Are Memecoins Dead in 2025? A Practical Framework for Retail Investors

Summary

Quick snapshot: memecoins after the 2025 drawdown

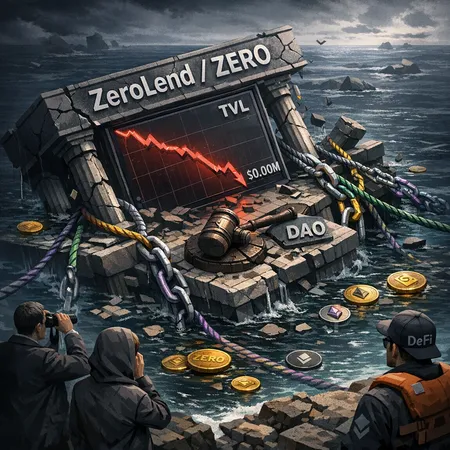

By mid‑2025 the most visible memecoins — DOGE, SHIB and PEPE — had retraced roughly 65–80% from prior highs. That kind of compression compresses narratives as fast as prices: retail FOMO evaporates, liquidity evaporates faster, and headlines turn from “to the moon” to “is it dead?” The question matters: are these assets temporarily re-rating with the cycle, or do they exhibit structural traits that imply permanent capital impairment?

For many traders the first comparison is to hard, resilient assets. For example, Bitcoin retains institutional narrative heft; memecoins do not. A focused analysis of tokenomics, technical setups and macro drivers is the only way to move beyond anecdotes.

Where the selloff came from: macro forces meet market structure

The 2024–25 tightening cycle and persistent hawkish central bank messaging reduced global liquidity. In risk‑off episodes, highest beta assets get hit first — and memecoins are textbook beta plays. CoinPaper and TokenPost both documented a clear technical deterioration for DOGE amid macro uncertainty, noting that Dogecoin recently lost a critical support level during a Fed‑reaction selloff (CoinPaper report; TokenPost analysis).

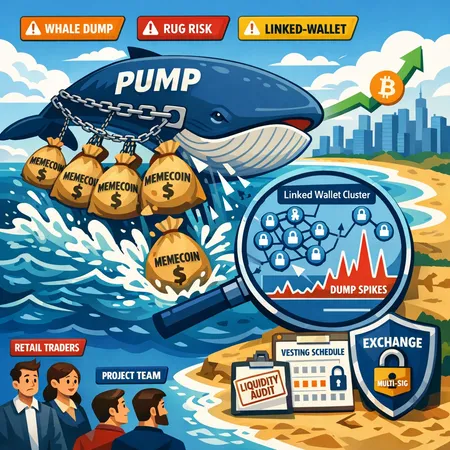

Two structural market features accelerated the falls:

- Concentrated liquidity and thin order books outside peak windows, which amplify moves.

- Reliance on retail and social narratives; when the narrative flips, so does demand.

CryptoTicker’s 2025 comparative piece frames this as a divergence: memecoins have underperformed Bitcoin not just in magnitude but in duration of underperformance, suggesting deeper regime change in investor preferences (CryptoTicker analysis).

Tokenomics and utility: the anatomy of resilience (or lack of it)

Not all memecoins are identical. To evaluate survival odds, examine four tokenomic axes:

Supply dynamics — fixed vs inflationary. DOGE is inflationary (ongoing issuance), SHIB began with massive supply but has active burn narratives, and PEPE was designed as a low‑utility meme token with supply determined at launch. Inflationary supply forces price to work against continuous dilution.

Distribution concentration — the percentage held by top wallets. High concentration increases liquidation risk when large holders move or sell.

Utility and layers — whether the token powers a broader ecosystem (payments, L2, staking, NFTs). SHIB has attempted to build utility (Shibarium, burn mechanics, NFTs), while PEPE remains largely speculative.

Governance and developer activity — ongoing development, clear roadmaps and active commits correlate with longer‑term survivability.

When tokenomics favor continued dilution or contain heavy concentration without meaningful utility, price can permanently devalue even after sentiment recovers.

Short technical aside: Dogecoin’s recent breakdown

DOGE’s chart action in 2025 crossed from technical to psychological damage when it broke a long‑standing support zone. Technical analysts pointed to volume‑weighted breakdowns and failed retests as signals that stop‑hunters and liquidity providers rotated capital out of DOGE first. The CoinPaper and TokenPost coverage of these breakdowns ties the event to wider macro pressure and reduced retail leverage.

A practical framework to assess revival potential vs permanent loss

Below is a compact, repeatable checklist retail investors and market analysts can apply before deciding whether to hold, top up, or exit memecoin positions.

Tokenomics Score (0–10)

- Inflation/deflation (-2/+2). Unlimited issuance penalizes score.

- Burn mechanism (+1 if transparent and regular).

- Locked supply or vesting schedules (+1 to +2 if meaningful).

Utility & Ecosystem Score (0–10)

- Active dApps, L2s, payment integrations or developer activity.

- SHIB, for example, gets some credit for Shibarium efforts; PEPE scores low here.

On‑chain Adoption Trend (0–10)

- 30/90/365 day active address trends, transfer counts, and DEX volumes.

- Sustained decline >30% across 90 days is a worrying sign.

Holder Concentration & Whales (0–10)

- If top 10 addresses hold >50%, downgrade risk sharply.

- Look for unexplained wallet clustering.

Market Structure & Liquidity (0–10)

- Average daily traded volume, spreads, order book depth.

- Thin books mean large trades move price and raise slippage risk.

Macro Sensitivity (qualitative)

- Is the token moving with risk‑on or decoupling? High correlation with risk assets reduces its idiosyncratic recovery potential.

Scoring: sum the numeric sub-scores (max 50). Rough heuristics:

- 40–50: Revival plausible with capital risk but clear runway.

- 25–39: High risk; possible speculative reversion but requires active monitoring and small position sizing.

- <25: Likely structural impairment; treat as digital lottery ticket, not investible capital.

Practical portfolio rules: cap any memecoin allocation at 1–3% of investable crypto capital unless scoring >40; use tranche buys and pre‑defined stop rules (hard stop or sell into rallies), and routinely rebalance.

Case studies: DOGE, SHIB, PEPE (concise)

DOGE (DOGE): Inflationary supply, historically tied to broad retail sentiment and payments narrative. The 2025 support break reduced its narrative optionality and increased short‑term volatility. Technical breakdowns noted by CoinPaper and TokenPost show how macro shocks translate to technical damage.

SHIB (SHIB): Starts with extreme supply but attempted to institutionalize utility via Shibarium and token burns. Its revival potential hinges on demonstrated, sustained activity on Shibarium and successful deflationary mechanics that outweigh the original supply handicap.

PEPE (PEPE): Designed as a viral meme play; minimal utility, high concentration and speculative flows. This profile implies recovery depends almost entirely on renewed retail frenzy or speculative NFT/DEX use cases — fragile paths to sustainable price.

For a comparative take on whether memecoins are 'dead' versus Bitcoin’s resilience, see the broader analysis at CryptoTicker which highlights the structural underperformance of meme assets in 2025 (CryptoTicker analysis).

How to act now: a sober checklist for retail investors

- Audit holdings against the six‑factor score above.

- Size exposure conservatively (small cap) and use installment or dollar‑cost strategies rather than lump sums — platforms like Bitlet.app can help structure buys over time.

- Apply stop rules: if on‑chain activity drops another 20% or a key support breaks with volume, reduce exposure.

- Treat recovery rallies skeptically: look for confirmatory increases in developer commits, unique active addresses, and real ecosystem usage before adding.

Conclusion: not dead, but many are wounded beyond repair

Memecoins in 2025 are not monolithic. Some — if they can translate community interest into real utility, reduce supply pressure and broaden holder bases — may recover. Many will remain highly speculative, and a subset will likely represent permanent capital losses for late entrants. Use structured, repeatable scoring, respect market structure and macro context, and proceed with strict position sizing.

Sources