Shiba Inu’s Road to 2026: Security, Burns, Futures Outflows and Whether Tokenomics Can Restore Momentum

Summary

Shiba Inu’s position today: narrative versus reality

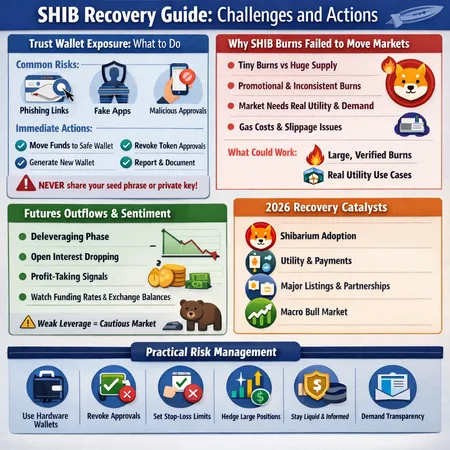

Shiba Inu (SHIB) remains one of the most discussed memecoins in crypto — driven as much by community narrative as by on-chain mechanics. That visibility helps, but it also magnifies downside when security flaws or market structure stresses emerge. Ahead of any 2026 recovery thesis, holders need to separate hope from the technical and operational facts: wallet security, token burn mechanics, and derivatives flows are the immediate levers that will determine short-term resilience.

For many traders, Bitcoin still sets macro risk appetite, but memecoins like SHIB react faster to micro events — hack reports, one-off burns, and big futures liquidations can move the price sharply and sustainably.

The Trust Wallet exposure: what happened and why it matters

A recent report detailed how a Trust Wallet-related exposure put SHIB holders at risk, highlighting pockets of compromised keys and unsafe flows into third-party dapps (Coinpaper report). The core issue in many of these incidents is not the blockchain itself; it’s compromised private keys, loose approval permissions, malicious dapp interactions, or poor seed phrase hygiene.

Immediate actions every SHIB holder should take now

- Revoke suspicious approvals. Use Etherscan or a revocation tool to list and cancel token approvals. Approvals allow contracts to move tokens; revoking is fast and effective.

- Move high-value holdings to a new seed/hardware wallet. If you suspect exposure, create a brand-new wallet (preferably hardware) and transfer assets. Never import a seed phrase into untrusted software.

- Update and audit wallet apps. Keep Trust Wallet and any mobile apps updated, and only download from official stores.

- Check transaction history for strange activity. If you see unknown outgoing transactions, act.

- Limit dapp interactions and use a burner wallet. Interact via a separate small-balance wallet to avoid exposing core holdings.

- Consider multisig for community treasuries. This prevents single-key failures from draining shared funds.

Does the SHIB project or ecosystem offer hack compensation? Historically, memecoin projects rarely provide centralized compensation; reimbursements typically require on-chain governance, a treasury with discretion, or third-party insurance. Expect limited or no blanket compensation. Instead, focus on preventive measures and community-level funds that have clearly defined multisig controls.

Token burn: recent numbers and why tiny burns didn’t change the burn rate

There was a headline-grabbing burn of 1,000,002 SHIB in a short window, but deeper metrics show the burn rate actually fell afterward (U.Today burn report). Why the disconnect?

- Absolute vs. relative burns. Burning a million tokens may sound large, but SHIB’s circulating supply is in the hundreds of trillions. Small absolute burns register as noise when compared to supply scale.

- One-off versus sustained burns. A single transaction is PR-friendly, but market impact requires continual, protocol-level removal — recurring burns, exchange-led burns, or deflationary mechanics built into transactions.

- Off-chain sinks vs on-chain visibility. Some burns are cosmetic (tokens sent to dead addresses) and don’t affect token distribution patterns like centralized exchange balances or large whales who can reintroduce supply.

Tokenomics fixes that could make burns meaningful include: built-in transaction burn rates, buyback-and-burn programs funded by treasury revenue, or locking mechanisms that slowly reduce circulating supply. Any meaningful change needs clear governance, fund sources and long-term commitment — not a single viral burn tweet.

Futures outflows: leverage, sentiment and short-term mechanics

On-chain data has pointed to significant futures and derivatives outflows related to SHIB, signaling deleveraging and large liquidation events in the derivatives market (U.Today derivatives outflow analysis). What does this imply for short-term price action?

- Deleveraging lowers bid-side liquidity. Large outflows typically mean traders are closing longs or getting liquidated. That removes immediate buying pressure and can cascade into spot sell pressure as margins are met.

- Funding rate and sentiment feedback loops. Negative funding rates and heavy outflows feed bearish sentiment; algos and funds respond quickly.

- Concentration risk. If a small number of whale accounts or desks controlled a lot of leverage, their exits can cause outsized price swings.

For retail holders, the takeaway is that heavy derivatives flows make short-term moves more violent and less predictable. A narrative-driven pump can still occur, but sustaining gains against a background of deleveraging is harder.

Roadmap and institutional catalysts for 2026 — how realistic are the claims?

There are bullish takes that roadmap advances or institutional interest could change SHIB’s trajectory into 2026 (Coinpaper roadmap piece). Possible catalysts some analysts point to include improved Layer-2 infrastructure (e.g., Shibarium adoption), higher-profile listings, or institutional on-ramps.

Assessing realism:

- Tech upgrades matter, but adoption is the real test. Shibarium or other tooling must drive active use cases that lock or burn tokens — simple deployment alone won’t move markets.

- Institutional interest is possible but conditional. Institutions look for liquidity, custody solutions, and clear regulatory/compliance signals. Memecoins rarely meet these criteria unless they evolve into utility-rich tokens or are bundled into diversified baskets.

- Narrative durability is fragile. Memecoins rely on social momentum. To convert hype into sustainable value, tokenomics must be credible (consistent burns, transparent treasury rules) and governance must limit free-riding or single-actor control.

In short, a 2026 recovery is possible but far from guaranteed: it requires persistent on-chain use, meaningful tokenomic adjustments, and improved market structure — not only a few headline burns or roadmap promises.

Practical risk management for retail holders and community managers

Short-term technical and security risks require tactical responses. Below are practical, prioritized steps:

For retail SHIB holders

- Harden wallet security. Move significant balances to a hardware wallet; revoke approvals from dapps; use a fresh seed for any wallet you suspect has been exposed.

- Size positions for volatility. Treat SHIB as a high-volatility memecoin — keep position sizes small relative to your total portfolio.

- Use risk tools where available. Consider stop-losses, partial take-profits, or dollar-cost-averaging strategies via platforms or services like Bitlet.app to avoid lump-sum exposure.

- Monitor derivatives flows and funding rates. A spike in outflows or sharply negative funding rates signals caution; reduce exposure or hedge accordingly.

For community managers and treasury stewards

- Adopt multisig and timelocks. Remove single-signature custodianship; require multiple signers for repayments or burns.

- Transparency in burn mechanics. Publish burn schedules that are auditable. One-off burns feel good but don’t build credibility.

- Insure or harden community funds. Investigate custody insurance or use cold storage for reserves.

- Communicate risk clearly. Educate the community about wallet hygiene and the limits of project compensation for hacks.

Action checklist — 10 concrete steps

- Revoke token approvals and check dapp permissions.

- Move significant SHIB to hardware/cold wallets.

- Split holdings: emergency stash (cold) vs operational (small hot wallet).

- Subscribe to on-chain alerts for major whale movements and funding-rate spikes.

- Size positions to tolerate 50–80% drawdowns in worst-case memecoin scenarios.

- For community treasuries: adopt multisig + timelock + public audit.

- Track burn metrics weekly and demand transparent reporting for any buyback-and-burn program.

- Avoid trusting unsolicited wallet-sweep or “compensation” offers — verify through official channels.

- Use revocation and portfolio-scan tools regularly.

- Keep liquidity on hand to opportunistically rebalance without panic-selling.

Bottom line: can tokenomics or fixes restore momentum?

Technically, tokenomics changes (sustained burn mechanisms, buyback-funded burns, or utility that locks tokens) could improve SHIB’s scarcity story — but they must be durable, transparent and enforced at scale. Security fixes at the user level are immediate and non-negotiable: wallet hygiene and multisig are the simplest ways to stop repeated losses.

Market structure factors — large futures outflows and deleveraging — make short-term rallies harder to sustain. Until there is sustained on-chain demand or credible institutional pathways, rallies will likely remain narrative-driven and vulnerable to rapid reversals. That means tactical risk management, operational security and realistic expectations are the best tools for retail holders and community managers.

Sources

- Trust Wallet hack exposes SHIB holders — Coinpaper

- 1,000,002 SHIB burned but burn rate drops — U.Today

- Large futures outflows and sell pressure on SHIB — U.Today

- Claims about Shiba Inu catalysts ahead of 2026 — Coinpaper

Note: This article focuses on technical and tactical guidance for holders and community managers and is not financial advice. For tools to manage recurring buys or installment strategies, some users use services like Bitlet.app to dollar-cost-average into volatile positions rather than entering at a single price.