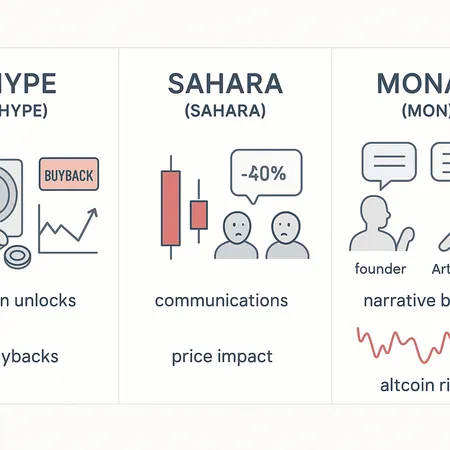

Token Unlocks, Buybacks and Team Communication: Case Studies of HYPE, SAHARA and MON

Summary

Why token unlocks, buybacks and communications matter

Token unlocks are one of the clearest scheduled shock events in crypto markets: they change the immediate supply dynamics and often act as catalysts for repricing. But unlocks are just one piece of the puzzle—how teams respond, how transparent they are, and how markets interpret narratives matters as much as the raw numbers. For many traders, DeFi and altcoin stories revolve around the interplay of liquidity, concentrated supply and sentiment. In short, token unlocks expose both technical vulnerabilities and communication strengths.

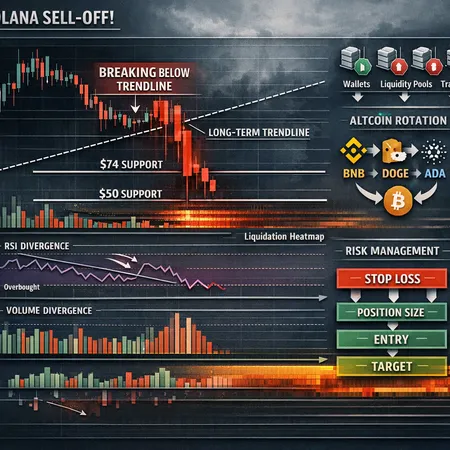

Case study 1 — HYPE: a large unlock met with buybacks

Hyperliquid (HYPE) faced a materially large scheduled token unlock that, on paper, should have increased selling pressure and weighed on price. Coverage ahead of the event highlighted the scale of the unlock and warned about potential supply dilution. Coinspeaker outlined the mechanics and market concern around the major unlock, framing it as an inbound sell event that markets needed to price in.

However, the project executed a notable buyback program during the same window. AmbCrypto reported that HYPE’s monthly buyback at times outpaced the selling pressure generated by unlocked tokens, producing a countercase to the usual narrative that unlocks always drive immediate dumps. On-chain flows showed token movement from vesting contracts to market addresses, but the offsetting buybacks absorbed a portion of the sell-side liquidity. The net result was far less severe price impact than many expected—not because unlocks ceased to matter, but because the project used balance-sheet tools to change the effective supply shock.

Key takeaways from HYPE: scheduled unlocks are predictable, but price impact depends on the relative size of buybacks, OTC absorption, and available liquidity. When projects disclose buyback mechanics in advance and execute them visibly, that can materially reduce panic selling.

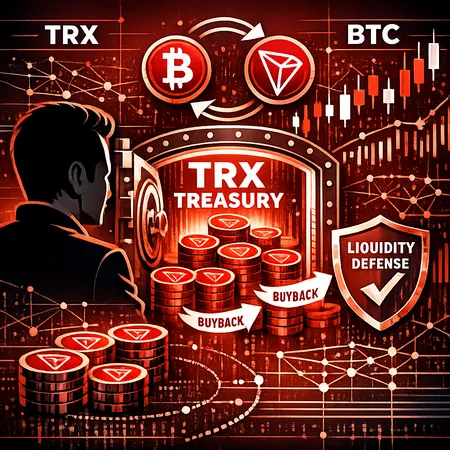

Case study 2 — SAHARA: a 40% plunge, denial, and the psychology of panic

Sahara‑AI (SAHARA) presented a different dynamic. The token fell roughly 40% in a short span while the team simultaneously denied any on‑chain security breach. Blockonomi’s reporting captured how the price moved faster than the facts and how market participants interpreted limited communication as a signal of deeper problems. The core lesson here is timing and clarity in communications.

When a large price move happens and the team quickly issues a denial, investors parse two things: the content of the message and the credibility of the messenger. Denial without transparent, verifiable on‑chain evidence (e.g., address audits, transaction traces, multisig confirmations) often fails to calm markets, because rumor and fear travel faster than forensic clarity. In SAHARA’s case, the swift plunge suggested traders were reacting to observable outflows and order‑book weakness more than a confirmed exploit, meaning the denial mattered but only after on‑chain signals were examined and corroborated.

This episode underscores how communications must be paired with verifiable on‑chain data to restore confidence. A calm, detailed update that points to specific transactions or third‑party audit results helps; a short tweet or blanket denial rarely does.

Case study 3 — MON: narrative battles and valuation swings

Monad’s (MON) episode shows that high‑profile narratives can be as influential as on‑chain mechanics. When Arthur Hayes publicly predicted a near‑total crash for MON, the claim injected a potent narrative into the market. The Monad CEO pushed back forcefully, as covered by Blockonomi, turning the story into a public spat. That back‑and‑forth became a lens through which traders reassessed risk.

Narrative battles operate on reputation, not just numbers. A respected commentator’s bearish claim can trigger short sellers, social contagion and headline-driven stops; a founder’s rebuttal can rally supporters and lead to buybacks, token burns, or on‑chain proof meant to disarm the critic. In MON’s case, the founder’s response served to counterbalance the bearish narrative, restoring some investor confidence in the short term. But the episode also raised longer‑term questions about credibility: repeated narrative firefights can increase perceived governance risk and ultimately dampen the valuation multiple that market participants are willing to pay.

The MON example demonstrates that communication is dual‑edged: it can quickly reverse sentiment, but it also places the team under lasting scrutiny. Investors should therefore treat public spats as signal events that change the risk profile of a token.

Comparative analysis: common patterns and where these cases diverge

Across HYPE, SAHARA and MON we see a handful of recurring themes:

Supply shock vs. absorption: HYPE’s buybacks show that supply shocks can be offset if there is credible, sufficiently large absorption. Buybacks change effective circulating supply and can buy time for markets to recalibrate. By contrast, SAHARA’s price move was driven more by fear and visible outflows than by a predictable supply schedule.

Speed of information vs. speed of execution: markets move before teams can fully verify issues. SAHARA’s denial arrived after the price had already reflected panic; HYPE’s buybacks were proactive and thus more effective.

Narrative contagion: MON highlights how influential voices and public disagreements can cause volatility regardless of fundamentals. Narrative risk is especially potent in low‑liquidity tokens where a small bandwagon can dramatically change order books.

Credibility and repeatability: a single well‑executed buyback or clear communication helps; a pattern of evasive or inconsistent comms degrades future credibility and increases altcoin risk premiums.

These differences matter for price impact calculations. An investor modeling the short‑term effect of an unlock should weigh not only the unlocked amount and current liquidity, but also the probability and capacity of offsetting actions (buybacks, OTC agreements, community treasuries) and the team’s communication track record.

Practical due‑diligence playbook for unlock events and team credibility

Below is a checklist and playbook designed for altcoin investors and risk analysts to use ahead of scheduled unlocks or high‑stress scenarios:

Read the vesting schedule and map dates to on‑chain addresses. Confirm which addresses hold vested tokens and whether they are multisig or controlled by a single key. If addresses are unknown, treat that as higher risk.

Measure market depth and liquidity. Quantify how much sell volume the order book can absorb before a meaningful price move. Use both centralized exchange order books and DEX liquidity pools. Low depth + large unlock = high price impact.

Assess the team’s financial capacity to absorb supply. Does the project hold a treasury denominated in stablecoins or BTC/ETH? Can it credibly execute buybacks without crippling operations? HYPE’s case shows buybacks can be effective—but only if adequately funded and executed transparently.

Review communication history. Score past responses for speed, transparency and verifiability. Has the team provided on‑chain evidence before? Do they work with auditors and reputable third parties? SAHARA’s episode illustrates that denials without evidence rarely stop panic.

Track social and narrative risk. Monitor high‑reach commentators, community sentiment and potential short‑seller interest. Narrative attacks (like the Hayes‑MON exchange) can amplify moves even when fundamentals are stable.

Watch on‑chain flows in real time. Look for transfers from vesting contracts to exchange addresses, and monitor large bids that might indicate OTC absorption. Publicly visible buybacks (wallets purchasing on DEXes) are a positive signal.

Prepare trade tactics: stagger exits, use limit orders at multiple levels, hedge using options or inverse products where available, and avoid being first‑out during panic.

Beware of optical fixes. Announcements of future buybacks or burns are good, but immediate, verifiable action matters more than plans promised for weeks away.

Platforms that aggregate vesting and on‑chain activity can shortcut this work; services such as Bitlet.app and other analytics tools help investors surface risk before it becomes a headline.

Final takeaways for investors and risk teams

Token unlocks are predictable events but unpredictable in their market outcomes. The three cases studied here show that: (1) proactive, well‑funded buybacks can materially blunt selling pressure (HYPE); (2) rapid, verifiable communications that point to on‑chain evidence are critical to stopping panic (SAHARA); and (3) narrative battles can shift valuations independent of fundamental metrics, especially in low‑liquidity tokens (MON).

For an investor, the core playbook is simple: quantify the supply shock, measure liquidity, validate the team’s capacity and credibility, and monitor narrative vectors. Treat communications as part of the asset’s fundamentals—because in crypto markets they increasingly are.

Sources

- Only 23%? Hype dumped — assessing Hyperliquid’s future post $9.5B token unlock (AmbCrypto)

- 60M HYPE token unlocking — major sell event inbound (CoinSpeaker)

- Sahara‑AI token plunges 40% as team confirms no security breach (Blockonomi)

- Monad CEO fires back after Arthur Hayes predicts 99% token crash (Blockonomi)