Shiba Inu’s SOU Recovery Goes Live: How Recovery NFTs Convert Claims and What Comes Next

Summary

Executive overview

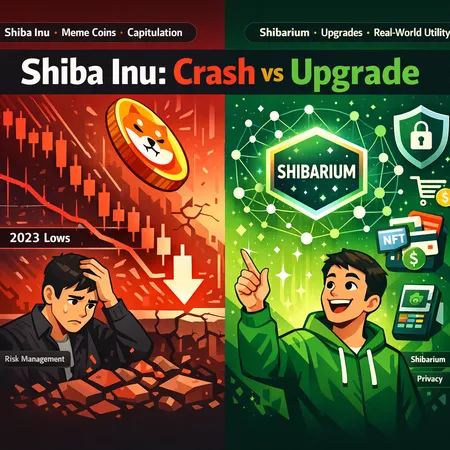

Shiba Inu’s SOU recovery framework has gone live to manage claims tied to the Shibarium bridge exploit. Rather than pursuing only off-chain reimbursements or centralized clawbacks, the team is issuing recovery NFTs—on-chain representations of exploit claims that are transferable, auditable, and tradable. This is a significant shift in how a large community token attempts post-exploit remediation, and it offers lessons for security teams and token communities across the space.

Two immediate reporting angles capture the moment: the launch announcement that the system is live and early market reaction as price dynamics digest the news. For background reading, see the launch coverage at Bitcoinist and market commentary observing momentum shifts after the rollout.

How the SOU recovery NFT mechanism converts claims into on-chain assets

At a conceptual level, the recovery-NFT approach tokenizes a claimant’s right to remediation. Instead of an off-chain IOU, the project mints a non-fungible token containing machine-readable metadata: claim ID, claimant address (or anonymized proxy), nominal value, settlement schedule, and any conditions (vesting, swap windows, dispute windows).

Key functional properties of such an NFT:

- Transferability — the NFT can be sold on a secondary market, turning an illiquid claim into a liquid instrument (though often at a discount).

- On-chain provenance — every step (mint, transfer, burn, redemption) is recorded, increasing transparency for the community and auditors.

- Composable tooling — depending on design, NFTs can be wrapped, fractionalized, or used as collateral in other protocols.

The Bitcoinist coverage of the rollout frames the SOU recovery system as production-ready to handle bridge-exploit claims, confirming that the mechanism is not experimental code in a repo but an operational tool being used in live remediation.

Important caveat: the recovery NFT is a procedural vehicle, not an assurance of full-value restitution. The NFT represents a claim; its market value will reflect perceived recoverability, project creditworthiness, and liquidity conditions.

Potential outcomes for affected users

- Faster liquidity through secondary markets

Affected users who need immediate value can sell recovery NFTs to market makers or other buyers. That converts a delayed, uncertain payout into available capital. But expect wide bid-ask spreads: claim tokens typically trade at a discount proportional to risk and time to settlement.

- Option to hold and redeem

Users who trust the remediation process or believe in long-term recoupment can hold the NFT and redeem when the protocol honors claims. This preserves upside if the project secures sufficient recoveries or settlements.

- Exposure to market and counterparty risk

Selling to speculators or market makers transfers recovery risk to those buyers. If the marketplace is thin, users may receive steeply discounted offers or face liquidity dry-ups.

- Behavioral and moral-hazard effects

Knowing claims can be sold may change claimant behavior: some will monetize immediately; others may shop claims to specialized recovery funds. This can be positive (distributes risk) but may also create incentives for opportunistic claim-chasing and litigation.

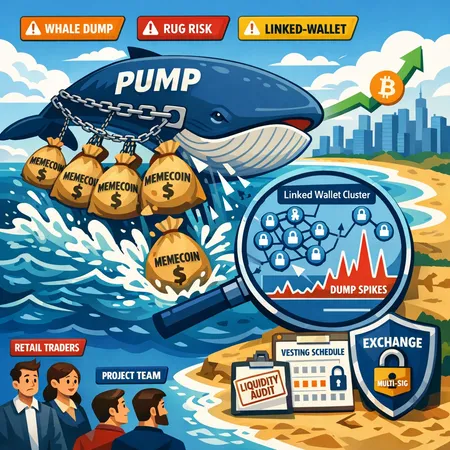

Ecosystem impacts: liquidity, price mechanics and market health

Issuing recovery NFTs introduces new on-chain supply dynamics. If many claimants sell into spot markets or convert proceeds to protocol tokens (e.g., SHIB), there may be short-term selling pressure. Market participants will price in the expected recovery fraction, legal costs, and timing uncertainty.

Liquidity intermediaries (OTC desks, NFT marketplaces, dedicated recovery funds) will likely emerge. Their willingness to pay is a function of legal clarity, enforceability of recovery, and the protocol’s capital resources. Without committed liquidity or a buyback program, recovery-NFT markets can become highly discounted and volatile.

Not all outcomes are negative: a transparent on-chain claim market can attract specialized capital that accelerates restitution. For community managers, supporting orderly markets (e.g., bonding liquidity, staged buybacks, or limit order facilities) reduces price shocks and reputational damage.

Legal recourse, compliance and enforceability

Turning claims into NFTs compresses remediation logic into on-chain artifacts, but it does not erase off-chain legal complexity. Questions that teams must clarify in documentation and terms of service include:

- What legal rights does NFT ownership confer (assignment of claim, agency to pursue recovery, or simply a redeemable voucher)?

- Are there KYC/AML implications for transferring claims, especially if recoveries involve fiat or centralized counterparties?

- How are disputes handled when claim ownership changes hands mid-dispute?

Because NFT-based claims cross technical and legal domains, projects should involve counsel early and make the legal nature of the NFT explicit in metadata and public FAQs. This reduces buyer uncertainty and supports higher market valuations.

Trust, governance and community perception

On-chain remediation like SOU can restore trust by making the remediation process auditable and systematic. It signals a willingness to put remediation mechanisms on-chain rather than behind opaque, ad hoc decisions.

However, transparency can cut both ways. Clear rules and visible transfers raise expectations; any deviation or slow execution will be highly visible and potentially damaging. Community managers should coordinate communications, maintain an on-chain activity dashboard, and explain timelines and prioritization to prevent rumor-driven volatility.

The market commentary that followed the SOU rollout also shows a second-order effect: trading momentum can slow as the community digests remediation mechanics and the market tests technical resistance levels. For a short-term picture of price reaction, see the technical note in U.Today discussing SHIB momentum during the recovery rollout.

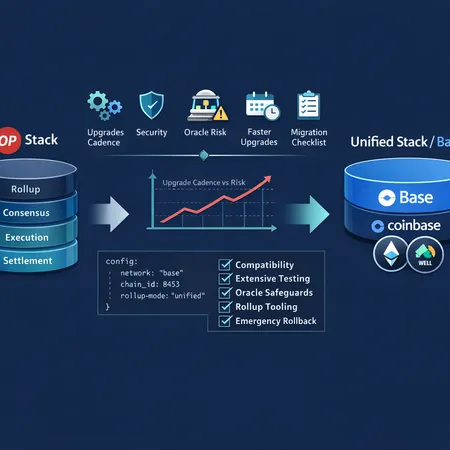

How this fits into bridge-security and post-exploit best practices

The SOU recovery model sits between two remediation poles:

- Centralized restitution (project-funded reimbursements or clawbacks) — fast, but requires trust in the team and centralized treasury control.

- Insurance/third-party coverage — outsourced risk but depends on coverage limits, claims process and insurer appetite.

On-chain claim tokenization is a hybrid: it preserves decentralization and auditability while enabling market-based risk distribution. Best practices when adopting this pattern:

- Define standardized claim metadata so tokens are machine-readable and composable.

- Publish a clear settlement roadmap with milestones, funds allocation and fallback mechanisms.

- Add governance guardrails (voting windows, multisig thresholds) to prevent unilateral changes that hurt claim holders.

- Engage with legal advisers to clarify claim transferability and representation.

This approach does not replace secure bridge engineering. Preventive controls remain top priority: audited contracts, timelocks, monitoring agents, and conservative cross-chain messaging designs. Remediation mechanisms are mitigation, not a substitute for hardened security.

Practical checklist for product and security teams

- Metadata standardization: include claim amount, timestamp, dispute window, and settlement priority in NFT metadata.

- Legal clarity: publish contract terms and a legal opinion on transferability and assignment.

- Market support: seed a liquidity pool or arrange OTC counterparties to reduce discounting.

- Governance transparency: set immutable rules for redemptions or upgrades to avoid surprise forks of claim logic.

- Audit and monitoring: third-party audit of the minting/redemption contracts and a public dashboard tracking outstanding claims and redemptions.

- Communications playbook: prepare templated updates for claimants, marketplaces, and token holders.

- Anti-abuse controls: consider KYC for large transfers or thresholds to mitigate sanction risk and money-laundering concerns.

Conclusion: an experiment worth watching

Shiba Inu’s SOU recovery rollout is an important case study in on-chain remediation. By converting bridge-exploit claims into recovery NFTs, the project has created a transparent, tradable vehicle to distribute risk. The model brings clear benefits—liquidity pathways, auditability and composability—but also introduces market, legal and governance complexities that teams must anticipate.

For community managers and security-focused product teams, the practical takeaway is that recovery-NFTs can be a powerful tool in the post-exploit toolbox, provided they are launched with standardized metadata, legal clarity, committed market support and strong communication. The broader lesson for the DeFi and bridging ecosystem is that remediation design deserves as much engineering care as the security controls that aim to prevent exploits in the first place.

Bitlet.app users and other market participants should watch how claim trading, discounting and redemption play out in the coming months to assess whether this approach becomes a repeatable industry pattern.

Sources

- Shiba Inu’s SOU recovery system goes live — Bitcoinist

- Shiba Inu momentum slows as price tests 200 EMA resistance — U.Today

For context on cross-chain and native DeFi interactions, see reporting about bridging and recovery mechanics across the broader DeFi ecosystem.