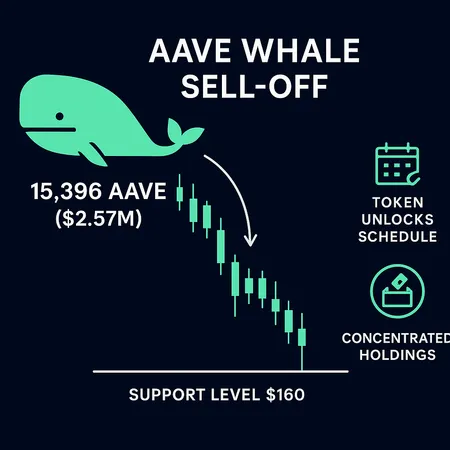

Aave whale capitulation: quantifying the 15,396 AAVE sell and what it means for $160 support

Summary

Executive snapshot

A large on-chain transfer of 15,396 AAVE — exchanged for roughly $2.57M at the time of sale — was moved to an exchange and appears to have been sold, a move that coincided with renewed pressure on the $160 technical support level. While the raw token quantity equals only a fraction of AAVE’s total supply, the psychological and liquidity impact can be outsized during thin market conditions. Ambcrypto flagged this specific whale sale and warned that the $160 support is in danger after multi-day declines, and broader token unlocks in the calendar may create compounding sell pressure.

For DeFi traders and governance participants, the core question is not whether one whale can break AAVE alone — it's whether this sale is a leading indicator of coordinated exits, amplified by scheduled unlocks and holder concentration. This note quantifies the move, assesses technical risk (the $160 level), outlines amplification mechanisms (concentration + unlocks), and recommends monitoring and governance responses.

Quantifying the 15,396 AAVE sale: scale and market impact

15,396 AAVE for $2.57M implies an average execution price around $167 per AAVE, which sits uncomfortably close to the $160 support level on many timeframes. Put another way, that quantity represents roughly 0.1% of AAVE’s maximum supply (16M) and on the order of 0.12–0.15% of commonly cited circulating-supply estimates (circulating supply varies with burned/vested tokens). Those percentages sound small — but context matters:

- Liquidity concentration: AAVE’s order books and liquidity pools are thin beyond near-market prices; a $2.5M takedown can noticeably move spot on low-volume days.

- Market psychology: Large transfers to exchanges are a visible on-chain signal that routinely triggers algorithmic and discretionary selling.

- Execution footprint: If executed as aggressive market sells, the price impact is front-loaded — the first portion of the sale extracts most liquidity and pushes price toward critical supports.

Ambcrypto’s coverage of the transfer highlights the immediate technical risk to $160 support, which had already been tested by multi-day declines and thinning bids.

Technical landscape: why $160 matters now

$160 is important because it has acted as a recent local floor on multi-day charts and anchors market expectations for short-term buyers. If price re-tests $160 on elevated volume and fails, the next bulls will be reluctant to step in without clear buying conviction.

Key technical observations traders should use to decide posture:

- Volume-confirmed break: A breach of $160 on higher-than-average daily volume suggests forced selling; if the break happens on low volume, it can be a liquidity vacuum move rather than a flood of sellers.

- VWAP / EMA clusters: Watch 20–50 EMA and the daily VWAP — sustained price below these indicates momentum has shifted to bears.

- Support confluence: A clear close below $160 with no intraday recovery typically invites stops clustered beneath that level, increasing downside velocity.

Ambcrypto’s reporting aligns with this view: multi-day declines reduce the margin for error, and a visible whale sale near this zone increases the probability of a decisive move lower.

Concentration + token unlocks: compounding downside risk

Two structural amplifiers can convert an isolated sale into a cascade:

Holder concentration: When a meaningful share of circulating tokens sits with a relatively small cohort of wallets, coordinated or coincident selling exerts disproportionate pressure on spot liquidity. Monitor the top-10/top-100 holder share and large holder transfer patterns; even small percentage moves from those wallets can equal multiple days’ trading volume.

Token unlock schedules: Scheduled vesting and unlocks add predictable supply to markets. Recent coverage of December unlocks notes a sizable batch of tokens being freed across DeFi projects, and while Aave-specific unlocks may vary, the broader DeFi unlock environment increases the probability that buyers step back awaiting fresh sell-side supply (Ethena-led $218M unlocks coverage). When unlock windows and whale sales overlap, market makers widen spreads and reduce committed bids.

Put simply: a 15k AAVE sale might be noise in normal conditions, but in a window of high unlock activity and concentrated holders it becomes a catalyst.

Signals traders should monitor (short-term risk assessment)

Active DeFi traders should put a small signals dashboard in place; watch these on-chain and market metrics in priority order:

- Exchange inflows: Sudden transfers of >5–10k AAVE to centralized exchanges in a 24h window are a red flag. The whale transfer of 15,396 AAVE is a clear example — treat repeats similarly.

- Exchange netflow (24–72h): Sustained positive netflows (more AAVE into exchanges than out) are correlated with price pressure.

- Order book depth and bid density around $160: Shallow bids below $160 increase break probability; measure depth depletion against average trade size.

- Volume-on-break: A confirmed break of $160 with volume >1.5x 30-day average increases odds of follow-through.

- Large-holder transfer clustering: Multiple large wallets moving tokens to exchanges or new custody within days is an early warning.

- Derivatives skew and open interest: Rising short interest and negative funding rates increase the speed of downside moves and can trigger liquidations.

- Safety Module / staking changes: Declines in AAVE staked in the Safety Module reduce systemic buy-side cushions.

Practical trader heuristics:

- Flag 15k+ exchange inflow as a >=2/5 risk signal; multiple such inflows within 48 hours upgrades the risk to 4/5.

- Hedge if price is below $160 on volume-confirmed break — prefer time-limited hedges (1–4 week) unless structural signals worsen.

Governance actions governments (DAO) should consider to shore up confidence

Governance faces a trade-off: stabilizing price without undermining decentralization or future liquidity. Recommended short-term and medium-term responses:

Short-term, non-dilutive measures

- Transparency & communication: Quickly publish an on-chain/DAO update explaining protocol health, treasury positions, and exposure. Clear communication reduces rumor-driven sales.

- Liquidity signaling: Use treasury-owned stablecoins or multi-sig funds to provide temporary liquidity to AMM pools (not direct market ops) via concentrated liquidity incentives; this can narrow spreads.

- Incentivize staking: Temporarily increase Safety Module or staking incentives to encourage capital to sit off-market and reduce available float.

Medium-term policy options

- Review vesting/unlock cadence: While changing contractual unlocks retroactively is fraught and often infeasible, governance can design future allocations with longer cliffs or gradual release to smooth supply shocks.

- Buyback framework: Debate a capped, transparent buyback-funded stabilization plan that uses non-operational treasury assets under multi-sig and DAO oversight. Make buybacks rule-based and time-limited to avoid moral hazard.

- Emissions and liquidity mining tweaks: Redirect incentives toward deeper pools and longer lockups to increase organic liquidity.

Governance must avoid knee-jerk centralization. Any intervention should be discussed publicly and follow pre-agreed treasury guardrails to preserve trust. For DAO voters, proposals that increase transparency and non-dilutive stabilization will generally garner more support than abrupt token-policy changes.

Tactical hedging and trade ideas for short-term traders

- Protective hedges: Buy short-dated puts or use short perpetual futures sized to portfolio exposure. Keep hedges timeframe-aligned with expected unlock windows.

- Relative trades: If AAVE’s implied volatility is rising out of proportion to realized, consider selling premium vs. hedging delta; else, long protection is cleaner.

- Liquidity-provision with caution: Provide concentrated liquidity above $160 (where you believe buys have value) and avoid deep in-the-money commitments that would force concentration below support.

Sizing guidance: keep hedge sizes proportional to downside risk — avoid full hedges unless you expect a multi-week structural downdraft. Many traders choose a 25–50% hedge of notional exposure while monitoring on-chain sell signals.

Putting it together: is this capitulation or noise?

A 15,396 AAVE sale alone is not proof of wholesale capitulation. Numerically it’s a small slice of total supply. But context matters: executed into thin liquidity near a tested support the move becomes a catalyst. Add nearby token unlocks, concentrated holder distribution, and risk-averse market participants — and a single whale sale can transform into a multi-day downtrend.

For traders, the difference between noise and capitulation will be clear within 24–72 hours by watching exchange inflows, volume on support tests, and other whale movements. For governance, the immediate priority should be transparency and confidence-building measures that do not erode long-term decentralization.

If you use Bitlet.app or other tools, integrate exchange inflow alerts and on-chain large transfer monitors into your dashboard — early signals are the most actionable.

Conclusion: disciplined monitoring and proportionate governance

- The 15,396 AAVE / $2.57M sale is meaningful tactically, not existentially. It threatens $160 support primarily because of market context: thin liquidity and an active unlock window.

- Traders should monitor exchange inflows, volume-confirmed breaks of $160, orderbook depth, and derivatives skew; use time-limited hedges if multiple risk signals trigger.

- Governance should prioritize transparency, temporary non-dilutive confidence measures, and longer-term adjustments to vesting and incentive design to reduce future shock vulnerability.

A measured, rules-based response from both traders and governance will limit knee-jerk reactions and help the market price AAVE more fairly as new information (unlock schedules, holder behavior) arrives.