Why GameStop Moved 4,710 BTC to Coinbase Prime — Custody, Selling Risk, and What It Means for Markets

Summary

Quick thesis — why this transfer matters

GameStop moved its entire 4,710 BTC treasury to Coinbase Prime in a single operation, a fact first reported in depth by CryptoNews and corroborated by other outlets. This is not a routine wallet-to-wallet shuffle: moving a corporate treasury from self-custody (or a different custodian) into Coinbase Prime carries both operational and signaling weight. For many traders, Bitcoin is still the primary bellwether; a move like this touches liquidity, custody dialogue, and investor psychology at once.

Timeline and chain facts

On-chain scanners flagged a coordinated transfer of 4,710 BTC from addresses tied to GameStop's treasury into Coinbase Prime. The initial reporting is available in CryptoNews' coverage of the transfer, with an alternative confirmation in CoinCu's write-up. Exact timestamps and the originating addresses were visible to blockchain watchers, and the move clustered into a set of large inputs rather than a protracted drip-sell.

Why the timeline matters: immediate, lump-sum transfers usually signal a planned custody action rather than organic trading activity. If GameStop intended to sell gradually on exchange order books without OTC support, we'd more likely have seen staged deposits or smaller transfers timed with liquidity windows.

Custody change vs. exit: how to read the move

Corporate treasuries move assets for several routine reasons; distinguishing intent requires context.

Custody change — the benign explanation

A move to Coinbase Prime can simply be a shift to an institutional-grade custodian. Prime custody offers the kinds of services public companies want: insurance frameworks, segregated storage, streamlined AML/KYC for counterparties, and direct access to OTC desks and settlement rails. For reconciliation, accounting, and audit purposes, firms often consolidate holdings with a single regulated custodian. Coinbase Prime is designed to serve institutional treasuries and offers features that make corporate treasury operations smoother.

Exit or liquidation — the riskier scenario

Conversely, transferring to an exchange-affiliated custody layer makes liquidation operationally trivial. If GameStop planned to convert BTC to fiat, Coinbase Prime gives immediate paths to OTC counterparties and on-exchange liquidity. Large, concentrated deposits on custodian platforms historically increase market anxiety about imminent selling, even when no ticket has been placed.

Balancing the two: timing, accompanying communications (SEC filings, press releases), and follow-on on-chain flows are the best clues. Without a concurrent SEC 8-K or Form 4-like disclosure mentioning a planned sale, the conservative base case is a custody consolidation. But markets price in asymmetric risk: one large corporate sell order can move price more than equal-sized buys spread across multiple whales.

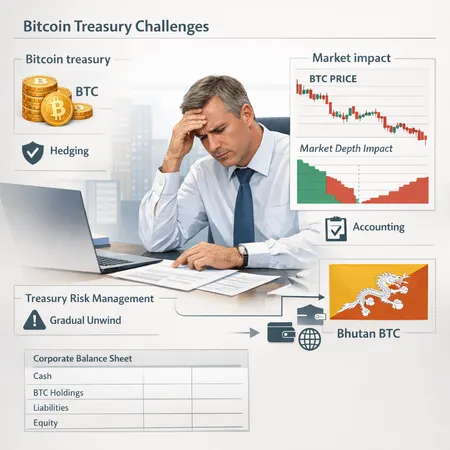

Coinbase Prime custody implications for corporate treasuries

Coinbase Prime is not the same as depositing funds on a retail Coinbase account. It's structured for institutions and public companies and offers:

- Segregated custody and insurance overlays for on-exchange balances.

- Direct access to Coinbase's OTC desk and liquidity providers.

- Trade settlement workflows, accounting reports, and connectivity to SWIFT or custodial fiat rails.

For a company like GameStop, the move reduces operational friction for hedging, borrowing against assets, or executing a sale with an institutional counterparty. It also lowers the friction cost of converting—or lending—BTC in ways that self-custody does not.

Short-term market signaling: liquidity and selling pressure

A concentrated transfer to Prime can be read by market participants as an increase in immediate sellable supply, even if no order has been placed. Why?

- Visibility: On-chain watchers and desks can detect the deposit and position the market accordingly. ETF managers, market makers, and OTC desks adjust risk exposure when large balances arrive at a centralized custodian.

- Liquidity matching: OTC desks can offer quotes quickly against large positions on Prime, enabling rapid block trades that bypass public order books but still extract liquidity from the market.

- Price impact asymmetry: A single large sell often causes sharper downside than equivalent buys distributed over time, because of depth and momentum effects.

But signal strength depends on what happens next. If the deposit simply sits awaiting legal paperwork, markets may shrug. If follow-up activity appears—order book hits, large OTC prints onchain-like settlement patterns—then the risk of price pressure rises.

ETF outflows and whale accumulation: how both can be true

At the same time GameStop moved BTC, US spot Bitcoin ETFs were seeing notable outflows, reported recently as the worst week in a year by CryptoNews. Simultaneously, blockchain-based data shows whale accumulation: large non-exchange wallets picking up significant amounts of BTC, as covered by Blockonomi.

These two trends are not mutually exclusive. They illustrate a classic market microstructure reality:

- Different actors, different objectives. ETFs are run by institutional asset managers with daily NAV considerations and redemptions; large whales (or strategic investors) operate on multi-week to multi-year horizons. ETF outflows reflect investor sentiment and liquidity needs; whale buying often reflects opportunistic accumulation or strategic reallocation.

- Execution channels differ. ETFs adjust via creation/redemption mechanisms and may route flows to OTC or exchanges, causing short-term pressure. Whales typically accumulate off-exchange or on-chain without engaging in public limit-order warfare that would flood order books.

- Timing and scale interplay. A corporate selling into a market seeing ETF redemptions could face worse execution, while whales might be picking up fragments on dips or using sophisticated execution to avoid front-running.

Net effect: spot ETF outflows can increase short-term selling pressure even while long-term holders are accumulating. That dynamic can magnify volatility—selling squeezing the market while patient capital picks up the pieces.

Tax, accounting, and regulatory considerations for corporate Bitcoin treasuries

Public companies are not free to treat crypto like a private HODL. There are multiple constraints and drivers:

- Accounting treatment. Many companies currently classify crypto as intangible assets under GAAP, which creates impairment risks on the balance sheet; fair-value accounting (as with securities) would change the P&L and tax outcomes. When a company moves to a custodian, auditors expect clear trails and documentation.

- Tax consequences. Converting BTC to fiat generates realized gains/losses. Corporates must factor in corporate tax rates, timing of recognition, and jurisdictional reporting. A block sale could create a large taxable event with predictable tax leakage.

- Disclosure and securities law. For listed companies, large balance changes or strategic shifts tied to material business decisions should be disclosed per SEC guidance. Sudden sales that materially affect enterprise value could invite questions from investors and regulators.

- AML/KYC and sanctions risk. Moving funds into a regulated custodian like Coinbase Prime facilitates compliance checks and reduces counterparty risk compared with obscure OTC channels.

For GameStop specifically, any sale would likely be choreographed with tax planning and investor communications in mind to avoid surprise governance scrutiny.

Practical trading and positioning scenarios for investors

Intermediate/advanced investors can prepare for multiple plausible outcomes. Below are tactical scenarios tied to probability buckets and suggested positioning and signals to watch.

- Custody consolidation (Base case): GameStop does not sell soon

- Signs: No large withdrawals from Coinbase Prime, no SEC filings, no big OTC prints reported.

- Strategy: Monitor on-chain flows and OTC market chatter. Maintain neutral to mildly bullish exposure to BTC; use options to hedge tail risk (e.g., buy puts with staggered maturities) rather than outright shorting.

- Controlled block sale via OTC (Medium probability)

- Signs: Sudden increase in OTC desk mentions, reports of large block trades, or coordinated off-exchange settlement activity. Coinbase Prime balance drops while exchange order books remain thin.

- Strategy: Avoid panic-selling. Consider buying volatility (long straddles) to profit from spikes, or scale into buys on confirmed washouts. Liquidity will likely be absorbed OTC, limiting extreme price crashes but increasing intraday volatility.

- Aggressive market sale onto public order books (Low probability but high impact)

- Signs: Large marketable sell orders appear on exchanges, order book sweeps, rapid exchange balance decreases.

- Strategy: If evidence shows execution on public books, expect sharp downward moves. Traders can short liquid derivatives with strict risk management, or buy deep OTM puts. Long-term investors may view price drops as accumulation points, but should be wary of tax/timing implications for corporate sales.

- Coordinated sale with ETF stress (Tail risk)

- Signs: Continued high ETF outflows combined with corporate selling—creates liquidity vacuum.

- Strategy: This is the most dangerous environment for price. Tactical defensive moves (hedging via futures, shifting to cash or stablecoins on margin) may be warranted. Long-term investors can keep buy-lists and allocate capital if on-chain accumulation by whales begins to accelerate post-dip.

Signals to watch in real time:

- Coinbase Prime balance change (custodian inflows/outflows). Large outflows after a deposit are meaningful.

- OTC desk rumors and reported block trades.

- ETF flows and AP creation/redemption notices (as reported by providers and analysts).

- On-chain movement from custodial to exchange hot wallets.

Why this matters beyond the immediate trade

A large public company moving a full treasury to an institutional custodian highlights several structural evolutions: corporate adoption of crypto is maturing, custodial services are becoming the plumbing of choice for treasurers, and market microstructure remains fragile when large positions concentrate in a few execution channels. The episode is instructive for reporters and investors tracking corporate crypto strategy and for platforms such as Bitlet.app that serve retail and institutional users navigating these dynamics.

Bottom line

The default read of GameStop's transfer should be operational: a custody consolidation that prepares the company for easier management, settlement, or potential future transactions. But in markets, perception often matters as much as fact. The timing amid ETF outflows and whale accumulation increases short-term uncertainty and potential volatility. Traders should track custodial flows, OTC desks, and ETF reports closely; long-term investors should remember the tax and disclosure constraints that make immediate corporate liquidation less trivial than an on-chain deposit might suggest.