF‑driven liquidity events.

Metaplanet’s recent run-in over its BTC buying and options program has exposed weak spots in disclosure practices and board oversight for companies with large crypto treasuries. This investigation breaks down the timeline, the mechanics of the strategy, comparable failures, regulatory lessons, and a practical governance checklist for public firms holding crypto.

Aave surpassing $1 billion in tokenized real‑world asset deposits signals a structural shift for DeFi, moving lending markets toward hybrid on‑chain/off‑chain capital and new counterparty models. This analysis explains tokenization mechanics, the risk and liquidity implications, regulatory considerations, AAVE token dynamics, and plausible 3–5 year adoption scenarios.

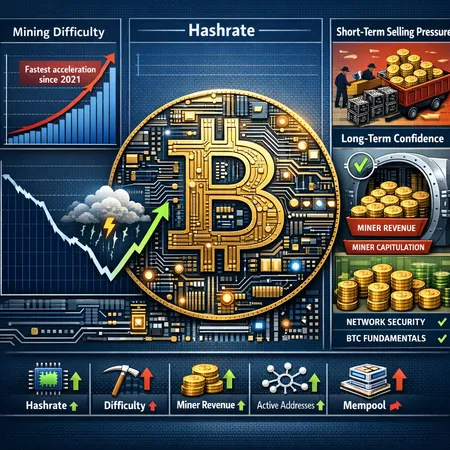

A rapid, record-setting jump in Bitcoin mining difficulty and a V‑shaped hashrate rebound signal shifting miner economics and stronger network security — but consequences for short‑term supply and price dynamics are nuanced. This explainer breaks down technical causes, miner behavior, on‑chain signals to watch, and practical trading/hedging takeaways.

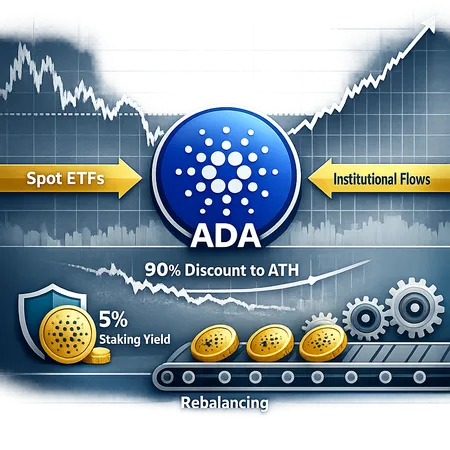

Cardano’s current valuation gap, staking utility, and improving market structure create a plausible pathway for ADA to attract institutional flows as spot ETFs broaden altcoin exposure. This article examines the mechanics behind that thesis, realistic upside, timeline, and a practical checklist for investors.

Ripple CEO Brad Garlinghouse’s 90% probability call on the CLARITY Act by April is a potential regulatory catalyst for XRP and Ripple’s stablecoin strategy. This piece breaks down the legislative timeline, market and legal consequences, RLUSD liquidity effects, and practical trade and risk-management frameworks.

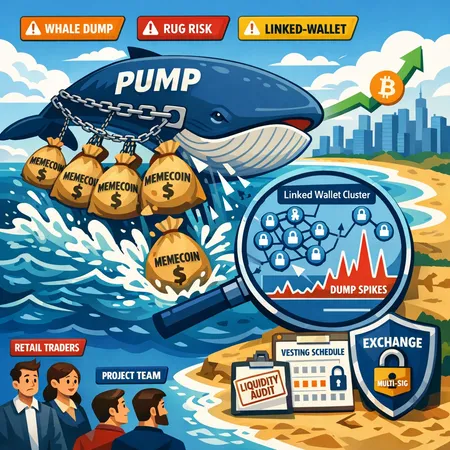

A recent linked-wallet dump of PUMP tokens exposed how concentrated tokenomics and coordinated wallets create asymmetric exit risk. This article explains how to spot linked-wallet behavior, practical safeguards for traders and projects, and market lessons as capital rotates toward Bitcoin.