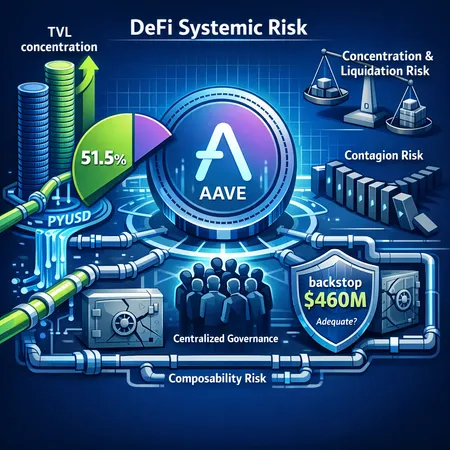

Aave’s 51.5% DeFi Lending Share: Why Concentration Is the New Systemic Risk

Summary

Executive overview

Aave’s newly reported 51.5% share of the DeFi lending market is more than a bragging right — it’s a concentration signal. When one protocol sits on a majority of total lending TVL, the market's resilience hinges on that protocol’s risk model, governance choices, and the adequacy of any capital or insurance backstops. For DeFi risk teams and protocol designers, this is a moment to recalibrate assumptions about composability and systemic exposure.

For many market participants, DeFi lending is now synonymous with Aave. That alignment creates benefits (liquidity, UX standardization) but also creates single points of failure.

How Aave accumulated dominance

Aave’s path to >50% market share is multi-factorial. Key drivers include:

Protocol-level liquidity and TVL dynamics: Aave’s market-leading interest rate markets, multi-v2/v3 deployments and wide asset support attract large deposits. Liquidity begets liquidity: deeper pools reduce slippage and improve oracle feeding, which in turn attracts more capital.

Token incentives and network effects: Historical AAVE token incentives, liquidity mining, and third-party integrations (wallets, aggregators, lending front-ends) created a flywheel. Paying early liquidity providers and integrations cemented market share.

Stablecoin flows: Large inflows from both algorithmic and regulated-style dollar tokens have concentrated stable liquidity on Aave. Recent reporting shows PYUSD alone surpassed $400m in Aave deposits, illustrating how single stablecoin flows can amplify concentration dynamics (see reporting on PYUSD deposits).

Taken together, these factors produce a reinforcing loop: large TVL reduces costs for borrowers and lenders, which attracts more activity and integrations, which further increases TVL concentration.

What a >50% share implies: liquidation risk, governance centralization, and contagion

A majority share in lending is dangerous in three linked ways.

Liquidation and market-impact risk

When Aave hosts a dominant share of borrows, large-scale liquidations create outsized market impact. Even with deep pools, liquidator strategies require on-chain execution that can push asset prices sharply. If many positions rely on the same collateral types or are denominated in the same stablecoins, a single stressed sell-off can cascade through other protocols that hold the same assets.

A few mechanics to note:

- Depth is not infinite: TVL does not equal immediately available liquidity for large liquidations without price slippage.

- Oracle lag and pro-cyclical triggers can create feedback loops where price moves cause liquidations that cause further price moves.

- Correlation between collateral and borrowed assets increases systemic exposure: e.g., a depeg in a widely used stablecoin simultaneously reduces collateral value and raises funding stress.

Governance centralization

Market share also magnifies governance power. If Aave’s token distribution, delegate behavior or large stakers are concentrated, decisions about risk parameters (collateral factors, liquidation incentives, emergency modules) and emergency interventions can be driven by a subset of participants. That centralization creates both operational and political risk: how and when a protocol pauses markets, alters parameters, or spends the safety fund has outsized consequences for the broader DeFi ecosystem.

Contagion through composability

The biggest systemic channel is composability. When other protocols integrate Aave — whether as a liquidity source, as collateralized lending rails, or via leverage primitives — they implicitly inherit Aave’s risk profile. Aave becoming impaired can cause downstream insolvencies. Composability turns smart contracts into chains of interdependence; the more nodes that rely on a central hub, the faster contagion propagates.

The $460m backstop: what it is and whether it’s enough

CryptoSlate reported a $460m backstop associated with Aave’s ecosystem. In plain terms, this number refers to the capital that could be called on in an extreme stress event — an insurance-style buffer to cover deficit auctions or protocol shortfalls.

But buffers must be judged relative to potential exposures, not absolute size. A few points:

- Scale mismatch: A backstop of $460m looks meaningful on paper but becomes small relative to the size of borrow books denominated in USD-equivalents when TVL and cross-protocol exposures run into multiple billions.

- Shock scenarios: If a large stablecoin depegs or if correlated liquidations require forced selling across many assets, the market impact losses could far exceed the backstop, especially when oracles lag or liquidity evaporates.

- Funding and accessibility: Backstops matter only if they are immediately accessible and fungible where needed (e.g., to cover an auction shortfall). The legal and operational structure of the backstop — who controls deployment and the governance required to use it — affects speed and effectiveness.

In short, the $460m backstop is an important safety layer but not a panacea. Risk teams should treat it as part of a layered defense rather than the final line.

(For the specific reporting on Aave’s market share and the backstop, see the CryptoSlate analysis. For how stablecoin flows like PYUSD are moving into Aave, see the coverage on PYUSD deposits.)

Composability risk: chains and concentration

Composability creates both innovation and fragility. When multiple protocols borrow from, or use Aave as a liquidity source, they expose user funds to Aave’s risk stack. Specific composability concerns:

- Recursive leverage: Protocols can programmatically borrow from Aave to bootstrap other positions, creating multi-layered leverage that multiplies losses.

- Reused liquidation pathways: Shared liquidator logic and shared oracles mean that one liquidation event can trigger similar automated responses across integrated systems.

- Hidden exposures: Protocols may not fully disclose or measure their on-chain exposure to Aave-based positions, leading to underestimation of systemic risk.

Designers must map these dependencies and demand better on-chain transparency and stress testing.

Policy and protocol-level fixes to decentralize lending markets

Addressing concentration requires both governance policy changes and technical protocol design. Below are concrete, implementable measures.

Governance-level mitigations

Exposure caps and risk budgets: Enforce maximum TVL or borrow share per asset or depositor group. Protocol governance can set exposure ceilings that automatically throttle new inflows once thresholds are reached.

Decentralized emergency playbooks: Create pre-approved contingency actions where multi-sig or a distributed emergency council can quickly deploy risk measures (pauses, parameter shifts) without central bottlenecks.

Voting design improvements: Use delegation limits, time-locked proposals, vote-decay and quadratic or conviction voting to discourage power concentration by large wallets.

Inter-protocol coordination frameworks: Formalize cross-protocol stress tests and communication channels akin to banking industry “war games.”

Protocol and technical designs

Dynamic capital buffers: Fund a protocol reserve using a share of interest income to grow an on-chain buffer that adjusts with utilization and market stress indicators.

Reinsurance and on-chain insurance tranches: Build multi-layered insurance where the first-loss is absorbed by a community tranche, and larger losses are covered by a reinsurance pool or syndicated capital.

Composability circuit breakers: Implement per-integration rate limits or contract-level isolation (e.g., limiting flash-loan usage or borrowed amounts when triggered by oracle volatility) so downstream contracts can’t automatically amplify stress.

Asset-specific risk tuning: Increase collateral requirements, reduce LTV or add higher-margin requirements for assets with large correlated exposures or outsized deposit concentrations (including newly popular stablecoins like PYUSD).

Improved oracles and smoother liquidation mechanics: Use multi-source, time-weighted median oracles and flexible liquidation windows to reduce forced-fire sales in thin markets.

Permissioned bootstrapping for large deposit flows: For very large stablecoin inflows, protocols can require staged onboarding or risk review before full exposure is accepted.

Market-structure and macro measures

Liquidity providers’ diversification incentives: Encourage LPs to distribute capital across multiple lending markets by adjusting fee shares or by offering risk-weighted rewards for providing liquidity to less concentrated venues.

Standardized systemic metrics: Adopt common on-chain risk dashboards that report protocol-level concentration metrics (share of lending TVL, single-asset share, largest depositor share, etc.) so participants and regulators can see red flags early.

Implementation trade-offs and political realities

Every mitigation involves trade-offs. Exposure caps reduce yield and may push capital to less-regulated corners. Stronger governance constraints can slow decision-making. On-chain reinsurance requires capital that may be hard to raise without clear revenue streams.

The right approach is layered: combine fast-acting governance mechanics for emergencies with longer-term incentives that encourage capital decentralization. Protocols should test these measures in sandboxes before applying them to mainnets.

Action checklist for DeFi risk managers and protocol designers

- Map out direct and indirect exposure to Aave, including integrations and recursive positions.

- Run reverse stress tests (what sequence of events would deplete the $460m backstop?) and publish results to stakeholders.

- Propose governance changes: exposure caps, improved voting, and emergency playbooks.

- Design protocol-level circuit breakers and dynamic buffer funding mechanisms.

- Coordinate cross-protocol stress testing and create an industry-wide risk dashboard.

Risk teams at builders like Bitlet.app and other infrastructure providers should prioritize visibility into Aave’s parameters and track large stablecoin flows (PYUSD being a recent example) to anticipate contagion vectors.

Conclusion

Aave’s market dominance offers clear user benefits, but the reality of a >50% lending share means DeFi now carries systemic risk in ways that earlier, more fragmented markets did not. The $460m backstop is a valuable safety layer, but not a substitute for structural change. Combining governance reforms, protocol design improvements and industrywide coordination will be essential to decentralize lending markets and prevent a single-protocol failure from cascading through DeFi.