Buybacks

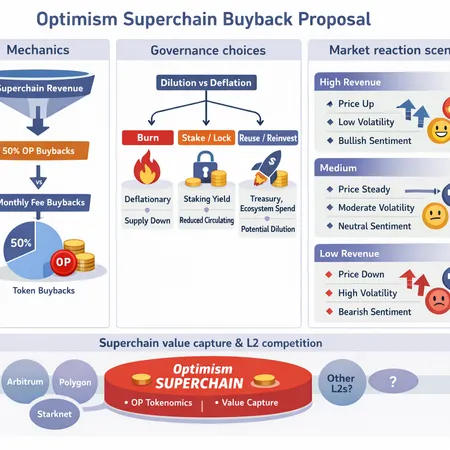

Optimism’s proposal to route Superchain revenue into OP buybacks forces a choice between steady supply-sink mechanics and flexible treasury policy. This deep-dive explains the buyback mechanics, compares a 50% revenue rule vs monthly fee-based buys, and outlines governance trade-offs — burn, stake or reuse — plus market scenarios and competitive implications for L2 value capture.

Recent disputes at Aave and Jupiter expose recurring governance failure modes — from brand/front-end control to buyback trade-offs. This article extracts practical fixes for DAO operators, governance researchers and tokenomics designers to harden DAOs against similar crises.

Structured buybacks have become a defining mechanic for some Solana meme tokens. This feature dissects how Pump.fun’s PUMP buybacks moved price and liquidity, measures scale, and gives a practical due-diligence checklist for retail investors and community managers.

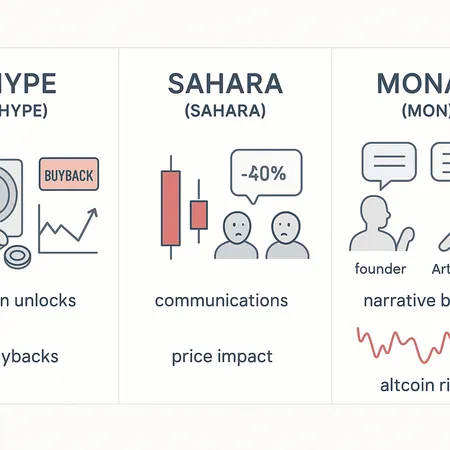

Token unlocks often reshape altcoin markets—this case study compares HYPE’s buyback response, SAHARA’s panic-driven plunge, and MON’s public narrative clash to extract a practical due-diligence playbook. Learn how unlock schedules, on‑chain signals and team communications change price impact and altcoin risk.

DeFi

All DeFi postsBitcoin

All Bitcoin postsLiquidity

All Liquidity posts- How US–Israel Strikes, an Oil Shock, and Strait of Hormuz Risk Are Roiling Bitcoin — What Traders Should Watch

- How U.S. Spot Bitcoin ETF Inflows Are Changing BTC Price Discovery and Liquidity

- Bitcoin's Tug-of-War: ETF Inflows Lift BTC to ~$68–70K — But Liquidity and a Multi‑Billion Options Expiry Threaten Volatility